(Energy Analytics Institute, 19.Apr.2022) — Highlights from ANP Brazil Substitute Director Marina Abelha during her presentation in Cartagena, Colombia on day 1 of the AAPG International Conference & Exhibition (ICE) taking place between 19-22 April 2022.

Comments from ANP Substitute Director Marina Abelha

— A completely diverse sector will emerge from Petrobras Divestment Plan. All onshore and shallow water fields are being sold, as well as some great offshore post-salt concessions: Abelha

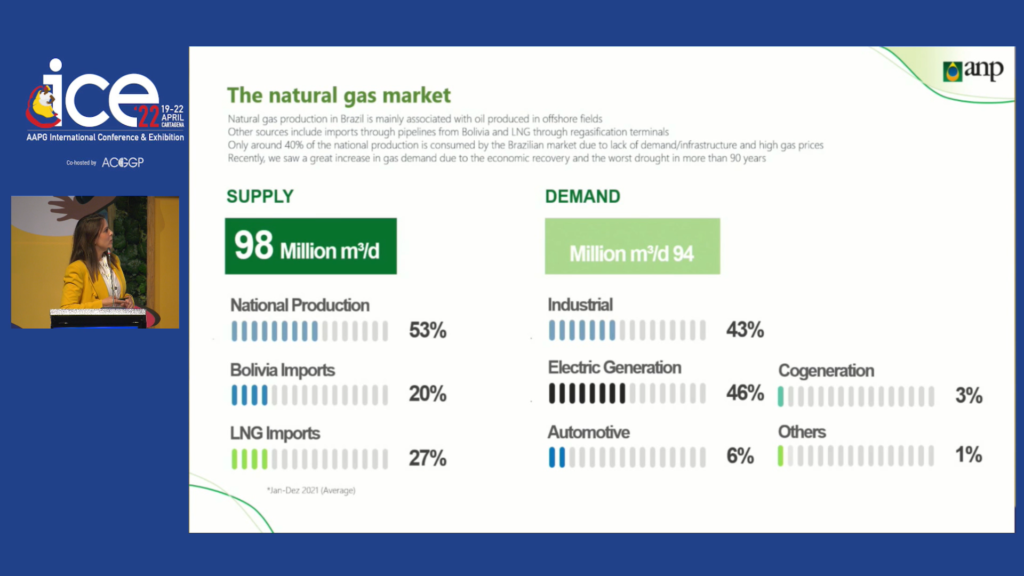

— “Great expectations for gas sector in Brazil”: Abelha

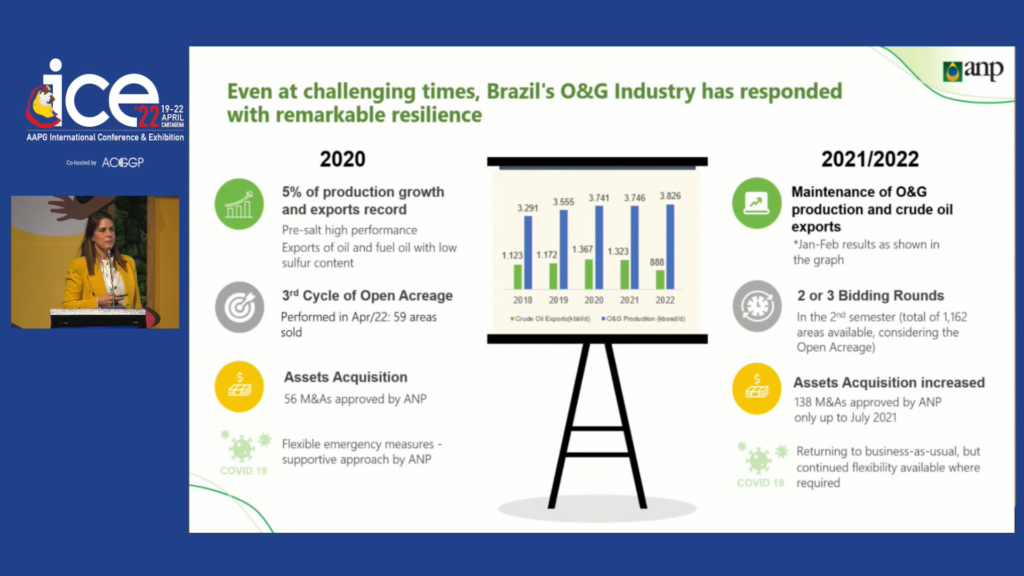

— “Even at challenging times, Brazil’s oil and gas industry has responded with remarkable resilience”: Abelha

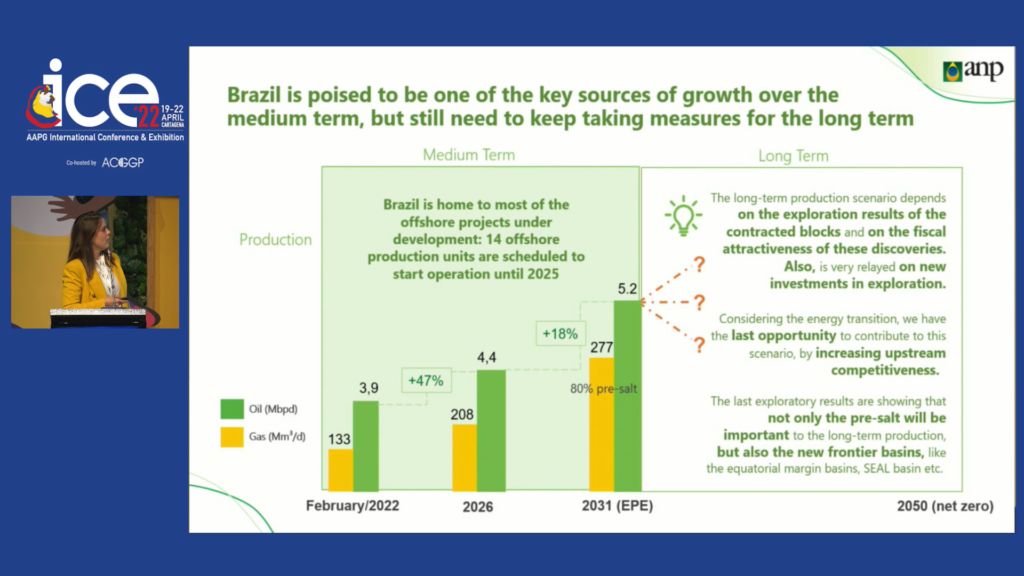

— Brazil’s oil production is forecast to surpass 5 million barrels per day in 2030, according to Empresa de Pesquisa Energética (EPE) estimates… Brazil has potential to be the largest crude oil exporter in 2030: Abelha

— Brazil is home to most of the offshore projects under development and 14 offshore production units are scheduled to start up until 2025: Abelha

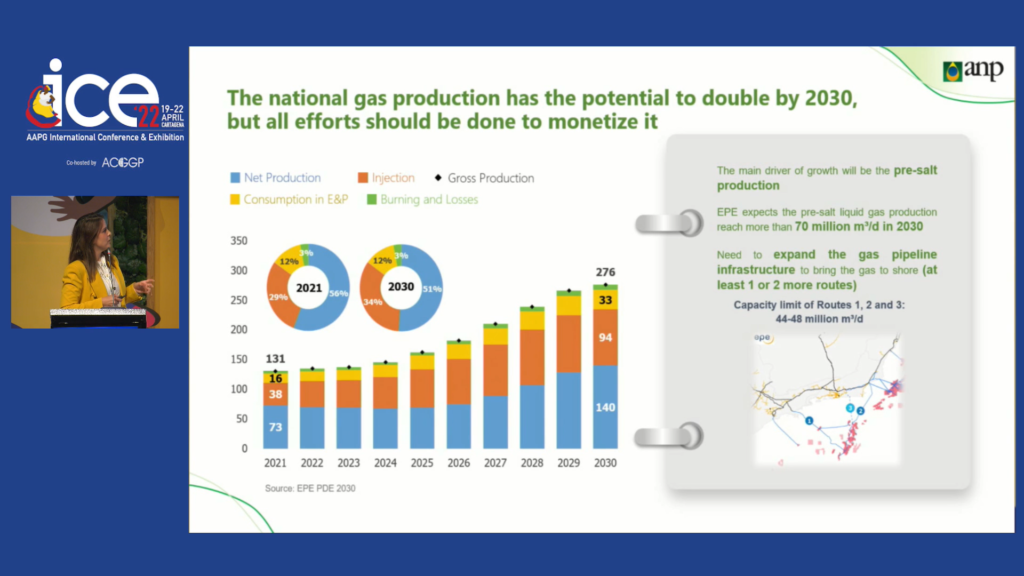

— EPE expects Brazil’s oil production to reach 4.4 MMb/d in 2026 and rise further to 5.2 MMb/d in 2031 vs 3.9 MMb/d in Feb. 2022. On the gas side, EPE expects Brazil’s gas production to reach 208 MMcm/d in 2026 and rise further to 277 MMcm/d in 2031 vs 133 MMcm/d in Feb. 2022: Abelha

— Recovery factors in Brazil are around 10%, so there is potential to increase these figure: Abelha

— One pre-salt well can produce more than 50,000 b/d of oil. In the post-salt shallow water fields are being divested, as well as some of the deepwater assets. The Campos Basin is home to the most opportunity to improve recover factors: Abelha

— Brazil’s natural gas production is mostly associated with oil production from offshore fields: Abelha

— Brazil needs to expand its gas pipeline infrastructure to bring gas to shore (at least 1-2 more routes): Abelha

— “Considering the energy transition, we have the last opportunity to contribute to this scenario, by increasing upstream competitiveness”: Abelha

____________________

By Ian Silverman, Aaron Simonsky and Piero Stewart. © Energy Analytics Institute (EAI). All Rights Reserved.