(Gran Tierra, 16.Apr.2020) — Gran Tierra Energy Inc. announced a business update regarding the Company’s proactive measures taken to protect its financial strength in response to the large decrease in world oil prices and the impacts of COVID-19. All dollar amounts are in United States dollars and production amounts are unaudited and on an average working interest before royalties (“WI”) basis, unless otherwise indicated.

Due to the unprecedented challenges of 2020, Gran Tierra has adjusted its production volumes, capital investments and operating and general and administrative (“G&A”) costs to protect the Company’s balance sheet and to preserve long-term value.

Temporarily Suspended Non-Profitable Production: Gran Tierra has temporarily suspended fields with zero or negative netbacks at current oil prices. Precautions to minimize restart costs have been taken in all assets secured during this interim period of low oil prices. At present, most of the Company’s minor fields have been suspended, resulting in the shut-in of approximately 2,500 barrels (“bbl”) of oil per day (“bopd”). Procedures and precautions were followed to ensure mechanical and reservoir integrity and security of the assets for an extended period, and to minimize the cost and timing of resuming production. As previously announced, another 4,000 bopd remains shut-in and waterflood operations remain suspended at the Suroriente and PUT-7 Blocks in the southern Putumayo region due to a local farmers’ blockade. With all of the shut-in fields producing from conventional reservoirs and properly suspended, the Company is confident that production and waterflood operations can be resumed efficiently to the same pre-suspension production levels once the COVID-19, blockade and economic restrictions pass.

In addition, approximately 4,800 bopd of production that are awaiting routine mechanical workovers will remain offline during the low-price environment. The Colombian government has deemed the oil and gas industry to be a strategic sector and the continuity of the oil and gas value chain is not restricted by government actions in response to the COVID-19 pandemic. However, some mobility and logistics issues may result in delays to the restarting of certain oil fields and mechanical workover services.

Gran Tierra remains focused on the ongoing production and waterflooding of the Company’s core assets at Acordionero, Costayaco and Moqueta, which represent 81% of Gran Tierra’s WI Total Proved Reserves as of December 31, 20191.

Colombian Government Initiatives to Assist the Oil Industry: In response to the recent drop in oil prices, the Colombian government has issued new regulations that are designed to support the oil industry. Gran Tierra plans to make use of these important new regulations. Decree 535 of April 10, 2020, was issued by the Ministry of Finance in order to expedite the recovery of value-added and income tax receivables from the tax authorities, to ensure that such funds are received by companies in the short-term. On April 7, 2020, the National Hydrocarbons Agency (“ANH”) issued Agreement 02, which allows oil companies to reduce substantially the amounts covered by letters of credit for block commitments. This new agreement also grants oil companies the option to request 12 months of additional time for the execution of exploration, evaluation and certain exploitation commitments.

First Quarter 2020 Production: During this time period, Gran Tierra’s production averaged approximately 29,530 bopd.

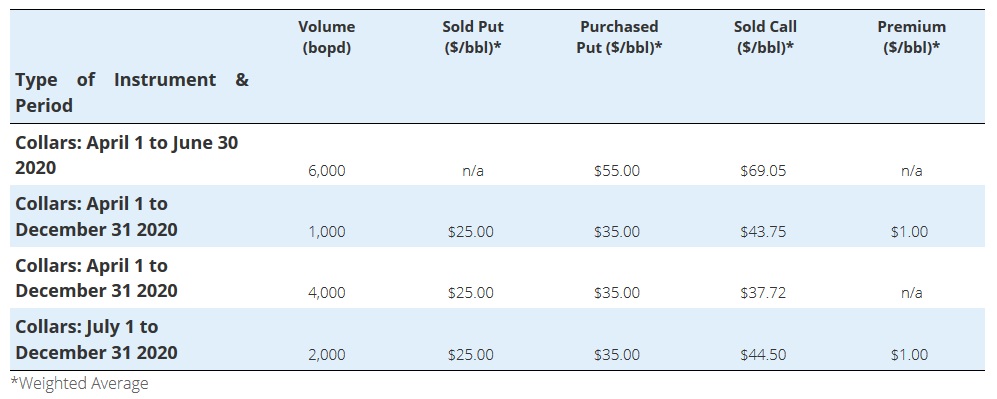

New Hedges: Gran Tierra has entered into additional 2020 oil price hedges to provide further downside protection against a near-term, low price environment by securing costless Brent collars. The new hedges complement Gran Tierra’s prior Brent oil hedges in place which cover 6,000 bopd of production in the first half of 2020.

Executive Salary and Board Compensation Reductions: In response to the current low and volatile oil price environment, Gran Tierra continues to take further steps to reduce its costs. Gran Tierra’s Executive Team and Board of Directors have taken a 20 percent reduction in salary and retainer fees, respectively. In addition, a number of cost optimization and efficiency measures are being implemented that will further reduce the Company’s G&A costs to levels consistent with lower anticipated activity levels. Gran Tierra expects these changes to result in a reduction of 30 to 35 percent in G&A costs compared to the Company’s original budget.

Oil Transportation: With the pipeline disruption of the OCP pipeline in Ecuador due to damage from natural landslides, Gran Tierra has made arrangements to ship its Putumayo Basin oil production to the Babillas Station located in the city of Neiva, the capital of the Department of Huila in Colombia. All other production is being shipped by pipeline or truck under normal contract arrangements.

Operating & G&A Cost Reductions: Significant progress has been made on lowering operating costs through the renegotiation of vendor contracts, with significant discounts achieved to date. Additional operating cost initiatives include personnel and rental equipment optimization. In addition to reducing operating costs, the Company is also benefiting from the recent depreciation of the Canadian dollar and Colombian peso. The Colombian peso has declined 15% versus the U.S. dollar from the Company’s original budget estimate. The majority of Gran Tierra’s operating costs (approximately 80%) and G&A costs within Colombia are denominated in Colombian pesos. All G&A costs in Canada are denominated in Canadian dollars.

Releasing Drilling & Workover Rigs: Following the recent substantial decrease in oil prices and the advent of the COVID-19 outbreak, Gran Tierra has taken the initiative to release all drilling and workover rigs. Activities at the Suroriente and PUT-7 Blocks in the southern Putumayo region remain suspended, pending final resolution of the local farmers’ blockade.

COVID-19 Protocols: Gran Tierra has implemented additional safety protocols during the COVID-19 pandemic to support the safety of employees, contractors and local communities. Such initiatives include the medical monitoring of field staff, disinfection of vehicles and locations, and a modified shift change strategy to accommodate social distancing. Humanitarian and medical aid packages have also been procured and distributed to support certain local communities where Gran Tierra operates.

2020 Guidance: Due to the uncertainty of the financial and operational impact of COVID-19 and the large decrease in world oil prices, Gran Tierra is withdrawing its previously announced full-year 2020 guidance. The Company is not providing an updated fiscal outlook at this time.

2020 Annual General Meeting (“AGM”) of Shareholders – May 6, 2020: In response to the evolving public health emergency and to support efforts to combat the spread of COVID-19, Gran Tierra will hold its AGM in a virtual-only format. An in-person meeting at a physical location will not be held. The previously announced date and time of the AGM, Wednesday, May 6, 2020, at 11:30 a.m. (Mountain Time) has not changed. Please monitor Gran Tierra’s annual meeting website at https://www.grantierra.com/investor-relations/2020-annual-meeting and filings with the SEC for updated information.

Gary Guidry, President and Chief Executive Officer of Gran Tierra, commented “We believe Gran Tierra has a competitive advantage to withstand the current challenging environment with our low decline, conventional asset base, our ability to control capital allocation and our low cost structure. We have taken aggressive actions to protect our balance sheet and cash flows by swiftly reducing our 2020 capital program and have targeted structural cash cost reductions through operational and organizational changes. In addition, we have recently added new oil price hedges to protect 2020 cash flows from further price decreases. We will continue to monitor the near and long-term commodity price environment and leverage our financial and operational flexibility to further adjust our plans should it become necessary. Due to current market conditions, we will not initiate a share repurchase program at this time and will continue to prioritize financial strength and liquidity.”

Gran Tierra has updated its corporate presentation on the Company’s website (www.grantierra.com), including its new near-term hedges to protect cash flow, liquidity position and debt maturity profile.

1 Gran Tierra’s 2019 year-end reserves were evaluated by the Company’s independent qualified reserves evaluator McDaniel & Associates Consultants Ltd. (“McDaniel”) in a report with an effective date of December 31, 2019 (the “GTE McDaniel Reserves Report”).

***