RIO DE JANEIRO, BRAZIL (By Petrobras, 6.Feb.2026, Words: 342) — Petrobras acquired a 42.5% stake in Block 2613, located offshore in the Republic of Namibia, Africa.

The transaction was carried out in partnership with TotalEnergies, which also acquired 42.5% and will act as the operator of the block.

The selling companies are Eight Offshore Investment Holdings and Maravilla Oil & Gas. After the completion of the transaction, Eight will retain 5% of the block, while Maravilla will end its participation in the asset. Thus, the consortium for Block 2613 will be composed of Petrobras (42.5%), TotalEnergies (42.5%), Eight (5%), and Namcor Exploration and Production (PTY) Ltd – a state-owned company held by the Government of Namibia (10%).

The block is located in the Lüderitz Basin and covers an area of around 11,000 km² offshore Namibia.

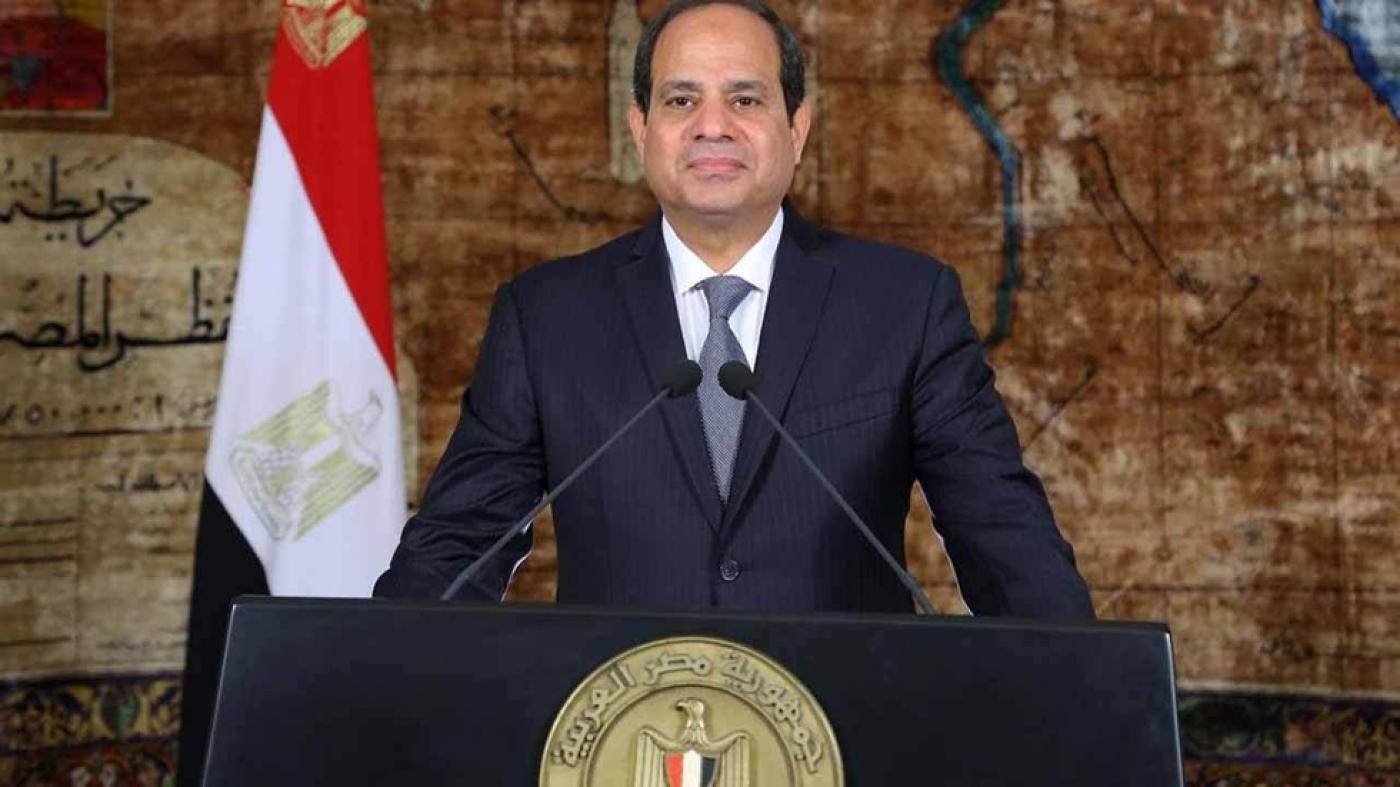

“The acquisition of new blocks is fundamental to Petrobras’ medium- and long-term planning, with a view to maintaining oil and gas reserves. We have been very carefully evaluating areas that have shown good prospects, both in Brazil and in other parts of the world. Working with partners in this new block marks Petrobras’ return to Namibia and will be very important within the company’s strategy to pursue new frontiers,” says Magda Chambriard, President of Petrobras.

This acquisition marks Petrobras’ return to Namibia and is aligned with the company’s long-term strategy, focused on portfolio diversification and the replenishment of oil and gas reserves through exploration of new frontiers and the strengthening of strategic partnerships.

“We have extensive geological knowledge of the region, which is largely analogous to our sedimentary basins. We are closely watching the West African coast and the good opportunities in Africa. This was the case in São Tomé and Príncipe, South Africa, and now Namibia,” concludes Petrobras’ Exploration and Production Director, Sylvia Anjos.

The transaction followed all the company’s corporate governance procedures and is in accordance with the 2026-2030 Business Plan.

The completion of the transaction is subject to the fulfillment of conditions precedent, including applicable governmental and regulatory approvals, notably from the Namibian Ministry of Industry, Mines, and Energy.

____________________