ATLANTA, GEORGIA (By Chad Archey, Energy Analytics Institute, 8.Dec.2025, Words: 301) — Vermilion Energy Inc. filed an early warning report in respect of its holdings in Coelacanth Energy Inc.

Of note, on 8 Dec. 2025, Vermilion sold 30,000,000 common shares of Coelacanth through a privately negotiated transaction with a group of purchasers, acting jointly and in concert, at a price of $0.76 per common share for a purchase price of $22,800,000. The amount represented an amount equal to more than 2% of the issued and outstanding common shares thereby triggering the requirement to file the early warning report, Vermilion said on 8 Dec. 2025 in an official statement.

RELATED: FERMI AMERICA INKS ESA WITH SOUTHWESTERN PUBLIC SERVICE COMPANY TO SECURE UP TO 200 MW OF POWER

Prior to the transaction, Vermilion had ownership, control or direction over an aggregate of 110,179,104 common shares, representing approximately 20.7% of the issued and outstanding common shares. Following the Transaction, Vermilion has ownership, control and direction over an aggregate of 80,179,104 common shares, representing approximately 15% of the issued and outstanding common shares, the company said.

“The common shares were sold in continuance of Vermilion’s stated priority of reducing its debt to further enhance the resiliency of its business. While Vermilion may not, until 8 Jun. 2026, sell more than 60,000,000 of the 110,179,104 common shares held by it prior to the transaction without the consent of Coelacanth pursuant to an amendment to the investor rights agreement with Coelacanth, Vermilion may, in the short term, decrease its holdings of common shares depending on market conditions, general economic conditions and industry conditions, and/or other relevant factors,” Vermilion said.

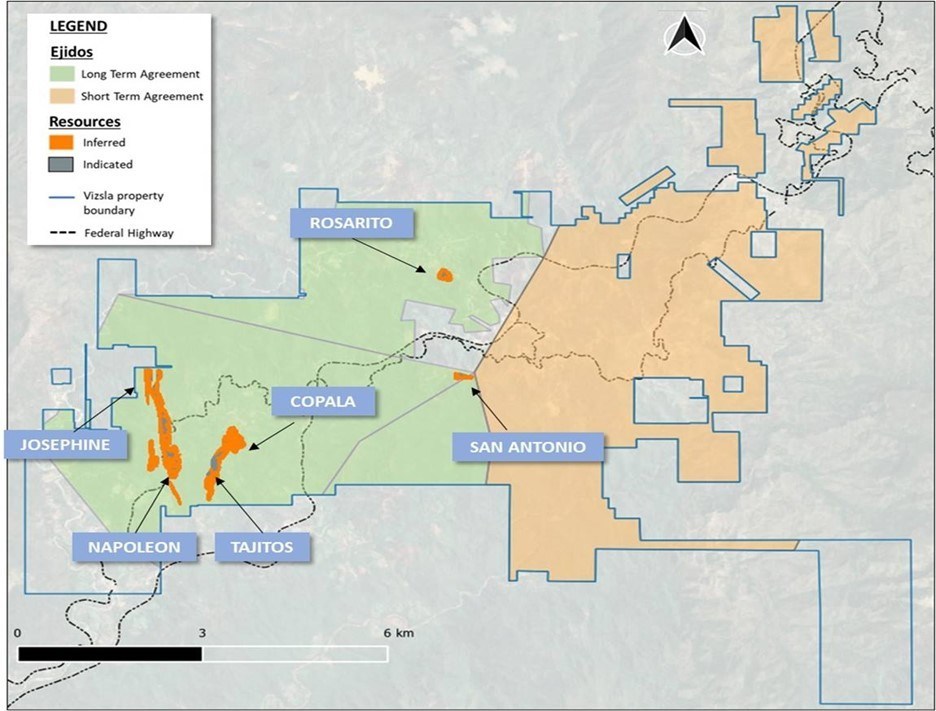

RELATED: VIZSLA FILES FEASIBILITY STUDY ON PANIC PROJECT IN MEXICO

Vermilion plans to continue to review its holdings of common shares and depending on the forgoing factors and amendment, as applicable, may in the future, increase or decrease its investment in the securities of Coelacanth.

____________________

By Chad Archey reporting from Atlanta. © 2025 Energy Analytics Institute (EAI). All Rights Reserved.