CALGARY, ALBERTA (By Enbridge 3.Dec.2025, Words: 681) — Enbridge Inc. announced its 2026 financial guidance and an annualized common share dividend increase from $3.77 to $3.88 per share, or 3%, effective 1 Mar. 2026.

HIGHLIGHTS

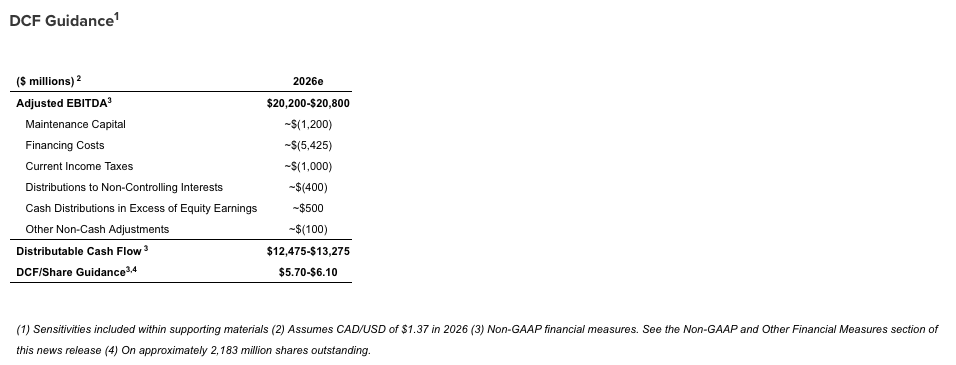

— announced 2026 adjusted earnings before interest, income taxes and depreciation (EBITDA)* guidance of $20.2bn to $20.8bn and distributable cash flow (DCF) per share* of $5.70 to $6.10

— declared 31st consecutive annual common share dividend increase, raising it by 3% to $0.97 per quarter ($3.88 annualized), effective 1 Mar. 2026

— reaffirmed 2025 full year guidance for EBITDA and DCF per share; the company expects to finish the year in the upper half of the EBITDA range of $19.4bn to $20bn, and at the midpoint for the DCF per share range

— the company reaffirmed its 2023 to 2026 compound annual growth rate outlook of 7-9% for EBITDA*, 4-6% for adjusted earnings per share (EPS)* and approximately 3% for DCF per share*, and post 2026 growth outlook of ~5% for EBITDA, EPS and DCF per share

CEO COMMENT

Commenting on the company’s outlook, Greg Ebel, president and CEO of Enbridge, noted the following:

“I’m pleased to announce Enbridge’s 2026 financial guidance. We are forecasting another year of steady and predictable growth driven by new projects entering service, as well as strong utilization and optimization of existing assets.

“Next year, Enbridge expects to generate Adjusted EBITDA between $20.2 and $20.8 billion and DCF per share between $5.70 and $6.10 per share, which represents a 4% increase from the respective midpoints of our 2025 guidance. We have approximately $8 billion of new projects entering service in 2026 across our franchises, all of which are underpinned by low-risk commercial frameworks. We also expect strong growth in 2026 from recent rate settlements and rate cases in both Gas Distribution and Gas Transmission. These regulatory outcomes support visible, durable growth through rate escalation and quick-cycle capital recovery mechanisms.

“We also announced a 3% increase to our common share dividend for 2026, representing our 31st consecutive annual increase. This increase reinforces our dividend aristocrat status, is underpinned by our growing cash flows and supports Enbridge’s first-choice investment proposition.”

2026 FINANCIAL OUTLOOK

Enbridge is issuing 2026 guidance for EBITDA of $20.2bn to $20.8bn and DCF per share* of between $5.70 to $6.10. In addition to the information provided below, the company has posted supporting materials to the Investor Relations section of the Enbridge Inc. website (link).

2026 EBITDA guidance is underpinned by expected strong utilization across the businesses and annualized contributions from acquisitions and secured growth projects entering service in 2025 as well as partial year earnings from secured growth projects expected to enter service in 2026.

Consistent with the past, the company has mitigated against cash flow volatility by substantially hedging its budgeted 2026 USD DCF exposure.

DCF per share guidance reflects interest expense on higher principal debt balances. Enbridge will continue to actively manage this exposure through its hedging program and enters 2026 with less than 15% of the debt portfolio exposed to interest rate variability.

Dividend increase

Enbridge announces that the quarterly common share dividend for 2026 will be increased by 3% from $0.9425 to $0.97 per common share, commencing with the dividend payable on 1 Mar. 2026, to shareholders of record on 17 Feb. 2026.

Capital investments and financing plan

Enbridge expects to deploy approximately $10bn of growth capital in 2026, exclusive of maintenance capital. We expect the balance sheet to remain strong with the debt-to-EBITDA ratio* at the end of 2026 expected to be within the company’s 4.5-5.0x target range. The financing plan includes approximately $10 billion of debt issuances in 2026 which is substantially earmarked for the refinancing of $5bn of debt maturities, with no external equity required. The company has hedged a portion of its anticipated fixed-rate term-debt issuances for 2026.

Growth outlook

This guidance aligns with the company’s 2023 to 2026, near-term growth outlook of 7-9% for EBITDA* growth, 4-6% for EPS growth and approximately 3% for DCF per share* growth. Post 2026, Enbridge expects adjusted EBITDA, EPS and DCF per share to grow by approximately 5% annually.

____________________