(Woodside, 22.Jul.2024) — Woodside has entered into a definitive agreement to acquire all issued and outstanding common stock of Tellurian including its owned and operated US Gulf Coast Driftwood LNG development opportunity.

The consideration for the transaction is an all-cash payment of approximately $900mn, or $1.00 per share of outstanding Tellurian common stock. The implied enterprise value is approximately $1.2bn. This represents an attractive entry into an opportunity with more than $1bn of expenditure incurred to date.

“The acquisition of Tellurian and its Driftwood LNG development opportunity positions Woodside to be a global LNG powerhouse,” said Woodside CEO Meg O’Neill.

“It adds a scalable US LNG development opportunity to our existing approximately 10 Mtpa of equity LNG in Australia. Having a complementary US position would allow us to better serve customers globally and capture further marketing optimisation opportunities across both the Atlantic and Pacific Basins.

“The Driftwood LNG development opportunity is competitively advantaged. Woodside expects to leverage its global LNG expertise to unlock this fully permitted development and expand our relationship with Bechtel which is the EPC contractor for both Driftwood LNG and our Pluto Train 2 project in Australia. “Through this acquisition, we are delivering on our strategy to thrive through the energy transition. Woodside believes that LNG will play a key role in the energy transition and is well positioned to deliver the energy the world needs while delivering significant value to our shareholders.”

Strategic rationale

The acquisition of Tellurian and its Driftwood LNG development opportunity strengthens Woodside’s positioning to deliver on our strategy to thrive through the energy transition. The expected benefits of the acquisition include:

— Expanding Woodside’s position as a leading independent LNG company;

— Adding a high-quality, fully permitted US LNG development option to Woodside’s portfolio;

— Leveraging Woodside’s LNG development, operations and marketing expertise to unlock the development and create value;

— Enabling value creation from marketing optimisation with geographic diversification;

— Increasing long-term cashflow generation potential with a phased development to manage investment decisions aligned with Woodside’s capital allocation framework; and

— Supporting Woodside’s carbon competitiveness through increased exposure to LNG and potential to reduce the average Scope 1 and 2 emissions intensity of Woodside’s LNG portfolio. Woodside’s target of reducing net equity Scope 1 and 2 emissions by 2030, and aspiration for net zero by 2050, are unchanged.

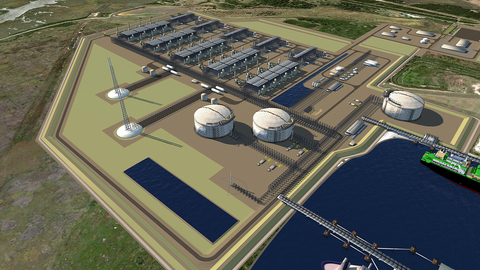

Driftwood LNG

Driftwood LNG is a fully permitted, pre-final investment decision (FID) development opportunity located near Lake Charles, Louisiana. The current development plan comprises five LNG trains through four phases, with a total permitted capacity of 27.6 Mtpa. The foundation development includes Phase 1 (11 Mtpa) and Phase 2 (5.5 Mtpa). Woodside is targeting FID readiness for Phase 1 of the Driftwood LNG development opportunity from the first quarter of 2025. The Driftwood LNG development opportunity is competitively advantaged:

— Construction has commenced, with pilings for Trains 1 and 2 complete, foundation work in progress and pilings underway for the LNG tanks. The progress on ground work reduces the risk to EPC timeline and cost.

— The development is fully permitted, and has a valid non-free trade agreement (FTA) export authorisation. The development also recently received an extension of its Federal Energy Regulatory Commission (FERC) authorisation;

— The design is cost and carbon competitive. Woodside expects development costs of ~$900-960/tonne for Phase 1 and 2. The contracting strategy is a lump-sum turnkey contract with LNG contractor Bechtel; and

Transaction details

Under the proposed transaction Woodside, or a wholly owned subsidiary of Woodside, will acquire 100% of the issued and outstanding shares of common stock of Tellurian.

Tellurian’s Board of Directors has approved the transaction and has recommended that its shareholders approve the transaction. The transaction is targeting completion in the fourth quarter of the 2024 calendar year.

The transaction is subject to satisfaction of customary conditions precedent, including maintenance of validity for existing authorisations (e.g. Department of Energy (DOE) and FERC), Tellurian shareholder approval, regulatory approval and other approvals.

In connection with entry into a binding agreement to acquire Tellurian, Woodside will provide a loan to Tellurian of up to $230mn to ensure Driftwood LNG site activity and de-risking activities maintain momentum prior to completion of the transaction. The loan is secured by a first priority lien over the borrower’s assets subject to customary exclusions. The latest maturity date for the loan is 15 Dec. 2024 or the date of transaction completion.

Woodside’s sole financial adviser is PJT Partners and its legal adviser is Norton Rose Fulbright.

____________________