(New Pacific Metals Corp., 7.May.2024) — New Pacific Metals Corp. reports its financial results for the three and nine months ended 31 Mar. 2024. All figures are expressed in US dollars unless otherwise stated.

FINANCIAL RESULTS

Net loss attributable to equity holders of the Company for the three and nine months ended 31 Mar. of $1.27mn and $4.54mn or $0.01 and $0.03 per share, respectively (three and nine months ended 31 Mar. 2023 – net loss of $2.28mn and $6.23mn or $0.01 per share and $0.04 per share, respectively). The Company’s financial results were mainly impacted by the following items:

- Operating expenses for the three and nine months ended 31 Mar. of $1.72mn and $5.41mn, respectively (three and nine months ended 31 Mar. 2023 – $2.38mn and $6.36mn, respectively).

- Net Income from investments for the three and nine months ended 31 Mar. of $0.44mn and $0.74mn, respectively (three and nine months ended 31 Mar. 2023 – $0.12mn and $0.16mn, respectively).

- Gain on disposal of plant and equipment for the three and nine months ended 31 Mar. of $nil and $0.05mn, respectively (three and nine months ended 31 Mar. 2023 – $nil and $nil, respectively).

- Foreign exchange gain for the three and nine months ended 31 Mar. of $0.01mn and $0.08mn, respectively (three and nine months ended 31 Mar. 2023 – loss of $0.02mn and $0.03mn, respectively).

Working Capital: As of 31 Mar., the company had working capital of $23.67mn.

PROJECT EXPENDITURE

The following schedule summarized the expenditure incurred by category for each of the company’s projects for relevant periods:

| Cost | Silver Sand | Carangas | Silverstrike | Total |

| Balance, 1 Jul. 2022 | $ 76,568,598 | $ 5,460,946 | $ 3,269,232 | 85,298,776 |

| Capitalized exploration expenditures | ||||

| Reporting and assessment | 1,008,174 | 88,558 | – | 1,096,732 |

| Drilling and assaying | 1,925,695 | 8,289,678 | 977,881 | 11,193,254 |

| Project management and support | 2,719,120 | 1,424,573 | 256,569 | 4,400,262 |

| Camp service | 467,690 | 1,005,158 | 174,651 | 1,647,499 |

| Permit and license | 195,821 | 9,389 | – | 205,210 |

| Foreign currency impact | (201,972) | (8,831) | (24,680) | (235,483) |

| Balance, June 30, 2023 | $ 82,683,126 | $ 16,269,471 | $ 4,653,653 | $ 103,606,250 |

| Capitalized exploration expenditures | ||||

| Reporting and assessment | 470,438 | 198,479 | – | 668,917 |

| Drilling and assaying | 47,217 | 23,894 | – | 71,111 |

| Project management and support | 1,307,101 | 842,711 | 51,530 | 2,201,342 |

| Camp service | 235,081 | 231,985 | 31,678 | 498,744 |

| Permit and license | 33,047 | 9,308 | – | 42,355 |

| Foreign currency impact | (246,085) | (49,389) | (20,995) | (316,469) |

| Balance, March 31, 2024 | $ 84,529,925 | $ 17,526,459 | $ 4,715,866 | $ 106,772,250 |

SILVER SAND PROJECT

For the three and nine months ended 31 Mar., total expenditures of $0.71mn and $2.09mn, respectively (three and nine months ended 31 Mar. 2023 – $1.22mn and $5.42mn, respectively) were capitalized under the project.

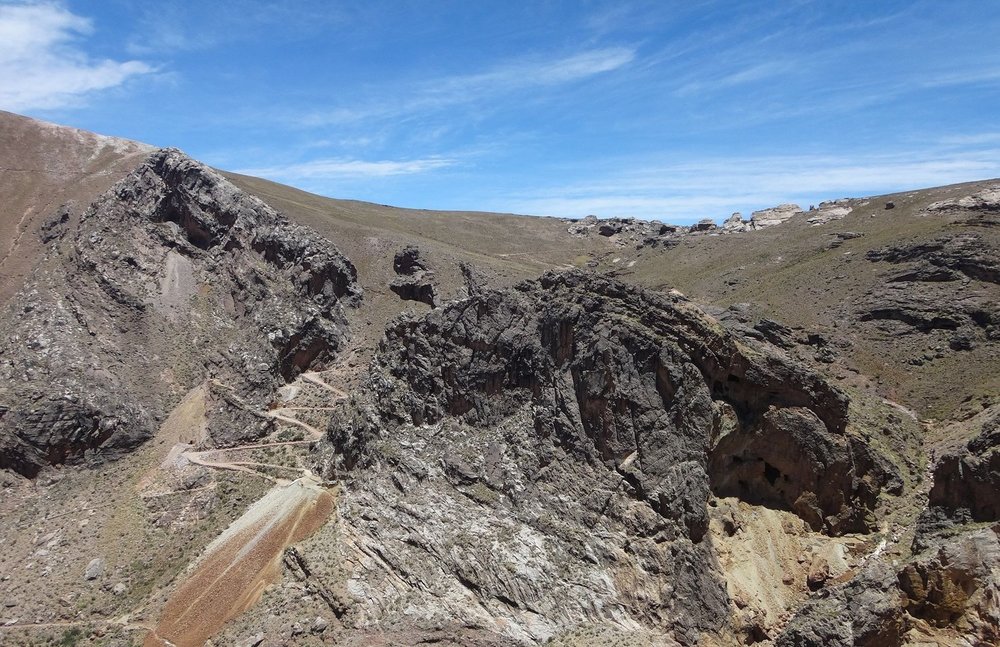

CARANGAS PROJECT

For the three and nine months ended 31 Mar., total expenditures of $0.37mn and $1.31mn, respectively (three and nine months ended 31 Mar. 2023 – $3.34mn and $9.19mn, respectively) were capitalized under the project.

SILVERSTRIKE PROJECT

For the three and nine months ended 31 Mar., total expenditures of $0.01mn and $0.08mn, respectively (three and nine months ended 31 Mar. 2023 – $0.20mn and $1.35 mn, respectively) were capitalized under the project.

MANAGEMENT DISCUSSION AND ANALYSIS

This news release should be read in conjunction with the company’s management discussion and analysis and the unaudited condensed and consolidated financial statements and notes thereto for the corresponding period, which have been filed with the Canadian Securities Administrators and are available under the company’s profile on SEDAR+ at www.sedarplus.ca,on EDGAR at www.sec.gov and on the company’s website at www.newpacificmetals.com.

ABOUT NEW PACIFIC

New Pacific is a Canadian exploration and development company with three precious metal projects in Bolivia. The company’s flagship Silver Sand project has the potential to be developed into one of the world’s largest silver mines. The company is also rapidly advancing its Carangas project towards a Preliminary Economic Assessment. For the Silverstrike project, the company completed a discovery drill program in 2022.

____________________