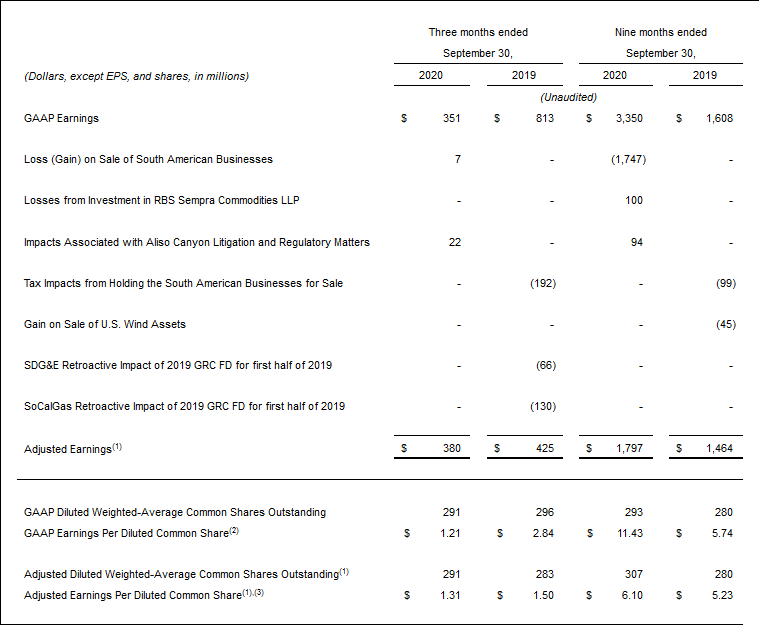

(Sempra, 5.Nov.2020) — Sempra Energy reported third-quarter 2020 earnings of $351mn, or $1.21 per diluted share, compared to third-quarter 2019 earnings of $813mn, or $2.84 per diluted share. On an adjusted basis, the company’s third-quarter 2020 earnings were $380mn, or $1.31 per diluted share, compared to $425 million, or $1.50 per diluted share, in the third quarter of 2019. Sempra Energy’s earnings for the first nine months of 2020 were $3.35bn, or $11.43 per diluted share, compared with earnings of $1.61bn, or $5.74 per diluted share, in the first nine months of 2019. Adjusted earnings for the first nine months of 2020 were $1.8bn, or $6.10 per diluted share, compared to $1.46bn, or $5.23 per diluted share, in the first nine months of 2019.

“We are excited to advance our leadership position in the most attractive markets in North America – California, Texas, Mexico and the LNG export market – with an unrelenting commitment to safety and operational excellence. Our investments in critical new energy infrastructure support economic prosperity, community wellbeing and the energy transition,” said Jeffrey W. Martin, chairman and CEO of Sempra Energy. “Our strategy of investing in a high-growth infrastructure platform supports long-term, stable cash flows, attractive economic returns and improved earnings visibility.”

The reported financial results reflect certain significant items as described on an after-tax basis in the following table of GAAP earnings, reconciled to adjusted earnings, for the third quarter and first nine months of 2020 and 2019.

1) Represents a non-GAAP financial measure. See Table A for information regarding non-GAAP financial measures.

2) To calculate Q3-2019 GAAP EPS, preferred dividends of $26mn are added back to GAAP Earnings because of the dilutive effect of Series A mandatory convertible preferred stock.

3) To calculate YTD-2020 Adjusted EPS, preferred dividends of $78mn are added back to Adjusted Earnings because of the dilutive effect of Series A mandatory convertible preferred stock.

Advancing Critical Energy Infrastructure in North America

In August, Phase 1 of the Cameron LNG export facility in Hackberry, Louisiana, reached full commercial operations under Cameron LNG’s tolling agreements. This marked the start of full run-rate earnings and cash flows. Sempra Energy’s share of full run-rate earnings from the Phase 1 project is expected to be between $400mn and $450mn annually, with no commodity or volumetric exposure. Due to the structure of the tolling agreements at Cameron LNG, Sempra Energy does not expect any earnings impact as a result of the recent outages due to Hurricanes Laura and Delta on the U.S. Gulf Coast.

Sempra Energy continues to work closely with local authorities as well as the highest levels of the Mexican government to advance the export permit process for Energía Costa Azul (ECA) LNG Phase 1. The company expects to reach a final investment decision in the fourth quarter of 2020.

Phase 1 of ECA LNG’s project is planned to be built and operated by Sempra LNG and Infraestructura Energética Nova, S.A.B. de C.V. (IEnova), Sempra Energy’s subsidiary in Mexico, as a single-train liquefaction facility. Last year, ECA LNG received authorization from the U.S. Department of Energy to export U.S.-produced natural gas to Mexico and to re-export liquefied natural gas (LNG) to countries that do not have a free-trade agreement with the U.S.

ECA LNG has successfully secured definitive 20-year sale-and-purchase agreements with Mitsui & Co., Ltd. and an affiliate of Total SE for the purchase of approximately 2.5 Mtpa of LNG from Phase 1 of the project.

In another development, the U.S. Department of Energy extended the terms of the export authorizations for Phase 1 of the proposed Port Arthur LNG export project through Dec. 31, 2050.

Additionally, IEnova is advancing construction of its Gulf of Mexico network of fuel terminals. All three terminals are backed by take-or-pay contracts with Valero Energy Corp. and, once completed, should contribute nearly 3.4 million barrels of combined refined products storage capacity, while improving Mexico’s energy security. Notably, the Veracruz terminal is situated in the largest Mexican port on the Gulf Coast and is expected to be one of the largest terminals in Mexico.

Executing Capital Plans and Driving Sustainability at U.S. Utilities

Oncor Electric Delivery Company LLC (Oncor) today announced its 2021-2025 capital plan of $12.2bn. This is a $300mn increase over Oncor’s previous 2020-2024 capital plan and is a result of new growth capital required across the system, increased maintenance on the transmission system, including investments to enhance the safety and reliability of service, and continued investment in technology and innovation. Additionally, Oncor recently issued its inaugural sustainable bond with proceeds expected to finance or refinance expenditures with minority- and women-owned business suppliers.

San Diego Gas & Electric Co. (SDG&E) and Southern California Gas Co. (SoCalGas) continue to execute on their record five-year capital investment plans. These plans are centered on enhancing safety, improving system reliability, and reducing energy-related emissions. Further, SDG&E has announced a new sustainability strategy that includes a commitment to place two green hydrogen projects into service by 2022, aiming to offer long-duration energy storage, increased system resiliency and reduced carbon intensity. In addition, SoCalGas has announced its participation in three research and development projects that are designed to advance fuel cell technology for trucking and transit and near-zero emissions natural gas technology for rail locomotives.

Investing in a High-Performing Culture

Sempra Energy is committed to creating long-term value by managing environmental, social and governance risks and opportunities. The company has a long-standing history of prioritizing diversity and inclusion to advance its high-performance culture and is continuing to build upon those efforts.

Last month, Sempra Energy received three awards recognizing its leadership position in diversity, inclusion and sustainability. Forbes and JUST Capital named Sempra Energy to the Forbes JUST 100 list, which is intended to recognize companies that are doing right by all their stakeholders, including employees, customers, communities, the environment and shareholders.

Additionally, Sempra Energy received the National Association of Corporate Directors’ NXT Award, recognizing boards for their excellence in utilizing diversity and inclusion as a strategy for building long-term value for their companies. The National Organization on Disability also recently recognized Sempra Energy as a 2020 Leading Disability Employer for adopting exemplary employment practices for people with disabilities.

Earnings Guidance

As a result of the company’s strong execution and financial results, Sempra Energy is reaffirming and guiding to the high end of both its full-year 2020 GAAP earnings-per-common-share (EPS) guidance range of $12.50 to $13.10 and adjusted EPS guidance range of $7.20 to $7.80. Additionally, Sempra Energy is reaffirming its full-year 2021 EPS guidance range of $7.50 to $8.10.

Non-GAAP Financial Measures

Non-GAAP financial measures include Sempra Energy’s adjusted earnings and adjusted EPS for the third quarters and first nine months of 2020 and 2019, adjusted diluted weighted-average common shares outstanding for the first nine months of 2020 and third quarter of 2019, and full-year 2020 adjusted EPS guidance range. See Table A for additional information regarding these non-GAAP financial measures.

Internet Broadcast

Sempra Energy will broadcast a live discussion of its earnings results over the Internet today at 12 p.m. ET with senior management of the company. Access is available by logging onto the website at www.sempra.com. For those unable to log on to the live webcast, the teleconference will be available on replay a few hours after its conclusion by dialing (888) 203-1112 and entering passcode 8857186.

__________