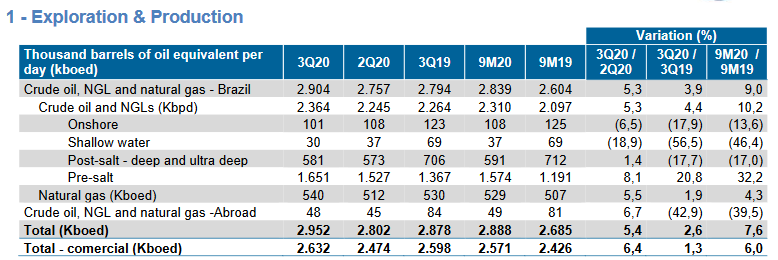

(Petrobras, 20.Oct.2020) — Petrobras’ operational performance in 3Q20 was very good, considering the challenging scenario imposed by the COVID-19 pandemic. Our oil and gas production in Brazil grew by 9.0% in the first nine months of this year compared to last year. The production of the pre-salt fields increased by 32%, while in the other areas, post-salt, shallow waters and onshore, there was a contraction.

We estimate that the average production in 2020 will reach 2.84 MMboed, of which 2.28 MMbpd of oil, with a variation of 1.5% upwards or downwards, exceeding the upper limit (2.5%) of the targets originally announced for the year (2.7 MMboed and 2.2 MMboed).

Higher than expected production growth did not result in excessive inventories, which would be possible given the significant reduction in global oil demand. On the contrary, we have been working with lower inventories than in the pre-COVID period thanks to the greater integration between production, refining, logistics and marketing.

Protecting the health of our employees has been the company’s number one priority. Home office, reduction of personnel on board and in industrial plants, continuous cleaning, medical assistance with access to telemedicine and adoption of a massive testing strategy with selection, testing, tracking and quarantining have been our main actions. To date, we have applied more than 270,000 tests, and companies providing services to Petrobras around 110,000, which has allowed us to reduce COVID’s transmission rate by identifying many cases of asymptomatic patients.

The contingency scenario for COVID-19 continues to limit the number of personnel aboard our offshore production facilities, leading us to postpone part of the scheduled shutdowns in 4Q20 to the beginning of 2021. However, we were able to carry out maintenance activities, which contributed to increase operational efficiency, operate safely and maintain optimum performance. Another highlight was the success achieved in the inspection campaign for pipelines susceptible to corrosion under tension by CO2 carried out with new technologies and tools, the results of which enabled the operational continuity of gas injection pipelines, reducing production expenses and losses.

The average production of oil, NGL and natural gas in 3Q20 reached 2.95 MMboed, 5.4% above 2Q20. Contributed to this result the growth in production in the Atapu field, with the start-up of the FPSO P-70 and first oil at the end of June, alongside the greater operational efficiency of P-74, P-75, P-76 and P-77, in the Buzios field. The performance of these platforms was supported by the temporary expansion of the oil and gas processing capacity of the units, using spare capacity in power generation and gas compression available until the beginning of gas exports, and by the high production potential of the wells and the reservoir. This enabled the achievement of monthly production records in Búzios, of 615 kbpd of oil and 765 kboed in July and the highest monthly production achieved by a well in Brazil, with the mark of 69.6 kboed from the BUZ-10 well registered in September. In that month, we also had 2 Búzios wells that exceeded the 65 thousand boed mark (BUZ-12 and BUZ-24, respectively with 67.4 and 65.8 kboed). In August, we started the gas flow from P-74.

The Tupi field reached the historic milestone of accumulated production of 2 billion barrels of oil equivalent, 20 years after the signing of the concession contract and 10 years after installing the first definitive production system. It is currently the deep waters field with the highest production worldwide and accounted for 28% of our production in 3Q20. In July, we reached the 150 kbpd production capacity on the P-67 platform, operating in this field. Tupi was also a pioneer in the development of the pre-salt layer and revealed the existence of a new exploratory model, previously unknown in the world.

We also progressed in the ramp-up of the P-68 platform, in Berbigão and Sururu fields, and P-70, in Atapu field, and we highlight the beginning of gas utilization from P-70, on October 15, 2020.

Continuing with active portfolio management, concentrating resources on world-class assets in deep and ultra-deep waters, in 3Q20 we signed a contract to sell all of our stake in 3 shallow water fields and 37 onshore fields. Additionally, we completed the sale of our entire stake in the Pampo and Enchova clusters (Campos Basin), Lagoa Parda cluster (Espírito Santo Basin) and in the Ponta do Mel and Redonda fields (Potiguar Basin), for US$ 437 million in cash* and US$ 650 million in earn-outs that are expected to have a positive impact on the company’s cash generation in the coming years. These fields produced 21.9 kbpd in the first six months of 2020, equivalent to 0.9% of our production.

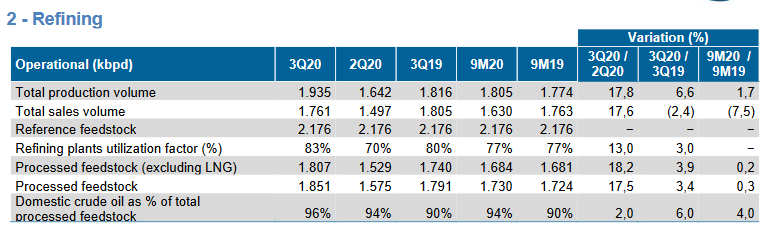

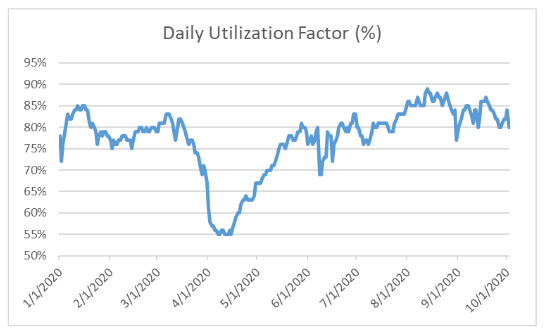

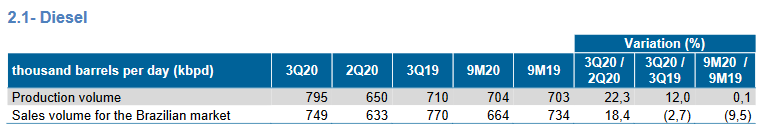

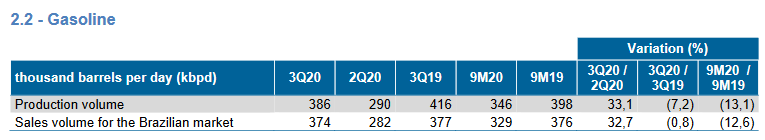

In this quarter we carried out the additional mothballing of the Merluza platform, located in the Santos Basin, totaling 63 platforms in shallow water mothballed since March 2020. It should be noted that the Merluza cluster, composed of the Merluza and Lagosta fields, continues in the process of divestment, as disclosed on March 31, 2020. In refining, the resumption of demand in the domestic market resulted in a recovery in sales and production of oil byproducts. Consequently, the utilization factor (FUT) of the refineries started to fluctuate around 80% in 3Q20, after reaching 55% in April. Thus, fuel production was 17.8% higher than in 2Q20 and in 9M20 it was 1.7% higher than in the same period last year.

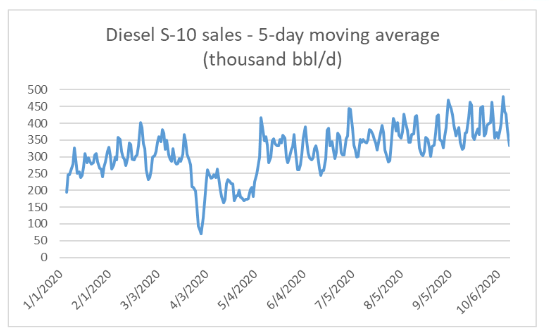

Since July, the production of S-10 diesel, with low sulfur content, has broken records, reflecting commercial actions implemented by the company to expand the offer of S-10 diesel to replace the S-500, consistent with the strategy of producing more environment-friendly fuels. In September, we reached the mark of 396 kbpd. The growth in the production of S-10 diesel reflects the greater demand for the product in Brazil, following the evolution of engines for heavy-duty and utility vehicles powered by diesel, responsible for most of the circulation of goods in Brazil. In relation to total sales, there was a recovery in demand and market share for diesel and gasoline compared to 2Q20, a period in which the demand was highly impacted by social distancing measures.

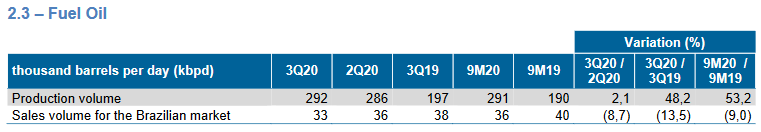

In August 2020, bunker deliveries at the Port of Santos were 190 thousand tons, 46% of the Brazilian market, the largest quantity delivered since April 2009, driven by grain exports in the period and the resumption of container handling.

In September 2020, we launched the Biorefino 2030 program, targeting projects for the production of a new generation of fuels, more modern and sustainable than the current ones, such as renewable diesel and aviation biokerosene (BioQAv). Renewable diesel is an advanced biofuel, produced from vegetable oils and with the same structure as conventional diesel oil, capable of reducing greenhouse gas emissions by 70% when compared to regular diesel and by 15% when compared to biodiesel. We have successfully completed industrial scale tests and await authorization from the National Energy Policy Council for marketing renewable diesel in Brazil. BioQAv, on the other hand, will become mandatory in Brazil from 2027 and its hydrogenation process uses the same raw materials necessary for the production of renewable diesel. The industrial units that produce BioQAv have renewable diesel as a co-product.

Asphalt sales also hit a record in July, reaching 227 thousand tons, the highest monthly volume since September 2016.

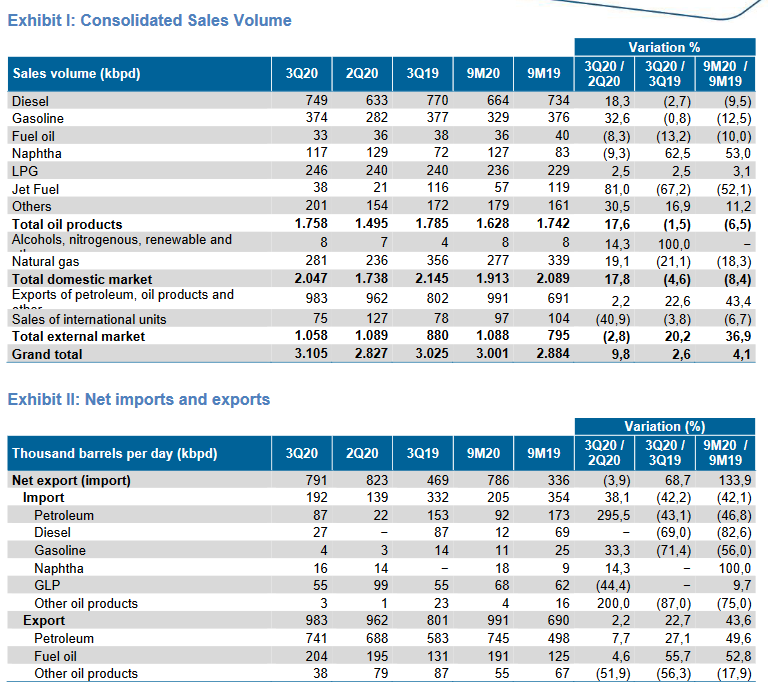

In 3Q20, exports of oil and oil by-products totaled 983 Kbpd. In September, we reached a new oil export record of 1,066 kbpd. Exports of fuel oil streams increased 5% compared to 2Q20.

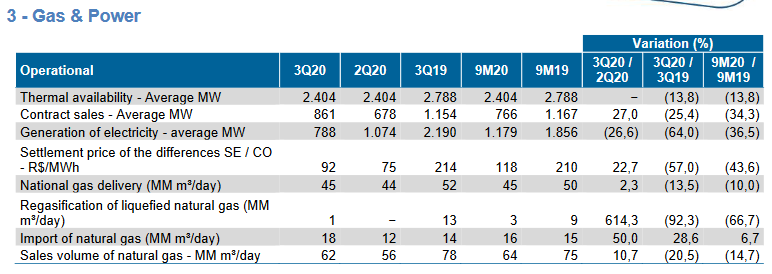

In the Gas and Power segment, the recovery in demand was observed mainly in sales to the non-thermoelectric market and intensified in 3Q20, and the highlight was the volume of 36 MM m³/day sold in September, approaching pre-crisis levels, as a result of the gradual resumption of the industry and loosening of the social distancing measures, with higher consumption of compressed natural gas and recovery of commercial consumption.

__________