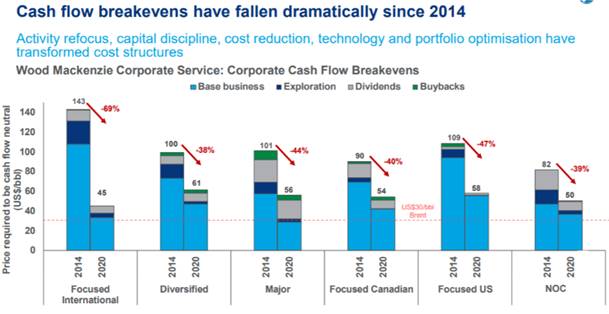

(WoodMac, 19.Mar.2020) — Survival mode has returned to the oil and gas sector as the oil price rout deepens. Corporate financials are in better shape than during the 2014/2015 crash, but room for manoeuvre is limited. Can companies cope with prices this low?

This crisis is very different from those that the sector has seen before. Debt and equity markets are all but closed for the US Independents, in contrast to the previous oil price collapse. Upstream M&A liquidity is also limited. Survival will rely on swift and deep cuts to investment.

Since the week of 9 March, more than a third of the companies Wood Mackenzie covers in its Corporate Service have cut capex by 30%. More work will be needed if low prices linger.

Roy Martin, from Wood Mackenzie’s corporate analysis team, said: “Deep spending cuts across the board are needed to achieve cash-flow neutrality at US$35/bbl in 2020.

“We calculate an average spending cut of 57% will be required for our coverage if only upstream spend is targeted. A reduction of 41% would be needed across all spend categories, including dividends, to be cash flow neutral at US$35/bbl.”

He added: “Three companies (Occidental, Apache and Kosmos) have already cut their dividend, freeing up a combined US$2.5 billion of capital. We expect more companies to follow suit. The Majors will use their balance sheets to support current dividends. We believe buybacks will be suspended and some will re-introduce scrip dividends to preserve cash.”

Martin said more radical action may be needed if current low prices persist.

He said: “Balancing the books at US$30/bbl in 2020 is possible for many companies. But tough decisions would be required. Over US$75 billion in 2020 discretionary E&D capex and US$80 billion of shareholder distributions to be cut – breaking a few promises to investors.”

*Graph source: Wood Mackenzie Corporate Service. Simple averages of companies in each segment. The base business breakeven is the price to cover up- and downstream spend, overheads and interest payments on debt. Based on current costs and development plans with no adjustment made for the collapse in price. This assumes our current base case development programme. This data is based on Q4 2019 CBT.

***