DHAHRAN, KINGDOM SAUDI ARABIA (By Aramco, 6.Aug.2025, Words: 359) — “Aramco’s resilience was proven once again in the first half of 2025 with robust profitability, consistent shareholder distributions and disciplined capital allocation. Despite geopolitical headwinds, we continued to supply energy with exceptional reliability to our customers, both domestically and around the world,” Aramco president & CEO Amin H. Nasser said referring to second-quarter 2025 and half-year 2025 results.

RELATED: Woodside inks non-binding collaboration agreement with Aramco

“Market fundamentals remain strong and we anticipate oil demand in the second half of 2025 to be more than two million barrels per day higher than the first half. Our long-term strategy is consistent with our belief that hydrocarbons will continue to play a vital role in global energy and chemicals markets, and we are ready to play our part in meeting customer demand over the short and the long term,” Nasser said.

RELATED: NextDecade and Aramco execute 1.2 MTPA LNG SPA for Rio Grande LNG Train 4

Highlights include:

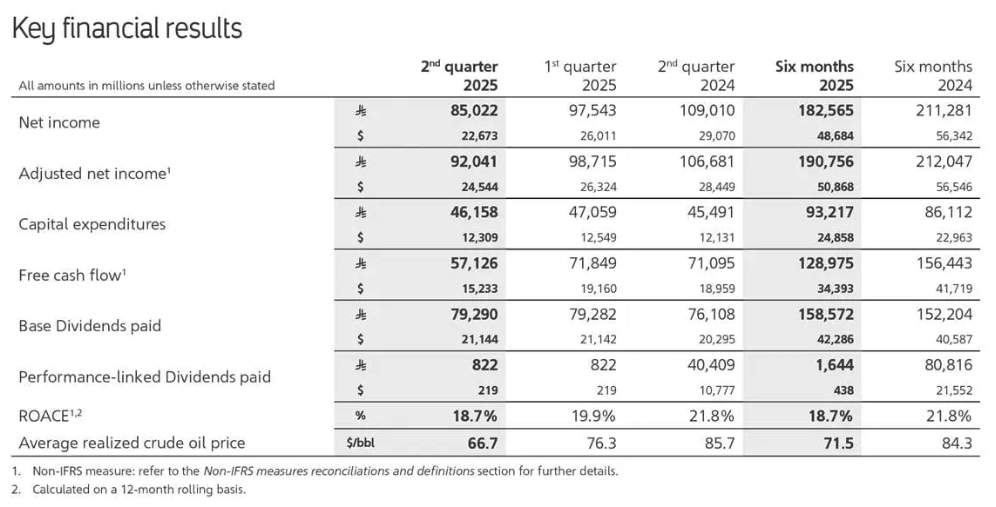

— adjusted net income1: $24.5bn (Q2) / $50.9 bn (H1)

— cash flow from operating activities: $27.5bn (Q2) / $59.3 bn (H1)

— free cash flow1: $15.2bn (Q2) / $34.4bn (H1)

— gearing ratio1: 6.5% as at 30 Jun, 2025, compared to 5.3% as at 31 Mar. 2025

— board declares Q2 2025 base dividend of $21.1bn and performance-linked dividend of $0.2bn, to be paid in the third quarter

— supply reliability of 100% in H1 maintains strong track record of consistency and stability

— progress at Berri, Marjan and Zuluf crude oil increments, and Jafurah Gas Plant on track

— phase one of Dammam development project brought onstream

— Global retail momentum continued with introduction of premium fuel lines in Chile and Pakistan

— power purchase agreements signed to develop new renewables projects, capitalizing on the Kingdom’s advantaged solar and wind resources

— strong global demand for $5bn bond issuance highlights investor confidence in Aramco’s strong financial position, resilience and long-term strategy

RELATED: Chevron’s Wirth on Venezuela, GranMorgu offshore Suriname, Petrobras on Proquigel

“We continue to invest in various initiatives, such as new energies and digital innovation with a focus on AI – aiming to leverage our scale, low cost, and technological advancements for long-term success,” Nasser said.

____________________