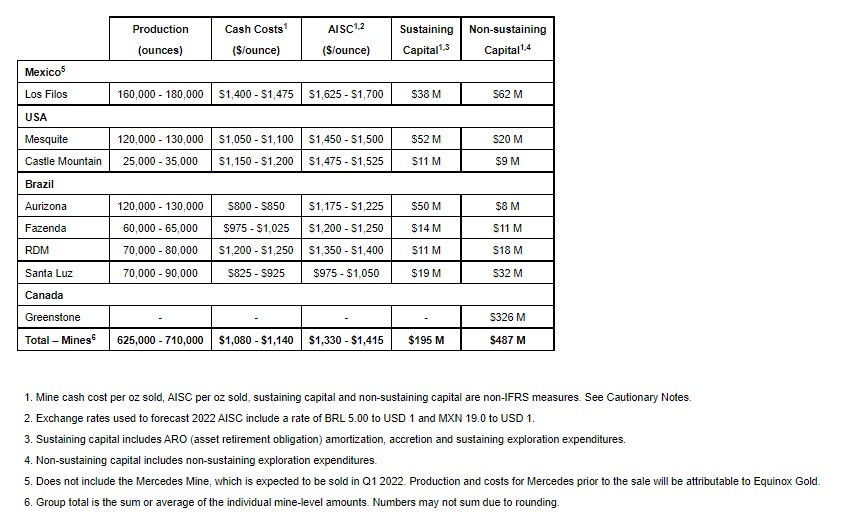

(Equinox Gold Corp, 25.Jan.2022) — Equinox Gold Corp. (TSX: EQX) (NYSE American: EQX) announces 2022 production guidance of 625,000 to 710,000 ounces of gold, increasing from 2021 production of 602,100 ounces of gold. Cost guidance includes cash costs1 of $1,080 to $1,140 per ounce and all-in-sustaining costs1,2 (“AISC”) of $1,330 to $1,415 per ounce of gold sold. Guidance does not include production from the Mercedes Mine as the previously announced sale is expected to close around the end of the first quarter of 2022. Equinox Gold’s Chairman, Ross Beaty, and CEO, Christian Milau, will host a corporate update today starting at 7:30 am PT (10:30 am ET). Further details are provided at the end of this news release.

Christian Milau, CEO of Equinox Gold, commented: “Our 2022 guidance represents the fourth consecutive year of production growth at Equinox Gold and includes production that will come from our new Santa Luz mine in Brazil, which has commenced commissioning. Production is forecast to increase quarter over quarter, with 60% of gold production and more than 85% of operating cash flow anticipated in the second half of the year.

“We continue to advance toward becoming a million-ounce producer by investing in our producing assets and bringing new mines to production. Our 2022 cost estimates reflect $195mn of sustaining capital investment in our mines as well as inflationary pressures occurring industry-wide, including significant increases to fuel and other consumables. Our key focus for 2022 is construction at our Greenstone project in Ontario, with a budget of $326mn for construction capital.”

Guidance

Production is expected to increase quarter over quarter and, as production increases, AISC will decrease. Cash costs and AISC are expected to be approximately $1,210 and $1,540 per ounce in H1 2022 and $1,025 and $1,295 per ounce in H2 2022, respectively. The weighting of production and cash flow into the second half of the year is primarily due to the Santa Luz mine transitioning from construction and commissioning to operations starting in Q2 2022. Production and cost guidance excludes the Mercedes Mine as the previously announced sale to Bear Creek Mining is expected to close around the end of Q1 2022, although ounces produced and capital spent prior to closing will be attributable to Equinox Gold.

Cash costs for 2022 reflect inflationary pressures across all operations, with approximately 15% cost escalation for fuel and other major consumables. AISC for 2022 includes $195mn of sustaining capital investment focused primarily on stripping campaigns at the Mesquite, Aurizona and Santa Luz mines to open up new ore sources and both open-pit stripping and underground development work at Los Filos that was in part delayed during 2021. The company is also completing tailings storage facility (“TSF”) expansions or lifts at Aurizona, RDM and Santa Luz and completing a leach pad expansion at Castle Mountain.

The company is undertaking several growth projects during 2022 including completing construction and commissioning of the Santa Luz mine, advancing construction of the Greenstone project, and conducting exploration focused on mine life extension at Mesquite, Aurizona, Fazenda, Santa Luz and RDM. Non-sustaining capital also includes underground development at Los Filos in part carried over from 2021, a pit expansion at RDM and permitting for the Castle Mountain expansion.

The company may revise guidance during the year to reflect changes to expected results.

Los Filos Gold Mine, Mexico

Los Filos production for 2022 is estimated at 160,000 to 180,000 ounces of gold. While Los Filos costs are expected to be lower in the second half of the year, waste stripping campaigns in the Los Filos and Guadalupe open pits and underground development for Bermejal will impact AISC and free cash flow for the year. Los Filos cost guidance for 2022 is estimated at cash costs of $1,400 to $1,475 per ounce, with AISC of $1,625 to $1,700 per ounce sold.

The Company continues to review the potential to construct a new carbon-in-leach plant to operate concurrently with the existing heap leach operation, which could increase production and lower costs, but does not expect to make a construction decision until the majority of Greenstone expenditures are complete and the current stability with local communities allows operations to continue without interruption.

Capital investments at Los Filos during 2022 are focused primarily on open-pit stripping and underground development, with almost $30mn of expenditures carried over from 2021. AISC at Los Filos in 2022 includes $38mn of sustaining capital, with $13mn allocated for capitalized stripping of the Guadalupe open pit, $7mn for development of the Los Filos underground mine, $10mn for fleet refurbishment and processing equipment and $4mn for exploration.

Non-sustaining growth capital of $62mn includes $23mn for stripping of the Los Filos open pit, $24mn for Bermejal underground development and $14mn for fleet rebuilds and new equipment.

Mesquite Gold Mine, USA

Mesquite production for 2022 is estimated at 120,000 to 130,000 ounces of gold, with approximately 60% of production coming in the second half of the year. Cash costs are estimated at $1,050 to $1,100 per ounce and AISC at $1,450 to $1,500 per ounce sold.

AISC at Mesquite in 2022 includes sustaining capital of $52mn related primarily to a $44mn stripping program to open up the new VE2 pit, which will be the primary source of ore in Q4 2022 and into 2023. Non-sustaining growth capital of $20mn includes $5mn for exploration with the objective of converting resources to reserves in the Brownie, VE2 and Rainbow pits. The Company is also permitting and planning the construction of extensions to the leach pad and will make $12mn in lease payments for the truck fleet.

Castle Mountain Gold Mine, USA

Castle Mountain production for 2022 is estimated at 25,000 to 35,000 ounces of gold with cash costs of $1,150 to $1,200 per ounce and AISC of $1,475 to $1,525 per ounce sold.

Costs at Castle Mountain will increase primarily as the result of the decision to crush and agglomerate ore to increase ore permeability and gold production. AISC for 2022 includes $11mn of sustaining capital, with $3mn allocated for plant modifications and $7mn for the current leach pad expansion that will accommodate the entirety of Phase 1 operations.

In 2021 Equinox Gold completed a feasibility study for a proposed Phase 2 expansion of Castle Mountain that is expected to increase average production to more than 200,000 ounces of gold annually. Non-sustaining growth capital of $9mn at Castle Mountain in 2022 includes $7mn for Phase 2 permitting, optimization studies and metallurgical test work, and nearly $2mn for exploration. The Company expects to submit Phase 2 permit applications in Q1 2022.

Aurizona Gold Mine, Brazil

Aurizona production for 2022 is estimated at 120,000 to 130,000 ounces of gold with cash costs of $800 to $850 per ounce and AISC of $1,175 to $1,225 per ounce sold.

AISC at Aurizona in 2022 includes $50 mn of sustaining capital allocated primarily to $19mn in capitalized waste stripping, $18mn to construct a new TSF and increase capacity of the existing TSF and $8mn for infrastructure including installation of a new pebble crusher. With fresh rock feed increasing to 30% in 2022, the pebble crusher will help to maintain processing capacity. Non-sustaining growth capital at Aurizona of $8mn is allocated almost entirely to exploration.

During 2021 Equinox Gold completed a pre-feasibility study for a potential expansion at Aurizona to extend the mine life and increase annual production by mining new underground and satellite open-pit deposits concurrently with the existing open-pit mine. The company will initiate permitting for an exploration portal, undertake some underground-focused exploration and continue to advance internal studies related to the expansion in 2022. Development work to access the underground deposit could begin in late 2022.

RDM Gold Mine, Brazil

RDM production is expected to increase almost 30% compared to 2021 as the result of modifications to the pit design based on a new geotechnical model. Production for 2022 is estimated at 70,000 to 80,000 ounces of gold. Cash costs are estimated at $1,200 to $1,250 per ounce and AISC at $1,350 to $1,400 per ounce sold.

AISC at RDM in 2022 includes $11mn of sustaining capital of which $9mn relates to increasing capacity of the TSF and installing a tailings thickener to reduce water consumption. Non-sustaining growth capital of $18mn relates primarily to capitalized stripping for a pushback of the open pit, with $3mn allocated for exploration.

Fazenda Gold Mine, Brazil

Fazenda production for 2022 is estimated at 60,000 to 65,000 ounces of gold, with cash costs estimated at $975 to $1,025 per ounce and AISC at $1,200 to $1,250 per ounce sold.

Of the $14mn sustaining capital investment planned for 2022, $6mn is allocated for underground development, $3 mn for open-pit waste stripping, $2mn for exploration to upgrade inferred resources and $2mn for engineering, plant maintenance and equipment. Non-sustaining growth capital of $11mn includes $4mn for underground development and $3mn for exploration.

In addition, the company has planned a significant exploration program in the Fazenda-Santa Luz district, a 70-km-long greenstone belt that hosts both the Fazenda and Santa Luz mines. The 2022 Bahia exploration program includes a $1.5mn airborne geophysical survey that will cover the entire belt and greatly aid in the development of new targets and more than 50,000 metres of drilling targeting high priority near-mine and regional targets. Of the total $9mn non-sustaining capital spend, $4mn has been budgeted to Fazenda with the remainder budgeted to Santa Luz.

Santa Luz Gold Project, Brazil

Equinox Gold commenced construction of Santa Luz on November 9, 2020, with a construction capital budget of $103mn. The project remains on schedule and on budget, with approximately $27mn of non-sustaining construction capital remaining to be spent in 2022. Santa Luz production for 2022, including gold produced before commercial production, is estimated at 70,000 to 90,000 ounces of gold with cash costs of $825 to $925 per ounce and AISC of $975 to $1,050 per ounce sold.

AISC at Santa Luz in 2022 includes $19mn of sustaining capital of which $11mn relates to open-pit stripping and $4mn for a TSF lift.

Greenstone Gold Project, Canada

Equinox Gold acquired a 60% interest in the Greenstone Gold project in April 2021 and commenced construction in Q4 2021, with first gold pour targeted for H1 2024. Over the life of the mine, total production is estimated at more than 5 mn ounces of gold, or approximately 360,000 ounces per year over the initial 14-year mine life, of which 60% is attributable to Equinox Gold.

The project has a construction budget of $1.23bn (C$1.53bn) on a 100% basis, with Equinox Gold funding 60%. For 2022 construction at the Greenstone project, Equinox Gold expects to fund $326mn. Construction activities will be focused on the process plant, repositioning of existing infrastructure, installation of new infrastructure and mobile equipment, water and tailings management, power and electrical.

Corporate

Corporate costs for 2022 are expected to be approximately $35mn or $50 per ounce of gold sold using the mid-range of production guidance. Corporate costs are not included in cash cost or AISC guidance and exclude discretionary equity-linked compensation.

Mineral Reserves and Resources

Equinox Gold expects to provide an update of Mineral Reserves and Mineral Resources in Q3 2022.

Corporate Update

Equinox Gold’s Chairman, Ross Beaty, and CEO, Christian Milau, will host a corporate update today commencing at 7:30 am PT (10:30 am ET). The update will be held via webcast so that all participants can see the presentation slides and ask questions of Ross Beaty, Christian Milau and Equinox Gold’s executive team. Investors without internet access can listen to the presentation and ask questions by joining the conference call. The webcast will be archived on Equinox Gold’s website until July 25, 2022.

____________________