(Touchstone, 14.May.2020) — Touchstone Exploration Inc. reports its operating and financial results for the three months ended March 31, 2020. Selected information is outlined below and should be read in conjunction with Touchstone’s March 31, 2020 unaudited interim consolidated financial statements and related Management’s Discussion and Analysis, both of which will be available under the Company’s profile on SEDAR (www.sedar.com) and the Company’s website (www.touchstoneexploration.com). Unless otherwise stated, all financial amounts herein are rounded to thousands of United States dollars.

Operational Highlights

— In response to the coronavirus (“COVID-19”) pandemic, we have made numerous adjustments to our operating practices to provide ongoing safety and business continuity. Aside from delaying timing of our capital projects, the Company has had no material operational impacts from the pandemic at present.

— First quarter 2020 crude oil sales averaged 1,589 barrels per day (“bbls/d”), compared to 1,690 bbls/d in the fourth quarter of 2019 and 2,121 bbls/d in the first quarter of 2019. Our mature field production has declined as a result of our increased focus of capital directed towards Ortoire exploration activities since January 2019

— In the first quarter we invested $1,823,000 in exploration activities, completing two successful production tests on our Cascadura-1ST1 exploration well and completing lease preparations on our Chinook-1 exploration well site.

— We continue to prepare to drill an exploration well at our Chinook prospect and currently anticipate drilling the well in July 2020.

We have negotiated a contract with a local construction firm to tie in the Coho-1 well, with operations expected to commence once government-imposed restrictions are lifted.

— Subsequent to quarter end, Touchstone entered into a framework agreement with the National Gas Company of Trinidad and Tobago and Heritage Petroleum Company Limited for the development, sale and purchase of natural gas and natural gas liquids produced from the Ortoire block.

— On May 13, 2020 we retrieved the downhole pressure recorder from the Cascadura-1ST1 well. The reservoir data will be interpreted internally and by our independent reserves evaluator, and we expect to release the results prior to the end of May 2020.

— Subsequent to the drilling of Chinook-1, we are currently reviewing the option of drilling a second deeper exploration well on the Cascadura field ahead of the previously planned Royston location in order to mitigate possible delays in the construction of the access road and fulfill our drilling obligations under the Ortoire licence.

Financial Highlights

— Touchstone exited the quarter with cash of $12,219,000 and net debt of $5,244,000. Net debt decreased by 68% from year end as a result of the previously announced February 2020 private placement that raised net proceeds of $10,850,000.

— Realized crude oil prices averaged $46.10 per barrel, decreasing 20% from both $57.38 per barrel in the prior quarter and $57.71 per barrel in the first quarter of 2019. A 44% decline in realized pricing from February to March 2020 led us to immediately restrict certain field operations and discretionary operational spending.

— We generated $1,257,000 in funds flow from operations ($0.01 per share), a decrease of 48% relative to $2,430,000 ($0.02 per share) in the first quarter of 2019. The decline was primarily attributable to lower production and significantly lower crude oil prices received in March 2020.

— Non-cash impairments charges of $19,215,000 were recognized, triggered by the impact of materially lower forward crude oil forecasts, offset by a deferred income tax recovery of $10,072,000. As a result, a net loss of $9,240,000 ($0.05 per share) was recognized in the first quarter of 2020 compared to a net loss of $185,000 reported in the prior year equivalent quarter.

Paul R. Baay, President and Chief Executive Officer, commented:

“The first quarter of 2020 has been unprecedented for the oil and gas industry given the collapse of oil prices and the global economic uncertainty of COVID-19. The safety of our employees continues to be of paramount importance to the Board and management team, and I would like to thank our employees for their dedication and flexibility during this challenging period as we adjusted to a new working environment.

While there have been major sector challenges, I am pleased to report that Touchstone has continued to take several positive steps during the quarter. In addition to the successful production tests at Cascadura, we have made progress on tying in the Coho-1 gas well, and the $10.85 million fundraising completed in February allows us to continue to prepare for drilling at our Chinook location, the third exploration well on the Ortoire block. With clear exploration targets, we remain confident about the long-term strategy of the Company, especially given our increasing focus on natural gas, and the increased stability that this will give us from a financial perspective amidst a volatile crude oil market.”

Touchstone Exploration Inc. is a Calgary based company engaged in the business of acquiring interests in petroleum and natural gas rights and the exploration, development, production and sale of petroleum and natural gas. Touchstone is currently active in onshore properties located in the Republic of Trinidad and Tobago. The Company’s common shares are traded on the Toronto Stock Exchange and the AIM market of the London Stock Exchange under the symbol “TXP”.

Operations Update

Current and forecasted crude oil pricing have deteriorated from a significant decrease in worldwide demand as a result of the pandemic and an increase in global supply due to disagreements over production restrictions between members of OPEC and Russia.Our realized crude oil price decreased by 44% from February to March. The rapid decline in oil prices had a negative impact on our cash flows during the first quarter and our projections for the balance of the year. The scale and duration of the COVID-19 outbreak remain uncertain, and the full extent of the impact on the Company’s operations and future financial performance is currently unknown.

We remain focused on protecting the health of our employees and communities and ensuring a decisive response for our investors. During the quarter, we introduced operating measures to protect the well-being of all stakeholders in line with local public health official guidelines while continuing to maintain safe operations and business continuity. With the continued volatility in crude oil pricing and our focus on effective and efficient operations, we are continuing to preserve liquidity and protect our financial position during this period of economic turmoil. We have reduced all discretionary development and operational spending and have only completed workovers on essential wells. We have also reduced operating and general and administrative costs and are continuing to identify greater reductions. In addition, we expect to store a portion of our second quarter 2020 crude oil production on an interim basis to sell in the future subject to internal and external levels of storage capacity.

Our objective remains to bring our two gas exploration discoveries onto production as soon as possible, which are expected to not only increase cash flow but insulate us from expected future crude oil price volatility from the continued effects of COVID-19 and worldwide oversupply. Despite current restrictions in Trinidad, we have proceeded with preparations for the tie in of the Coho-1 natural gas well, as we have submitted the necessary regulatory applications to build the required pipeline and surface facilities. Touchstone has contracted a local operator to proceed with the project, who has confirmed that the majority of the equipment is currently available domestically. Upon receipt of all approvals, we expect to commence operations immediately and are targeting 120 days to complete. We currently estimate to commence production from the well in October 2020.

In addition, we completed the construction of the Chinook-1 drilling location prior to the March 15, 2020 pandemic related lockdown, which gives us the option to mobilize the drilling rig following the removal or easing of government-imposed transportation restrictions. Subject to maintaining liquidity targets, the Company is currently anticipating spudding the well in July with additional procedures in place to keep all personnel safe during drilling operations.

We are reviewing our exploration program and are evaluating the option of drilling a second exploration well on the Cascadura field ahead of the previously planned Royston location. This option mitigates possible delays in the construction of the Royston access road as Trinidad enters the rainy season, as well as affording us additional information relating to the production facilities required to optimize sales from the Cascadura field. This well remains subject to future commodity prices and liquidity targets, making it dependent on the Company achieving Coho-1 natural gas sales.

We continue to monitor the situation and economic environment, and we will adapt our business operations and drilling program to ensure that we preserve and grow long-term shareholder value. We thank our shareholders and stakeholders for their continuing support and look forward to coming out of this challenging period with a stronger and sustainable Company.

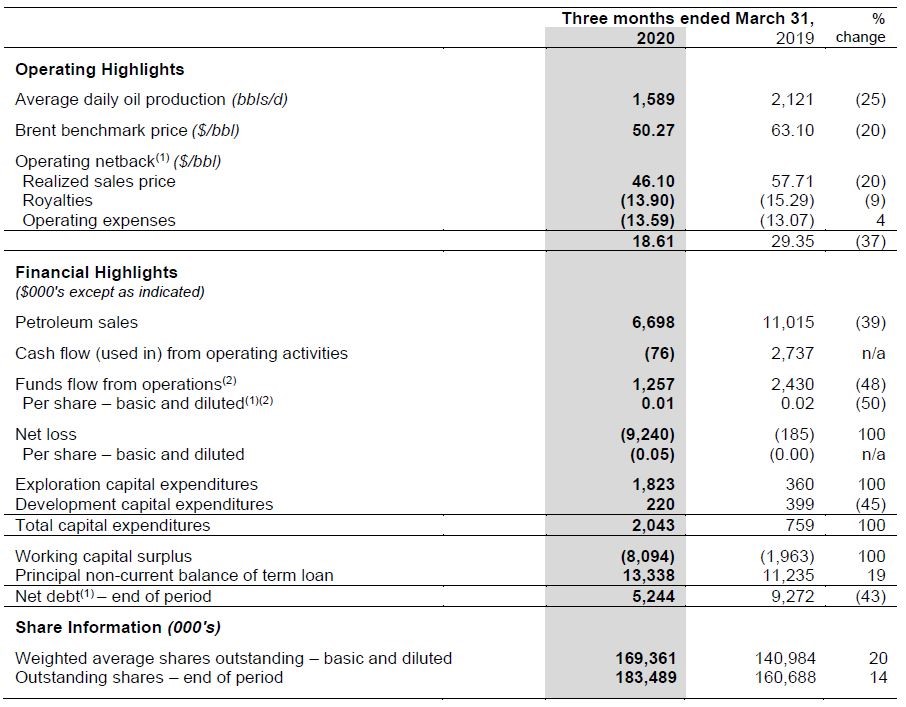

Q1 2020 Financial and Operating Results Summary

Notes:

(1) Non-GAAP financial measure that does not have a standardized meaning prescribed by International Financial Reporting Standards (“IFRS”) and therefore may not be comparable with the calculation of similar measures presented by other companies. See “Advisories: Non-GAAP Measures“.

(2) Additional GAAP term included in the Company’s consolidated statements of cash flows. Funds flow from operations represents net loss excluding non-cash items. See “Advisories: Non-GAAP Measures“.

Operating Results

In the first quarter of 2020, Touchstone completed two successful production tests on the Cascadura-1ST1 exploration well on the Ortoire block, investing a total of $1,536,000 in testing and lease building activities (2019 – $nil).

We conducted minimal developmental activity in the quarter, with average crude oil sales declining to 1,589 bbls/d, a 6% decrease relative to the 1,690 bbls/d produced in the prior quarter and a 25% reduction from 2,121 bbls/d produced in the first quarter of 2019. Our crude oil sales volumes have decreased due to the ongoing impact of natural declines associated with limited capital investment since the final two wells of the 2018 drilling program were brought onstream in January 2019. In March 2020 we sold 702 net barrels of natural gas liquids produced from the Cascadura-1ST1 production tests.

Financial Results

We generated $1,257,000 in funds flow from operations in the first quarter of 2020, which was down 48% from the prior year first quarter primarily due to a 24% decline in production and 20% drop in realized crude oil pricing. We recorded a net loss of $9,240,000 ($0.05 per share) in the first quarter of 2020 versus a net loss of $185,000 ($0.00 per share) generated in the prior year equivalent quarter. The decrease was primarily driven by non-cash property and equipment impairment charges of $19,215,000 as a result of decreases in forecasted commodity prices, partially offset by an associated deferred tax recovery of $10,072,000. Impairment charges were incurred due to the material reduction in crude oil price forecasts but may be reversed in future periods if commodity price forecasts improve.

In February we completed a United Kingdom based private placement in order to support the drilling of our third exploration commitment well at the Chinook prospect. The private placement raised net proceeds of approximately $10,850,000 by way of a placing of 22,500,000 common shares. As a result, we exited the first quarter with a cash balance of $12,219,000, a working capital surplus of $8,094,000 and a C$20 million principal term loan balance. Net debt on March 31, 2020 was $5,244,000, which represented a reduction of 68% relative to year end. Our credit facility does not require the commencement of principal payments until January 2021, and we remained comfortably within the financial covenants as at March 31, 2020.

***