(Chevron, 31.Jul.2020) — Argentina’s highest court unanimously rejected the plaintiffs’ final bid to enforce a fraudulent $9.5 billion Ecuadorian judgment against Chevron Corporation. This is the latest in a string...

(Energy Analytics Institute, 9.Jul.2020) — Ecuador envisions mining exploration investments of $1.3bn through January 2022, according to comments from the country’s Mines Vice Minister Fernando L. Benalcázar. Benalcázar’s comments came...

(Argus, 19.Jun.2020) — Another senior Venezuelan opposition figure has resigned following the government's leak of a strategy to favor ConocoPhillips in an escalating battle for Venezuelan state-owned PdV's US refining...

(PetroTal, 7.May.2020) — PetroTal Corp. announces that the Northern Oil Pipeline (“ONP”) operated by Petroperu S.A. has been shut down by a public health directive from the Peruvian government, thereby...

(Houston Business Journal, Olivia Pulsinelli, 28.Nov.2018) — Houston-based refiner Citgo Holding Inc. will remain owned by Venezuela’s state-run oil company, Petróleos de Venezuela SA, if PDVSA follows through with the...

(Houston Chronicle, Sergio Chapa, 26.Nov.2018) — A payment on a $1.4 billion arbitration award to a Canadian gold mining company is allowing Venezuela to keep ownership of Citgo Petroleum’s three...

(Financial Post, 19.Nov.2018) — Ensign’s date change makes it more likely that it will emerge as the successful bidder for Trinidad, CIBC analyst says. Rising temperatures in the battle between...

(Bloomberg, Davide Scigliuzzo, 31.Oct.2018) — Venezuela just forked over almost $1 billion to stay current on a bond backed by shares of its U.S. refiner Citgo. The question is why....

(Energy Analytics Institute, Ian Silverman, 29.Oct.2018) — Weatherford International plc reported Western Hemisphere 3Q:18 revenues of $762 million were down $7 million, or 1%, sequentially, and down $5 million, or...

(Reuters, Marianna Parraga, Collin Eaton, 26.Oct.2018) — Cash-strapped state-run oil companies in Mexico and Venezuela have begun diverting crude historically processed for domestic use and sending it to U.S. refiners...

(Ft.com, Gideon Long, 25.Oct.2018) — In a month in which emerging market government bonds have been hammered by the prospect of US rate increases, geopolitical risk and fears of a...

(Bloomberg, 24.Oct.2018) — Petroleos de Venezuela SA’s plan to make a $949 million bond payment would mark a rare exception for Nicolas Maduro’s regime as it tries to hold on...

(Bloomberg, Cristiane Lucchesi, Francois Beaupuy, Scott Deveau, 15.Oct.2018) — French utility Engie SA and a Canadian pension fund plan to offer as much as $9 billion (34 billion reals) for...

(Stabroek News, 13.Oct.2018) — The Guyana government and the Canadian province of Newfoundland and Labrador will be signing a technical cooperation agreement on oil and gas in the coming week,...

(Energy Analytics Institute, Ian Silverman, 3.Oct.2018) — Transparency in information is necessary in order for Bolivia and producing departments of the small Andean country to understand the full details related...

(Financial Times, Benedict Mander, 23.Sep.2018) — Green energy groups say huge shale oil and gas reserve is leaking greenhouse gases. Jorge Daniel Taillant used a $100,000 infrared camera this year...

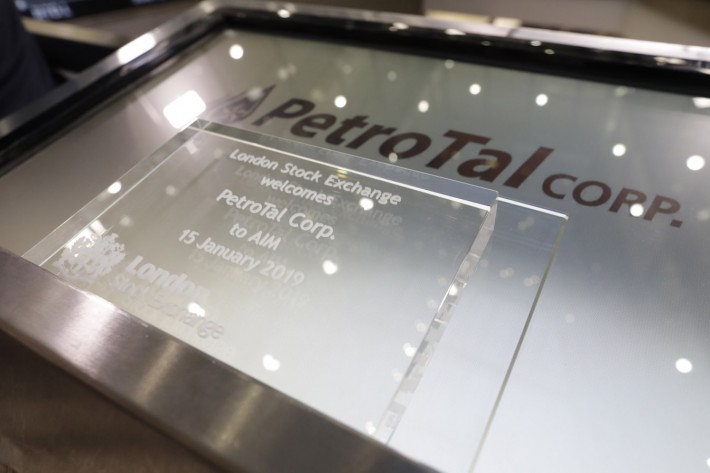

(Energy Analytics Institute, Aaron Simonsky, 13.Sep.2018) — PetroTal Corp. is seeking joint venture partners to drill the first exploration well by the fourth quarter 2019 or early 2020. “We are...

[caption id="attachment_3669" align="alignnone" width="1536"] A year after two category 5 hurricanes caused destruction across parts of the Caribbean, most children in the affected countries are now back in school and...

(Frontera Energy Corporation, 7.Sep.2018) — Frontera Energy Corporation has been named a Canadian Sustainable Development Goals award winner for the second consecutive year by the Global Compact Network Canada, the...

(Efe, 6.Sep.2018) — Peru’s government is exercising caution after mining company Macusani Yellowcake announced in July that it had discovered the world’s largest lithium deposit, the energy and mines minister...

(Mining.com, Valentina Ruiz Leotaud, 29.Aug.2018) — State-owned Petróleos de Venezuela SA or PDVSA announced on Twitter that it filed an appeal requesting that a Delaware court vacate a decision made...

(Energy Analytics Institute, Ian Silverman, 27.Aug.2018) —Trinidad and Tobago is relying on Russia as its main source of imported crude oil. Between January and June 2018, the small twin-island country...

(Oilprice.com, Irina Slav, 23.Aug.2018) — Rosneft has asked a U.S. federal court to establish “a robust appraisal and sale process” of Citgo shares following Canadian miner Crystallex’ win at court...

(The New York Times, Clifford Krauss, 20.Aug.2018) – More than a decade ago, Venezuela seized several oil projects from the American oil company ConocoPhillips without compensation. Now, under pressure after...

(Energy Analytics Institute, Jared Yamin, 19.Aug.2018) – Canada’s Frontera Energy Corporation confirmed the presence of hydrocarbons in the Mirador reservoir in the Acorazado-1 exploration well in Colombia. The well is...

(Energy Analytics Institute, Jared Yamin, 18.Aug.2018) – Frontera Energy Corporation declared the Delfin Sur-1 exploration well offshore Peru non-commmercial. On August 12, 2018, the company completed drilling the well, located...

(Express, Simon Osborne, 16.Aug.2018) – Venezuela’s oil assets are being targeted by angry creditors after a US court granted a Canadian mining company permission to send in the bailiffs. Firms...

(Energy Analytics Institute, Piero Stewart, 15.Aug.2018) – If all goes off as planned, by 2025, Guyana will be the 5th largest oil producer in the Latin American and Caribbean region....

(Energy Analytics Institute, Jared Yamin, 11.Aug.2018) – Crystallex seems to have cut in line while there are many others already in line for CITGO assets and value. What follows are...

(OilPrice.com, Irina Slav, 10.Aug.2018) – Canadian gold miner Crystallex was ruled the winner in a long-running case against Venezuela, which it has sued for the forced nationalization of its assets...

(Reuters, Brian Ellsworth, 10.Aug.2018) – Crystallex’s victory in a legal battle with Venezuela that paves the way for it to collect a $1.4 billion award hinged on a finding that...

(The Wall Street Journal, Andrew Scurria and Julie Wernau, 9.Aug.2018) – A U.S. federal judge authorized the seizure of Citgo Petroleum Corp. to satisfy a Venezuelan government debt, a ruling...

(Associated Press, 9.Aug.2018) – A Canadian gold mining company on Thursday won the right to go after Venezuela's prized U.S.-based oil refineries and collect $1.4 billion it lost in a...

(Jamaica Gleaner, CMC, 8.Aug.2018) – Regional commission ECLAC is reporting that foreign direct investments, FDI, in Guyana increased to US$212 million last year in part as a result of the...

(Energy Analytics Institute, Jared Yamin, 18.Jul.2018) – Vancouver, British Columbia-based Advantage Lithium Corp. arranged a private placement of 15,585,000 common shares of Advantage Lithium at a price of $0.77 per...

(Reuters, 16.Jul.2018) – Canadian miner Plateau Energy Metals Inc’s Peru unit Macusani Yellowcake S.A.C. said on Monday it has found 2.5 million tonnes of high-grade lithium resources and 124 million...

(Energy Analytics Institute, Ian Silverman, 10.Jul.2018) – A small Central American country will be considered a pioneer in the region with use of a type of “eco-friendly asphalt” that gives...

(Energy Analytics Institute, Ian Silverman, 30.Jun.2018) – Canada’s Frontera Energy Corporation announced commencement of mobilization of the Petrex-10 drilling offshore Peru. Drilling of the Delfin Sur-1 exploration well is expected...

(Energy Analytics Institute, Ian Silverman, 25.Jun.2018) – The Canadian company plans to use majority of proceeds to repurchase notes due in 2021. Frontera Energy Corporation completed the offering of $350...

(Energy Analytics Institute, Ian Silverman, 22.Jun.2018) – Frontera Energy Corporation aims to lower certain costs in Colombia. The Canadian company continues with efforts to reduce its transportation costs, including those...

(Xinhua, 14.Jun.2018) – Energy ministers from G20 countries met here on Thursday to discuss transitioning to renewable energy and other alternative green energy. The gathering in Argentina's southwestern city of...

(Energy Analytics Institute, Ian Silverman, 12.Jun.2018) – Canada’s Frontera Energy Corporation continues its active drilling program in Colombia. The company had six (6) drilling rigs operating continuously in the first...

(Energy Analytics Institute, Ian Silverman, 12.Jun.2018) – The offer will consist of a two-for-one share split of the company's issued and outstanding common shares. The record date of the Share...

(Energy Analytics Institute, Ian Silverman, 3.Jun.2018) – Canada’s Frontera Energy Corporation announced it was notified by Petroperu S.A. of a force majeure event affecting a portion of the NorPeruano pipeline...

(Energy Analytics Institute, Jared Yamin, 29.May.2018) ‐- Spain’s Gas Natural Fenosa is finally exiting Colombia. The company sold 15.46 million shares, representing the remaining 41.89% interest in gas distributor Gas...

(Energy Analytics Institute, Ian Silverman, 26.May.2018) – Canacol Energy Ltd., the exploration and production company with operations focused in Colombia, announced its Annual General Meeting of Shareholders will be held...

(Energy Analytics Institute, Piero Stewart, 17.Feb.2017) – A Paris Court of Appeal’s rejection of an annulment from Venezuela will force the cash-strapped South American country to pay $730 million to...

(Gold Reserve Inc., 7.Feb.2017) – Gold Reserve Inc. announced that on February 7, 2017, the Paris Court of Appeal rejected all of Venezuela’s arguments and issued a judgment dismissing the...

(Gran Tierra Energy Inc., 29.Nov.2016) – Gran Tierra Energy Inc. closed the previously announced underwritten public offering of shares of its common stock. The company sold 43,335,000 shares of its...

(Energy Analytics Institute, Jared Yamin, 25.Jun.2016) – U.S. President Barack Obama insists the Venezuelan government respect the democratic process regarding calls for a recall referendum against Venezuelan President Nicolas Maduro,...

(Gran Tierra Energy Inc., 11.May.2015) – Gran Tierra Energy Inc. announced several new executive appointments effective immediately: Ryan Ellson, Chief Financial Officer; Alan Johnson, Vice President, Asset Management; Lawrence West,...

(Moody's, 7.Apr.2015) – LNG suppliers are curtailing their capital budgets, amid low oil prices and a coming glut of new LNG supply from Australia and the U.S.A., Moody's Investors Service...

(Gold Reserve Inc., 30.Mar.2015) – Gold Reserve Inc. reported on developments in the proceedings instituted in the U.S. District Court for the District of Columbia to confirm the $740 million...

(Pacific Rubiales Energy Corp, 14.Mar.2015) – Pacific Rubiales Energy Corp. and Ecopetrol, S.A. have agreed not to extend the Rubiales and Pirirí Field Association Contracts, expiring in June 2016 ....

(Gran Tierra Energy Inc., 2.Feb.2015) – Gran Tierra Energy announced that the employment of its Chief Executive Officer and President Mr. Dana Coffield has been terminated. Coffield tendered his resignation...

(Energy Analytics Institute, Pietro D. Pitts, 18.Sep.2013) – Tudor Pickering Holt & Co. LLC Managing Director David Pursell spoke with Energy Analytics Institute in a brief interview from Dallas, Texas....