HOUSTON, TEXAS (By Pietro D. Pitts, Energy Analytics Institute, 28.Sep.2025, Words: 1,640) — ExxonMobil Corporation is taking aim at the US Gulf Coast to address growing decarbonization needs of industrial clients, while also addressing emissions from its own operations. To this end, ExxonMobil looks to remove up to 100 million metric tons per annum (MTA) of captured carbon dioxide (CO2) across the vast Gulf region. The endeavor is massive to say the least given that to-date ExxonMobil has only secured third-party CO2 offtake of around 10 MTA. This as emitters remain hesitant to sign on in mass for varied reasons.

ExxonMobil’s carbon capture and storage (CCS) efforts align with global efforts to reduce CO2 emissions in general and the company’s 2030 emission-reduction plans and ambition in particular to achieve net zero greenhouse emissions (Scopes 1 and 2) for its operated assets by 2050.

And, ExxonMobil is capable of building that amount of infrastructure, according to Rystad Energy vice president of CCUS Brendan Cooke. This, as Exxon already has a large number of permits along with access to enhanced oil recovery (EOR) fields off existing pipelines.

RELATED: ExxonMobil experts on capturing, moving and storing CO2 along the US Gulf Coast

“They have perhaps the largest existing pipelines available, certainly the largest ones along the US Gulf Coast. And, they’re set up very well in terms of being able to be the number one choice for storage and transportation services along the Gulf Coast,” Cooke told Energy Analytics Institute (EAI) last week during an telephone interview.

“I think the biggest bottleneck is going to be getting enough emitters to sign on to actually reach that 100 MTA goal. And that’s where we’re seeing bottlenecks, not just for ExxonMobil, but for all classic developers. And, right now the issue is [whether] you can actually convince an emitter to install capture equipment at their facility and make the investment on the emitter side,” Cooke said.

ExxonMobil boasts over 100 years managing and transforming hydrocarbon molecules. That experience and core competency has anchored the company’s push to capture, transport, and store CO2, produce hydrogen, and extract lithium out of brine.

To-date, ExxonMobil boasts it has already cumulatively captured 120 million metric tons of CO2 — more than any other company, accounting for 40% of all the anthropogenic CO2 ever captured. Recently, the company made an obvious move to strengthen its low carbon solutions business in the US space with its $4.9bn all-stock acquisition of Denbury Inc.

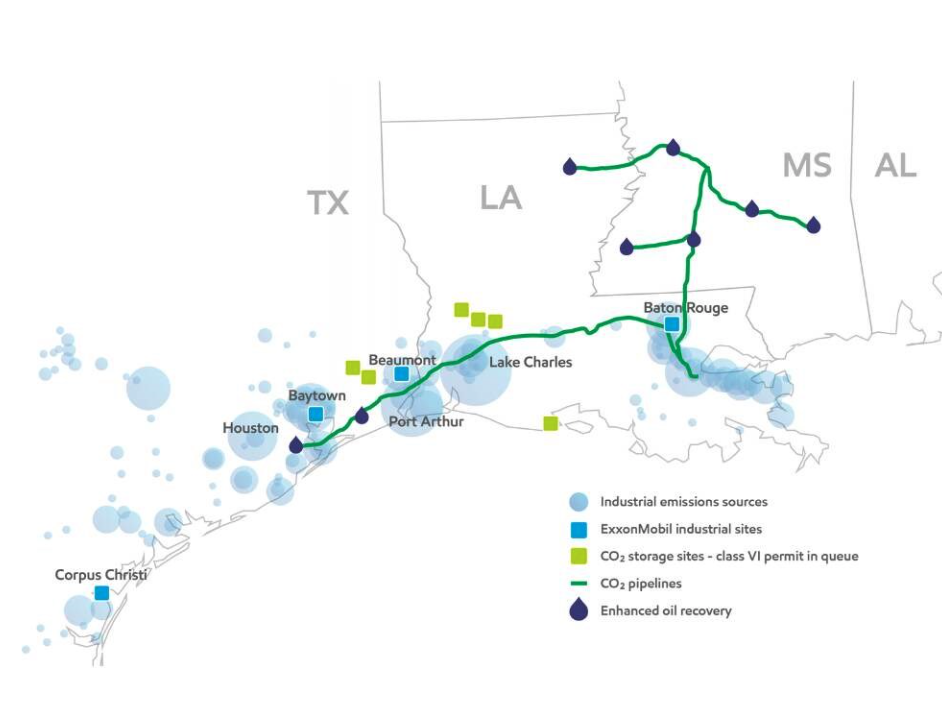

In the aftermath of the Denbury acquisition, ExxonMobil boasts the largest owned and operated CO2 pipeline network in the US. The deal added over 1,300 miles of CO2 pipelines, including nearly 925 miles of pipelines in Louisiana, Texas and Mississippi, 1 of the largest US markets for CO2 emissions, according to ExxonMobil. Resultantly, ExxonMobil also now has access to over 15 strategically located onshore CO2 storage locations.

“There’s no shortage of emissions, there’s lots of emissions. It’s trying to find people willing to capture these emissions,” Wood Mackenzie director, CCUS economics Peter Findlay told EAI last week during a telephone interview. Talking about a potential date for Exxon to reach the 100 MTA goal, Findlay said “2035 sounds optimistic and 2040 sounds more realistic.”

Decarbonization on 2 fronts

The US Gulf Coast possesses the critical drivers needed to provide a lower-cost decarbonization solution for industrial applications, according to ExxonMobil. These drivers include: a high concentration of emitters, geologic storage space, and existing transportation infrastructure. Besides, 1/3 of all US industrial emissions come from this region, according to the US Environmental Protection Agency (EPA).

And these drivers, strengthened by policies like the US Inflation Reduction Act (IRA), are key and assist ExxonMobil to build up its CCS network with an eye on assisting its industrial customers significantly reduce their emissions, according to the company.

ExxonMobil’s efforts already focus on point-source emissions or the process of capturing CO2 from industrial activity that would otherwise be released into the atmosphere. ExxonMobil has been safely capturing CO2 for more than 30 years.

ExxonMobil boasts the only large-scale end-to-end CCS system in the world. The US Gulf Coast is a strategic fit for ExxonMobil to scale up CCS as around 70% of its CCS pipelines are located in 3 Gulf states: Louisiana, Texas, and Mississippi. And, with such a vast coverage area, there are hundreds of federal mandates on the construction operation and monitoring of CO2 pipelines, according to ExxonMobil.

In the storage space, ExxonMobil continues to add acreage onshore and offshore to expand this capacity, which is expected to reach 30 MTA by 2030. Reaching this goal is subject to additional investment by ExxonMobil, receipt of government permitting for CCS projects, and start up of low-carbon hydrogen project in Baytown, Texas. Additionally, ExxonMobil continues to negotiate to gain access to nationally owned acreage that holds potential for CO2 storage, while its also continues to work with local jurisdictions on the appropriate permitting to store CO2.

“The Denbury acquisition gives [ExxonMobil] a lot of optionality around going onshore versus offshore, but then within onshore, going EOR versus storage. And, the recent enhancement of the One Big Beautiful Bill Act (OBBBA) gives them [optionality around] EOR and utilization,” Findlay said. EOR is most relevant here up to $85 [per ton of carbon] and bodes well for companies like ExxonMobil and even Occidental Petroleum (Oxy), who can say, we’ll take advantage of EOR where it makes sense.”

ExxonMobil has made specific progress with hard-to-abate sectors seeking to reduce their emissions. The company has committed to transporting and storing over 17 MTA of CO2 from its customers, more than any other company. This includes up to 9.8 MTA for third party customers and up to 7.5 MTA for the Baytown low-carbon hydrogen project, pending a final investment decision (FID) slated for 2025 with anticipated startup in 2029.

As such, the Spring, Texas-based energy company’s template for reducing CO2 emissions includes work on these 2 fronts.

ExxonMobil clients

The first front includes work for ExxonMobil’s clients across a range of industries including plans to use CCS to help make low-carbon electricity for data centers to help meet growing demand for computing power driven by artificial intelligence (AI). ExxonMobil’s advantage is it can manage the lifecycle of carbon from CCS owing to a vast network that can integrate into customers’ assets and logistical footprints.

The first front includes work with clients across a range of industries including plans to use CCS to help make low-carbon electricity for data centers to help meet growing demand for computing power driven by AI. And, ExxonMobil chairman and CEO Darren Woods sees “huge appetite in [the data center] space.”

“So, we’re not interested in the power-gen business. We have talked about low carbon data centers and having a power aspect to that. That’s really an enabler to carbon capture and storage,” Woods said on 1 Aug. 2025 during the company’s second-quarter 2025 webcast. “We’re interested in data centers, not from the power standpoint, but for our ability to decarbonize. And to the extent that these hyperscalers want decarbonized power.”

Through May 2025, ExxonMobil boasted signing deals with at least 7 CCS customers for up to 9.8 MTA for third party storage including CF Industries, a global manufacturer of hydrogen and nitrogen products (2.5 MTA); Linde, a leading industrial gases and engineering company (2.2 MTA); Nucor Corporation, North America’s largest steel and steel products producer (0.8 MTA); New Generation Gas Gathering or NG3 (1.2 MTA); Calpine Corporation, the US largest producers of electricity from natural gas (2 MTA) and another unnamed producer (1.1 MTA).

During an investment presentation in May 2025, ExxonMobil vice president, treasurer and investor relations head Jim Chapman said the Spring, Texas-based company was scaling up its low carbon solutions businesses with the expectation that earnings in the space could reach around $1bn by 2030.

“In low carbon solutions, we offer ways to help other industries decarbonize. We’re investing in areas where we have clear competitive advantages and can deliver strong returns,” Chapman said.

ExxonMobil continues to add suitable acreage onshore and offshore to expand its storage capacity. The company eyes achieving 30 MTA by 2030.

ExxonMobil didn’t respond to requests from EAI for details around the last 1-2 CCS deals and customers or general questions around its CCS operations along the US Gulf Coast including questions around safety and freshwater sources where it plans to store CO2.

Still, a lot of storage development still needs to happen, coupled with that storage being assigned to emitters for ExxonMobil to hit its 100 MTA target, according to Rystad’s Cooke.

“It’s gonna take a while, not only in the sense of development, but also in the sense of the Environmental Protection Agency (EPA) permitting timeframes. So, that has been a bottleneck for storage developers thus far. But I think the bigger issue outside of that, is getting emitters to actually sign for storage,” Cooke said.

ExxonMobil operations

The second front includes work by ExxonMobil to decarbonize its own operations.

A case in point is the planned start-up of ExxonMobil’s CCS expansion at its facility in LaBarge, Wyoming where the company looks to reduce the site’s emissions by 1.2 MTA. This, in addition to the 6-7 MTA already captured yearly at LaBarge. The additional capture will allow ExxonMobil to reduce greenhouse gas (GHG) emissions from its upstream operated emissions by 3%. The LaBarge facility currently captures nearly 20% of all human-made CO2 captured in the world each year, according to ExxonMobil.

But, Wood Mackenzie’s Findlay reminds us that the public’s appetite for decarbonization in general in the US is still pretty bearish.

“The appetite for paying for polluting is not high,” Findlay said.

____________________

By Pietro D. Pitts reporting from Houston. © 2025 Energy Analytics Institute (EAI). All Rights Reserved.