HOUSTON, TEXAS (By Editors at Energy Analytics Institute, 27.Jun.2025, Words: 463) — The International Energy Agency (IEA)‘s World Energy Investment shows that capital flows to the energy sector are set to rise to $3.3tn in 2025, up 2% in real terms compared to 2024.

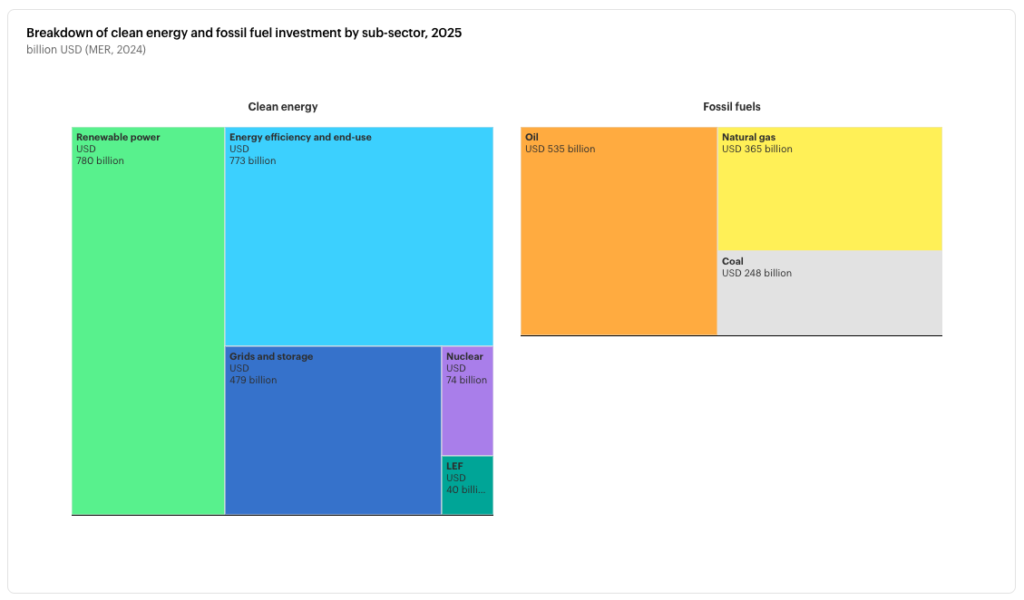

Of the total amount, $2.2tn is going collectively to renewables, nuclear, grids, storage, low-emissions fuels, efficiency and electrification, twice as much as the $1.1tn going to oil, natural gas and coal.

“Open questions about the economic and trade outlook means that some investors are adopting a wait-and-see approach to new project approvals, but we have yet to see significant implications for spending on existing projects,” the IEA said on 28 Jun. 2025 in an official statement.

Key highlights from the report include:

— rapid growth in spending on energy transitions over the past 5 years was kicked off by post-pandemic recovery packages and then sustained by a variety of economic, technology, industrial and energy security considerations, not only by climate policies,

— investment trends are being shaped by the onset of the ‘Age of Electricity’ and the rapid rise in electricity demand for industry, cooling, electric mobility, data centers and artificial intelligence (AI),

— spending on low-emissions power generation has almost doubled over the past 5 years, led by solar PV,

— nuclear investment is making a comeback, rising by 50% over the past 5 years, and approvals of new gas-fired power are rising,

— fast-growing electricity use and concerns about electricity security underpinned a wave of coal plant approvals in China.

— investment in grids is struggling to keep pace with the rise in power demand and renewables deployment.

— lower oil prices and demand expectations are set to result in a a 6% fall in upstream oil investment in 2025, the first year-on-year decline since the Covid slump in 2020 and the largest since 2016,

— its short investment cycle makes US tight oil the bellwether for changing market dynamics, with an anticipated fall of almost 10% in spending in 2025,

— investment in low-emissions fuels is set to reach a new high in 2025, but at less than $30bn, it remains small in absolute terms and projects remain heavily dependent on policy and regulatory support,

— investments in coal supply continue to tick upward with another 4% increase expected in 2025, a slight slowdown compared with the 6% annual average growth seen over the last 5 years,

— costs for some key clean technologies have resumed their strong downward trend, while supply chain pressures are still visible for grid materials and in the oil and gas sector,

— Despite growing concerns about the high supply concentration for critical minerals, growth in investment slowed in 2024 amid lower prices, and exploration activity was flat year-on-year,

— the geography of energy investment is shifting in ways that will have long-term implications.

Download the IEA’s full report here.

____________________

By Editors at Energy Analytics Institute. © 2025 Energy Analytics Institute (EAI). All Rights Reserved.