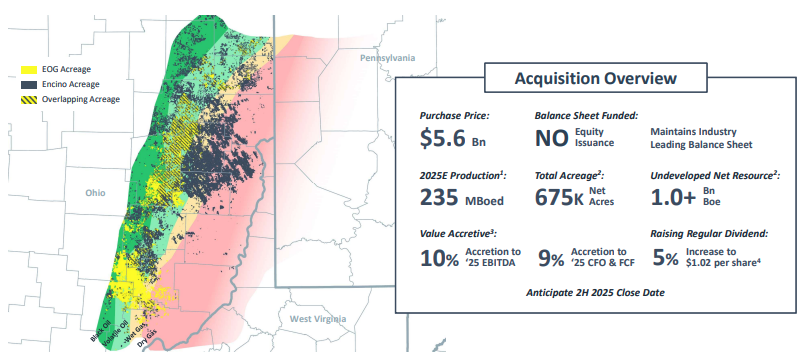

HOUSTON, TEXAS (Editors at Energy Analytics Institute, 30.May.2025, Words: 652) — EOG Resources, Inc. announced a definitive agreement with Canada Pension Plan Investment Board (CPP) and Encino Energy under which EOG will acquire Encino Acquisition Partners (EAP or Encino) for $5.6bn, inclusive of EAP’s net debt.

EOG currently expects to fund the acquisition through $3.5bn of debt and $2.1bn of cash on hand.

Details regarding the acquisition’s impact to EOG’s 2025 capital and volume guidance will be provided after closing, which is expected to occur in the second-half 2025. The acquisition is subject to clearance under the Hart-Scott-Rodino Act and other customary closing conditions, EOG announced on 30 May 2025 in an official statement.

“This acquisition combines large, premier acreage positions in the Utica, creating a third foundational play for EOG alongside our Delaware Basin and Eagle Ford assets,” EOG chairman and CEO Ezra Y. Yacob said in the statement. “Encino’s acreage improves the quality and depth of our Utica position, expanding EOG’s multi-basin portfolio to more than 12 billion barrels of oil equivalent net resource.

Advisors on the deal include Goldman Sachs & Co. LLC, which is serving as EOG’s exclusive financial advisor, and its affiliate, Goldman Sachs Bank USA, which is the sole provider of fully committed financing. Wachtell, Lipton, Rosen & Katz is serving as EOG’s lead legal advisor. Akin Gump Strauss Hauer & Feld LLP is also serving as legal counsel to EOG.

Transaction Highlights

— Transforms EOG into a leading Utica E&P:

The acquisition of Encino’s 675,000 net core acres significantly increases EOG’s Utica position to a combined 1,100,000 net acres, representing more than 2 billion barrels oil equivalent of (BOE) undeveloped net resource. Pro forma production totals 275,000 barrels of oil equivalent per day (boe/d) creating a leading producer in the Utica shale play.

— Accretive financial metrics:

The transaction is immediately accretive to EOG’s net asset value as well as all per-share financial metrics. Specifically, the acquisition is accretive on an annualized basis to 2025 EBITDA by 10%, and cash flow from operations and free cash flow by 9%.

— Immediate returns-enhancing benefits. Significantly expands EOG’s contiguous liquids-rich acreage, adds premium-priced gas exposure, and increases working interest:

The acquisition expands EOG’s core acreage in the volatile oil window, which averages 65% liquids production, by 235,000 net acres for a combined contiguous position of 485,000 net acres. In the natural gas window, the acquisition adds 330,000 net acres along with existing natural gas production with firm transportation exposed to premium end markets. In the northern acreage, where the company has delivered outstanding well results, EOG increases its existing average working interest by more than 20%.

— Operational expertise and increased scale drive meaningful synergies:

EOG expects to generate more than $150mn of synergies in the first year driven by lower capital, operating, and debt financing costs.

— Supports return of capital to shareholders with 5% dividend increase, while maintaining industry leading balance sheet:

The acquisition’s accretion to free cash flow contributes to EOG’s commitment to return cash to shareholders. The Board of Directors today declared a dividend of $1.02 per share on EOG’s common stock. The dividend will be payable 31 Oct. 2025, to stockholders of record as of 17 Oct. 2025. The indicated annual rate is $4.08. EOG remains committed to a strong balance sheet and expects the acquisition will have no material impact on its long-term target of less than one times total debt-to-EBITDA ratio at bottom cycle prices of $45 WTI oil.

“We are excited to execute on this unique opportunity that is immediately accretive to our per-share metrics and meets our strict criteria for acquisitions – high quality acreage with exploration upside, competitive with our current inventory, gained at an attractive price,” Yacob said. “Our ability to execute on the Encino acquisition without diluting our shareholders will be a textbook example of how EOG utilizes its industry leading balance sheet to take advantage of counter cyclical opportunities to enhance the returns of our business and create long-term value for our shareholders.”

____________________

By Editors at Energy Analytics Institute. © 2025 Energy Analytics Institute (EAI). All Rights Reserved.