(Frontera, 2.Mar.2022) — Frontera Energy Corporation (TSX: FEC) reported financial and operational results for the fourth quarter ended 31 December 2021. All financial amounts in this news release are in United States dollars, unless otherwise stated.

Gabriel de Alba, Chairman of the Board of Directors, commented:

“Frontera continues to deliver on its strategic, operational and financial objectives. In 2021, Frontera generated operating EBITDA of $373.2mn, an increase of 117% compared to 2020 and within the company’s tightened and increased full-year operating EBITDA guidance range. Frontera also averaged 37,818 boe/d, in-line with 2021 guidance. Frontera’s production costs averaged $11.46/boe and its transportation costs averaged $10.43/boe, both within 2021 guidance ranges. The company reported a year end cash position of $320.8mn and released approximately $105.6mn of restricted cash. Frontera increased its uncollateralized credit lines to $89.6mn at year-end and repurchased approximately 3.86 mn common shares, or 7.4% of the public float, for cancellation for approximately $21.5 mn under its current NCIB as of 31 December 2021.”

Orlando Cabrales, Chief Executive Officer (CEO), Frontera, commented:

“Frontera delivered strong fourth quarter results. Production averaged 38,605 boe/d, up 6% compared to the previous quarter and the company’s year-end production exit rate was 40,457 boe/d excluding Petrosud. Frontera’s daily production on 1 March 2022 was approximately 42,000 boe/d and the company’s year-to-date average to 1 March 2022 is approximately 40,500 boe/d. Compared to the previous quarter, cash provided by operating activities in the fourth quarter increased by 43%, the company’s operating netback increased 26%, the company’s net sales realized price increased 17% and the company’s transportation costs decreased 12%.

During the fourth quarter, Frontera began early production of ~2,400 boe/d (gross) at the La Belleza discovery on VIM-1, completed the Conciliation Agreement with Cenit and Bicentenario which eliminated more than $1bn in contingent liabilities, acquired 100% of the issued and outstanding shares in Petroleos Sud Americanos S.A. which added ~1,300 boe/d production and signed an agreement to acquire the remaining 35% interest in el Dificil block held by PCR Investments S.A., adding an additional ~500 boe/d of production when the deal closes in the second half of 2022. Subsequent to year end, we discovered hydrocarbon bearing reservoirs in multiple formations at the Jandaya-1 exploration well in Ecuador and we were awarded Block VIM-46 in the 2021 Colombia Bid Round. Importantly, we discovered approximately 200 feet of net pay within multiple horizons at the company’s potentially transformational Kawa-1 exploration well, offshore Guyana.”

Fourth Quarter Operational and Financial Results:

- Production averaged 38,605 boe/d, up 6% compared to 36,422 boe/d in the prior quarter and 41,945 boe/d in the fourth quarter of 2020. In 2021, Frontera averaged 37,818 boe/d, in-line with the company’s 2021 guidance of 37,500-39,500 boe/d compared with 47,800 boe/d in 2020. See the table above for production by product type for the prior quarter, fourth quarter of 2020, and year end 2021 and 2020. Frontera’s year-end production exit rate was 40,457 boe/d excluding production from the Petrosud acquisition. Frontera’s daily production on March 1, 2022 was approximately 42,000 boe/d consisting of approximately 21,500 bbl/d of heavy oil, 17,850 bbl/d of light and medium crude oil, 9,400 mmcf/d of conventional natural gas and 1,000 bbl/d of natural gas liquids. The company’s year-to-date average to 1 March 2022 was approximately 40,500 boe/d consisting of approximately 21,000 bbl/d of heavy oil, 16,850 bbl/d of light and medium crude oil, 9,400 mmcf/d of conventional natural gas and 1,000 bbl/d of natural gas liquids.

- Operating EBITDA was $148.3mn in the fourth quarter compared with $72.6mn in the prior quarter and $35.6mn in the fourth quarter of 2020. The increase in operating EBITDA quarter over quarter was primarily a result of two more cargoes sold during the fourth quarter of 2021. Frontera generated $373.2mn of EBITDA in 2021, up 117% compared to $172.3mn in 2020. Frontera’s $373.2mn of EBITDA in 2021 was within its 2021 EBITDA guidance of $360 – $380mn.

- The company reported a total cash position of $320.8mn at 31 December 2021 compared to $419.5mn at 30 September 2021. Cash utilization during the period included $39.6mn of debt service and interest, $8.5mn in the Petrosud acquisition and $6.2mn to repurchase shares.

- The company’s restricted cash position was $63.3mn at 31 December 2021 compared to $100.7mn in the third quarter of 2021, a release of approximately $37.4mn. The decrease in restricted cash quarter over quarter is primarily due to the release of approximately $28.9mn related to a pipeline settlement agreement that was approved on 11 November 2021 (the “Conciliation Agreement“). In 2021, the company released approximately $105.6mn of restricted cash. The company anticipates releasing additional restricted cash in the second quarter of 2022 as the company continues to optimize its credit lines.

- Cash provided by operating activities was $113.5mn in the fourth quarter of 2021, compared with $79.1mn in the prior quarter and $42.1mn in the fourth quarter of 2020.

- At 31 December 2021, the company had a total inventory balance of 807,061 bbls compared to 1,423,321 bbls at 30 September 2021. Sales volumes, net of purchases in the fourth quarter increased by 46% compared with the prior quarter, reducing the inventory volumes in Colombia in the quarter.

- The company has various uncommitted bilateral credit lines. As of 31 December 2021, the company had increased its uncollateralized credit lines to $89.6 mn, an increase of $69.6 mn compared to 31 December 2020. Subsequent to the quarter, the company increased its credit lines by approximately $16 mn.

- Under the company’s current Normal Course Issuer Bid (“NCIB”) which commenced on March 17, 2021 and ends 16 March 2022, the company repurchased for cancelation 989,300 common shares during the fourth quarter of 2021 at a cost of approximately $6.2mn. As of 1 March 2022, the company has repurchased approximately 4.1mn common shares for cancellation for approximately $23.0mn with an additional approximately 1.1mn common shares available for repurchase under the NCIB. The company intends to renew its NCIB when it expires on 16 March 2022, to permit purchases for up to 10% of its public float over the next year. There can be no assurance that the company will renew or complete its NCIB program as it remains subject to the Board’s discretion based on the company’s financial position and outlook at the time and acceptance by the Toronto Stock Exchange.

- Capital expenditures were $135.5mn in the fourth quarter of 2021, compared with $103.2mn in the prior quarter and $24.9mn in the fourth quarter of 2020. The company executed approximately $314.3mn in total capital spending in 2021 compared to $108.1mn in 2020. The increase in capital expenditures in the fourth quarter compared to the prior quarter was primarily due to increased operational activity as the company drilled 14 development wells and increased exploration activity in Guyana, Colombia and Ecuador. The company’s $314.3mn total capital spending in 2021 exceeded its 2021 capital guidance of $245-$295 mn.

- The company recorded net income of $629.4mn or $6.60/share in the fourth quarter of 2021, compared with net income of $38.5mn or $0.40/share in the prior quarter and net income of $48.6mn or $0.50/share in the fourth quarter of 2020. Net income for the year was $628.1mn or $6.50/share in 2021, compared with a net loss of $497.4mn or $5.13/share in 2020. The increase in net income quarter over quarter was mainly due to the reversal of impairments, the recognition of additional deferred tax assets, the increase in Brent oil prices and additional volumes sold at the end of the year. The increase in net income year over year was mainly due to the reversal of impairments and the recognition of additional deferred tax assets.

- The company’s operating netback was $47.80/boe, up 26% compared with $37.79/boe in the prior quarter and $13.57/boe in the fourth quarter of 2020 primarily due to higher net sales realized price and reduction in transportation costs mainly due to the recognition of prepaid services of the Bicentenario system, partially offset by the increase in production costs mainly due to additional higher well services, maintenance activities, and the increase in power generation and communities costs.

- The company’s net sales realized price was $69.53/boe in the fourth quarter, up 17%, or $10.06/boe, compared to $59.47/boe in the prior quarter and $37.88/boe in the fourth quarter of 2020. The increase was primarily driven by higher Brent oil prices, higher volumes sold, lower costs of risk management contracts and lower royalties per boe during the fourth quarter of 2021.

- Production costs averaged $12.71/boe in the fourth quarter of 2021, up 11% compared with $11.44/boe in the prior quarter and $12.95/boe in the fourth quarter of 2020.The increase in production costs was mainly due to additional well services, maintenance activities, and the increase in power supply and community costs. Frontera’s production costs averaged $11.46/boe in 2021, at the high end of its 2021 guidance range of $10.50-$11.50/boe.

- Transportation costs averaged $9.02/boe, down 12% compared with $10.24/boe in the prior quarter and $11.36/boe in the fourth quarter of 2020. The decrease in transportation costs was mainly due to the recognition of prepaid services of the Ancillary Agreements paid in 2020 as part of the implementation of the Conciliation Agreement, termination of the take or pay contracts for the Monterrey – El Porvenir pipeline, and the offloading facilities in Monterrey, Santiago and Oleoducto de Los Llanos Orientales (“ODL“). Frontera’s transportation costs averaged $10.43/boe, within its 2021 guidance range of $10.00-$11.00/boe.

- The company recorded a realized loss on risk management contracts of $6.7mn in the fourth quarter of 2021 compared to a realized loss of $6.6 mn in the third quarter of 2021 and a loss of $8.2mn in the fourth quarter of 2020. The realized loss on risk management contracts was primarily due to the cash settlement on three-way collars, puts and put spreads contracts paid during the quarter at an average price of $79.66/bbl. Subsequent to 31 December 2021, the company entered into new put hedges totaling 2,640,000 bbls to protect 2022 estimated production up to September 2022 at a $70/bbl strike price, and upgraded 565,000 bbls existing hedges as of 31 December 2021 from a $60/bbl strike price to $70/bbl strike price. The company’s first quarter 2022 hedges do not materially cap upside price potential. See the Hedging Update section below for more information.

- In 2021, Frontera implemented its “Building a Sustainable Future” ESG strategy and achieved 98% of its ESG goals for the year. The company neutralized 41% of its emissions through carbon credits and preserved and restored 765 new hectares of key connectivity corridors in Casanare and Meta Departments, Colombia. It was awarded the Equipares Gold Seal for the company’s commitment and efforts to close gender gaps in the workplace and in the communities where it operates, increased the purchase of local goods and services to $40mn, recorded a total reportable incident rate of 1.70 and was recognized in 2021 for the first time as one of the World’s Most Ethical Companies by Ethisphere. See below for more information.

Operational Update

Guyana

CGX and Frontera, the majority shareholder of CGX and joint venture partner of CGX in the petroleum prospecting license for the Corentyne block offshore Guyana, have safely completed exploration activities at the Kawa-1 exploration well. In line with our exploratory objectives, the well has now been safely plugged and abandoned and the Maersk Discover drilling rig has been released from the Kawa-1 location. Only a single lost time injury was recorded throughout Kawa-1 well operations. The final cost of the Kawa-1 exploration well was $141mn.

The Kawa-1 well was drilled to a total depth of 21,578 feet (6,577 metres) in the northern section of the Corentyne block. Drilling results confirm the presence of an active hydrocarbon system at the Kawa-1 location. Successful wireline logging runs confirmed net pay of approximately 200 feet (61 metres) within Maastrichtian, Campanian, Santonian and Coniacian horizons. These intervals are similar in age and can be correlated using regional seismic data to recent successes in Block 58 in Suriname and Stabroek Block in Guyana.

The Joint Venture did not get MDT data or sidewall core samples and has engaged an independent third-party to complete further detailed studies and laboratory analysis on drilling cuttings from the Santonian, Campanian and Maastrichtian intervals and well-bore fluid samples to evaluate in situ hydrocarbons. Preliminary results from the Santonian interval indicate the presence of liquid hydrocarbons in the reservoir. Results from the Campanian and Maastrichtian intervals are pending.

Kawa-1 well results have improved the Joint Venture’s understanding of the operational and geological complexities of the basin and will help reduce the technical risks of the Wei-1 exploration well. Given the initial positive results at the Kawa-1 well the Joint Venture is moving forward with its second exploration well, Wei-1 on the Corentyne block.

The Joint Venture has begun the integration of detailed seismic and lithological analysis and pore pressure studies from the Kawa-1 well into drilling preparations in advance of spudding the Wei-1 exploration well which will be spud in the second half of 2022. The Wei-1 exploration well will target Campanian and Santonian aged stacked channels in the western fan complex in the northern section of the Corentyne block. Data from both the Kawa-1 and Wei-1 wells will inform future activities and potential appraisal/development decisions.

On 14 February 2022, the Joint Venture announced that as a result of the initial positive results at the Kawa-1 exploration well, the Joint Venture will focus on the significant exploration opportunities in the Corentyne block and will not engage in drilling activities on the Demerara block in 2022.

CGX is currently assessing several strategic opportunities to obtain additional financing to meet the costs of the drilling program.

Colombia

Frontera’s daily production on 1 March 2022 was approximately 42,000 boe/d and the company’s year-to-date average to 1 March 2022 was approximately 40,500 boe/d.

Currently, the company has five drilling rigs and five workover rigs active at its Quifa, Coralillo, Corcel, Copa and Guaduas operations in Colombia and at the Perico block in Ecuador. In the fourth quarter of 2021, the company drilled 14 development wells including 12 at Quifa, and 2 at Guatiquia and completed 56 workovers and well services at Quifa, Guatiquia, Canaguaro, Abanico, Corcel, Cajua, Cravoviejo, Cubiro and Casimena. In 2021, the company drilled 42 producer wells, 3 injector wells and completed 148 workovers and well services.

Production at Key Fields

At Quifa, current production is approximately 16,100 bbl/d of heavy crude oil (including both Quifa and Cajua). The company drilled 12 development wells at Quifa in the fourth quarter of 2021 and 25 development wells and 2 injector wells in 2021. Frontera also continued to recover water disposal levels in the fourth quarter by performing interventions in some water disposal wells at different injection layers.

At Guatiquia, current production is approximately 9,400 bbl/d of light and medium crude oil. The company successfully completed the Coralillo-9 well during the quarter which is currently producing 700 bbl/d. Frontera also completed Coralillo-15 in the fourth quarter which began production of 600 bbl/d in January 2022.

At CPE-6, current production is approximately 5,000 bbl/d of heavy crude oil. In the fourth quarter, Frontera began operations on its facilities expansion strategy which is expected to handle up to 120,000 bbl/d and over 5,000 bbl/d.

On the VIM-1 Block (Frontera 50% W.I., non-operator), production from the La Belleza discovery began on 8 November 2021 with gross rates of approximately 2,400 boe/d (consisting of 1,400 bbl/d of light crude oil and 6,000 mcf/d of conventional natural gas). The Planadas-1 exploration well, located 6.3 kilometers west of the La Belleza-1 discovery, was drilled to a measured depth of ~13,700 feet and yielded no hydrocarbons. The operator, at sole risk, proceeded with a sidetracking operation to investigate a nearby updip target.

Ecuador

On 7 December 2021, Frontera spud the Jandaya-1 exploration well on the Perico block (Frontera 50% W.I. and operator) in Ecuador. The well was drilled to a total depth of 10,975 feet (3,345 meters) and a total of 78 feet vertical depth of potential hydrocarbon bearing reservoir was encountered in three formations. Production tests in the lower Hollin formation have produced 780 barrels per day of 27.9 degree API crude oil and 0.582 mn standard cubic feet per day of gas, for a combined 882 total boe with a 1.7% water cut, after 29 days of testing. Development planning activities and permitting work has begun in advance of long-term testing of at least six months or a longer period of time if approved by authorities. The company is also preparing the environmental impact assessment as part of its efforts to obtain a production environmental license.

On 28 January 2022, Frontera spud its second exploration well called Tui-1 in the southern portion of the Perico block. The Tui-1 exploration well is expected to be drilled to a total depth of 10,972 feet and is targeting the same Hollin formation as Jandaya-1. Additional prospects on the Perico block have been identified and are being matured for future drilling.

In the Espejo block (Frontera 50% W.I., non-operator), the company anticipates acquiring 60 square km of 3D seismic followed by spudding the first exploration well in the block in the second half of 2022.

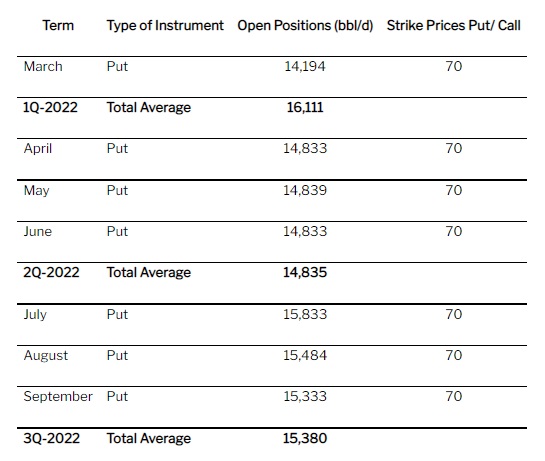

Hedging Update

As part of its risk management strategy, the company uses derivative commodity instruments to manage exposure to price volatility by hedging a portion of its oil production. The company’s strategy aims to protect 40%-60% of the estimated production to protect the revenue generation and cash position of the company while maximizing upside. Previously, the company’s hedging strategy included the use of a combination of capped and uncapped instruments. For 2022, Frontera has adjusted its strategy from previous years, now only using put options, which allows the company to capture the full upside price benefit while offering efficient downside hedging.

Subsequent to 31 December 2021, the company entered into new put hedges totaling 2,640,000 bbls to protect 2022 estimated production up to September 2022 at a $70/bbl strike price, and upgraded 565,000 existing hedges as of 31 December 2021 from a $60/bbl strike price to $70/bbl strike price. The following table summarizes Frontera’s hedging position as of 2 March 2022.

Update on Frontera’s ESG Strategy Implementation

In 2021, Frontera made significant progress implementing its “Building a Sustainable Future” ESG strategy, achieving 98% of its ESG goals for the year. In the environmental focus area, the company neutralized 41% of its emissions through carbon credits and, preserved and restored 764 hectares of key connectivity corridors in Casanare and Meta departments, Colombia and continued maintenance activities on an additional 783 hectares the company had previously restored.

In the social focus area, Frontera was awarded the Equipares Gold Seal for the company’s commitment and efforts to close gender gaps in the workplace and in the communities where it operates. The company also strengthened its local supplier programs and increased the purchase of local goods and services to $40mn. Frontera continues to build a strong HSE culture, achieving a total reportable incident rate of 1.70 for the year.

In the governance focus area, Frontera was recognized in 2021 for the first time as one of the World’s Most Ethical Companies by Ethisphere, a leader in the promotion of business ethics. The company continues to improve its ethics, integrity, compliance, and responsible risk management standards and remains committed to develop its ESG risk management processes across the company.

Fourth Quarter 2021 Conference Call Details

A conference call for investors and analysts will be held on Thursday, 3 March 2022 at 10:00 a.m. Eastern Time. Participants will include Gabriel de Alba, Chairman of the Board of Directors, Orlando Cabrales, Chief Executive Officer, Alejandro Piñeros, Chief Financial Officer and other members of the senior management team.

Analysts and investors are invited to participate using the following dial-in numbers:

Participant Number (Toll Free North America): 1-888-204-4368

Participant Number (Toll Free Colombia): 01-800-518-3328

Participant Number (International): 1-647-794-4605

Conference ID: 9418837

Webcast Audio: www.fronteraenergy.ca

A replay of the conference call will be available until 11:59 p.m. Eastern Time on March 10, 2022.

Encore Toll free Dial-in Number: 1-647-436-0148

International Dial-in Number: 1-888-203-1112

Encore ID: 9418837

____________________