(Trinidad and Tobago Newsday, Carla Bridglal, 22.Nov.2018) — Crude oil’s importance to the TT economy is now second to natural gas, but its contribution is by no means miniscule — estimated to be 6.8 per cent of GDP in 2018 — and so the country should at least be monitoring current volatility in the international market.

Prices have plummeted nearly 30 per cent since October 3, where their lofty US$76 per barrel heights seemed a comfortable distance from the US$65 per barrel pegged in the national budget. Now, with prices around US$54, it’s hard not to wonder if that might have been an over-confident consideration.

“Can one project the price of oil? At the Central Bank, we tend to be very conservative. We don’t believe the good times will last and oil prices will go up forever, but we have been wrong before. I can’t say if that decision (by the Finance Minister) was appropriate—it did seem so at the time, but you don’t build your future on continuous increases,” Central Bank governor Alvin Hillaire said at the bank’s recent Monetary Policy Report launch.

To be fair, Finance Minister Colm Imbert’s projection was based on an international projection that had, since the beginning of the year, been trending upward, well above the US$52 per barrel that last year’s budget had been pegged on. And while there are several variables still to consider, including output, an oil price 20 per cent lower than budgeted will inevitably have an impact on the projected expenditure for 2019, not the least adding strain to the deficit.

Imbert declined to comment on the government’s outlook, nor whether the decision to peg oil prices at that level was optimistic, instead referring the Business Day to the US Energy Information Administration’s (EIA) projections for 2019, which have oil prices at $64.85 per barrel.

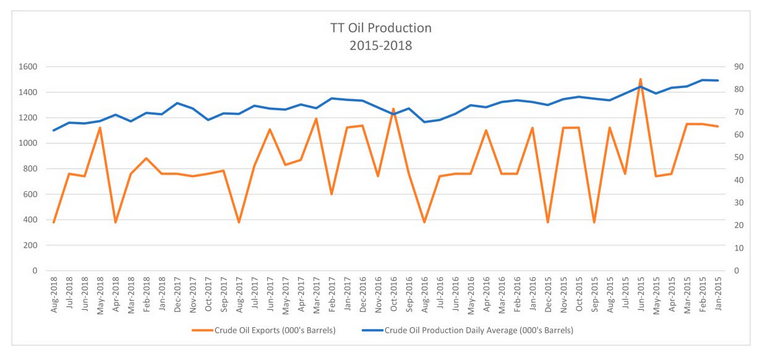

Oil prices will also inevitably influence the operations of new state entity, Heritage Petroleum, whose business is exploration and production (E&P). Heritage will acquire Petrotrin’s E&P assets, and the company’s chairman Wilfred Espinet (also chairman of Petrotrin), has said the company should not have any problem selling its product on the international market because oil is a marketable and valuable commodity. Nevertheless, the state company is the country’s biggest producer of oil—nearly 60 per cent—but its assets are among some of the most mature fields in production.

According to the 2018 Review of the Economy, crude and condensate output “continued to be hampered by the natural decline in output from mature fields, coupled with the lack of additional output from new sources and the adverse effects of aging infrastructure.”

Petrotrin famously lost money in periods of high oil prices because it had to import its raw material to feed the refinery. The Pointe-a-Pierre refinery is set to shut down all operations at the end of this month, so TT has to import its fuel—via the Paria Trading Company, which, it stands to reason, may benefit from lower international commodity prices.

Then there’s oversupply in the market. US oil production is at its highest levels ever at 11.6 million barrels of oil per day, and the EIA has projected that increase to 12 million. Russia is producing 11.4 million barrels per day, and Saudi Arabia is producing at its highest level ever 10.7 million barrels per day.

In October 2018, world oil production was 100.7 million barrels per day, which is about 2.6 million barrels more than it was at the same point in 2017. “In 2019, it can be expected that the world will be over supplied with crude oil by between one to two million barrels of oil per day. While admittedly, growth in demand for oil in the last 12 months is on rise (+1.7 per cent) it has been outpaced by the growth in supply (+2.4 per cent),” said former energy minister Kevin Ramnarine.

The Organisation of Petroleum Exporting Countries (OPEC) has been contemplating cuts—led by Saudi Arabia— to restore a balance in the market. Speaking at the Gas Exporting Countries Forum (GECF), OPEC member Venezuela’s energy minister Manuel Quevedo said the group supported a fair price in the market that will allow for balance. “It’s a very difficult question sometimes. We always want to have a balance in the market,” he said. Consumers want a certain price and the producing country wants an adequate return on investment.

Added to the oversupply scenario are two other factors, Ramnarine said. The first is the US dollar which has been appreciating against major currencies recently. There is generally a negative correlation between the US dollar and the oil price—as the dollar appreciates the oil price falls. The second factor is the expected slowdown or the deceleration in growth in the euro area and China in 2019. Given these scenarios, the oil price is expected to remain soft.

“While oil has a lesser impact on TT government revenue compared to natural gas it still has an impact on some liquefied natural gas sales, on the methanol price and the price of natural gas liquids sold by Phoenix Park Gas Processors Ltd,” Ramnarine said. Natural gas is still the driver of the economy, so that can provide some buffer, though not enough to really boost the overall economy.

Ramnarine suggested that while TT will continue to benefit from natural gas projects like Juniper and Angelin, their positive impact, while welcomed, will be insufficient to cause the spill-over effect needed to pull the non-energy sector.

***

#LatAmNRG