(Energy Analytics Institute, 15.Jan.2022) — Energy briefs including Chile’s state oil and gas entity ENAP celebrating 66 yrs of operations at the Aconcagua Refinery; construction of Mexico’s Olmeca Refinery progressing...

(Talos Energy, 5.Jul.2021) — Talos Energy Inc. (NYSE: TALO) provided an update regarding operatorship for the company's Zama asset in offshore Mexico. On 2 July 2021, Talos was notified by...

(Argus, 21.Dec.2020) — Proposed changes to rules governing importing and exporting hydrocarbons, refined products and petrochemicals in Mexico would "seriously affect competitive conditions in the commercialization of fuels," competition watchdog...

(Talos, 4.Nov.2020) — Talos Energy Inc. announced its financial and operational results for the third quarter of 2020. Key Highlights: -- Production of 48.6 thousand barrels of oil equivalent per...

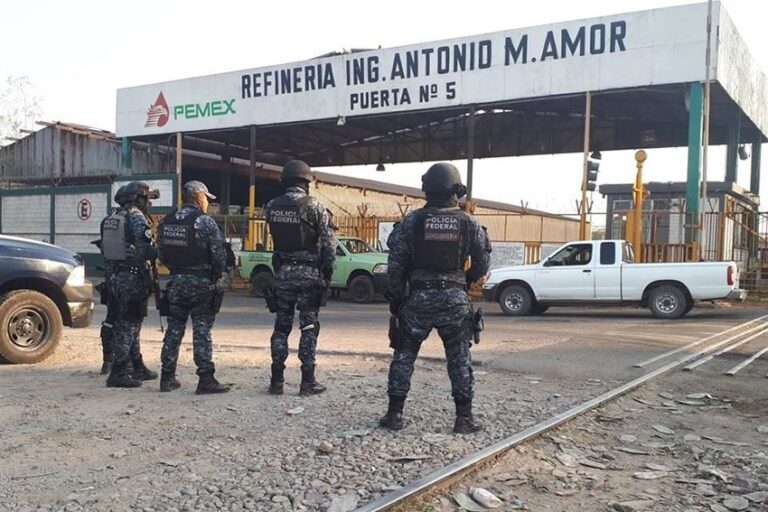

(Energy Analytics Institute, 15.Jul.2020) — Mexico’s Energy Secretariat anticipates a rise in the number of workers to be employed during the rehabilitation of the Salamanca refinery this year versus last....

(Talos, 9.Jul.2020) — Talos Energy Inc. announced that on 7 July 2020, that it received a notice from Mexico's Ministry of Energy (SENER) instructing the partners of Block 7 and...

(Energy Analytics Institute, 8.Jul.2020) — Mexico’s Energy Secretary (Sener) instructed the unification of a shared reservoir between the Zama field discovered through Contract CNH-R01-L01-A7 / 2015 by Talos Energy Offshore...

(Argus, 29.Oct.2019) — Mexico expanded its clean energy certificates (CELs) to legacy, mostly hydropower generators previously excluded from the program, which was created primarily to boost new wind and solar...

(Energy Analytics Institute, Jared Yamin, 25.Jun.2019) — Mexico’s state oil and gas entity Pemex will supply the Yucatan Peninsula with 240 million cubic feet (MMcf/d) of natural gas starting 15...

(Energy Analytics Institute, Aaron Simonsky and Ian Silverman, 25.Jun.2019) — Heard on the street related to the Latin America and Caribbean upstream, midstream, downstream and renewable energies sectors. ARGENTINA --...

(Energy Analytics Institute, Jared Yamin and Ian Silverman, 9.May.2019) — Heard on the street and LatAmNRG briefs related to the Sener and Pemex moving forward with the Dos Bocas Refinery...

(Ft.com, Jude Webber, 9.May.2019) — Andrés Manuel López Obrador, Mexico's president, has stepped up his commitment to an $8bn refinery project, rejecting three private sector bids as too costly and...

(Talos Energy Inc., 5.Nov.2018) — Talos Energy Inc. and its partners in Block 7 offshore Mexico signed a Pre-Unitization Agreement (PUA) with Pemex that enables information sharing related to the...

(S&P Global Platts, 18.Oct.2018) — Gas shortages in southern Mexico will reach a critical point in November as Pemex natural gas production continues declining and users lack access to LNG...

(Pemex, 20.Sep.2018) — Pemex and the Block 7 consortium signed the first ever pre-unitization agreement in Mexico. Petróleos Mexicanos (Pemex) and Talos Energy, as operator of the Block 7 Consortium,...

(Pemex, 26.Jul.2018) – Environmental protection and sustainability, the governing principles of the State-Owned Productive Company’s work The CEO of Petróleos Mexicanos, Carlos Treviño, inaugurated the 7th Environmental Conferences this morning...

(Natural Gas Intelligence, Ronald Buchanan, 13.Jul.2018) – Mexico President-Elect Andres Manuel Lopez Obrador aims to decentralize the government in a sweeping plan to ease the congestion of population, buildings, vehicles...

(ThinkGeoEnergy, 26.Jun.2018) – Indicated in a recent webinar as part of the upcoming GEOLAC geothermal conference, a new price mechanism specifically tailored towards geothermal is being considered for Mexico. As...

(Platts, 30.Jun.2017) — Mexican state-run utility CFE has canceled its auction to bring natural gas into the Pacific state of Baja California Sur, the company said. CFE said the gas...

(Pemex, 10.Jun.2015) – The Ministry of Energy (SENER), Pedro Joaquín Coldwell, opened the 10th Mexican Petroleum Congress at the Guadalajara Expo, which brought together 270 national and international companies with...