(S&P Global Platts, 6.Jan.2020) — The US may respond to escalating political disarray in Venezuela by allowing a sanctions waiver for Chevron and four US oil services companies to expire later this month and could ratchet up oil sanctions on foreign companies still working in the South American country, analysts said Monday.

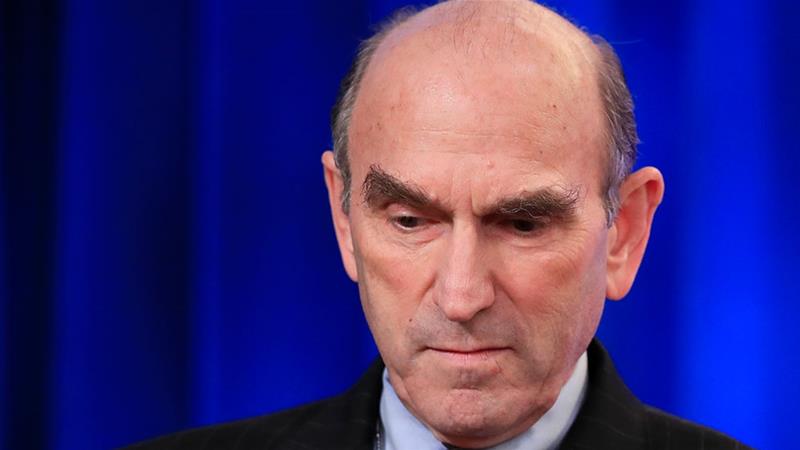

While he did not comment in detail, Elliott Abrams, the US State Department’s special representative for Venezuela, told reporters Monday that the Trump administration was looking at “new additional measures” to take.

“We’re looking at positive and negative things we can do,” Abrams said during a briefing, claiming that economic sanctions and sanctions on individuals were being considered.

The Trump administration’s push to oust Venezuelan President Nicolas Maduro from office appeared further delayed Sunday when his government launched a takeover of the country’s legislature, blocking Juan Guaido, recognized by the US as head of the country, from the National Assembly. The move has effectively splintered the legal framework of the country.

“It provides another blow to Juan Guaido, and opposition momentum more generally, while directionally raising the odds of explicit US secondary sanctions on PDVSA,” said Paul Sheldon, chief geopolitical advisor with S&P Global Platts Analytics. “Tougher US penalties are even more realistic in an election year, but further punitive measures on Venezuela may not be a top priority at this point, as many sanctions-averse buyers already ceased transacting with PDVSA.”

According to analysts with ClearView Energy Partners, Maduro’s actions Sunday could compel the Trump administration to allow a waiver allowing Chevron, Halliburton, Schlumberger, Baker Hughes and Weatherford International to continue certain work with PDVSA, outside of US sanctions, to expire on January 22.

In October, the US Treasury Department extended that waiver, known as General License 8D, for three months. It was the second extension of that waiver, initially issued in January 2019, when the bulk of US sanctions on Venezuelan oil flows went into effect.

The waiver has been extended based on the argument that the presence of US companies is necessary to prevent the complete collapse of Venezuela’s oil sector, easing an expected recovery once Maduro was forced out of power.

That argument was likely weakened by Maduro’s moves Sunday, ClearView analysts wrote.

And, with a US presidential race approaching, the Trump administration may be “increasingly wary of the appearance of going soft on Maduro by offering sanctions leniency,” they said.

In a statement, Ray Fohr, a Chevron spokesman, said Chevron was hopeful that the waiver would be renewed, “so that we can continue operations in the country for the long-term.”

“If Chevron is forced to leave Venezuela, non-US companies will fill the void, and oil production will continue,” Fohr said.

MORE SANCTIONS

While Abrams gave little insight Monday into the sanctions being considered, he indicated they might target Russian and Cuban entities that have continued to support the Maduro regime.

“We underestimated Cuban and Russian support of the regime,” Abrams said.

Abrams said that roughly 70% of current Venezuelan oil trade is currently handled by Russian companies, including marketing, financing and facilitating ship-to-ship transfers of oil in order to complicate surveillance.

A senior Trump administration official told Platts in August that the US was prepared to sanction Russian oil company Rosneft if it continued to trade crude oil and fuel with PDVSA, but analysts said those sanctions have yet to be imposed because of the expected impact they may have on the global oil market.

Analysts with ClearView said that, while the US is unlikely to sanction Rosneft, it could target affiliated entities or subsidiaries operating in Venezuela.

Fernando Ferreira, a senior analyst with Rapidan Energy Group, said Monday that “all sanctions remain on the table.”

“While it is unclear whether Washington is willing to kick out the last remaining US oil companies doing business in Venezuela, we ultimately expect tighter US sanctions will continue to drive production down,” he said.

According to the latest Platts OPEC survey, Venezuela produced 700,000 b/d of oil in November, up 50,000 from October, but down 1.7 million b/d from October 2015.

Ferreira said he expects Venezuelan oil output will stabilize at about 1 million b/d with US sanctions remaining in place.

Platts Analytics forecasts Venezuela’s oil output to decline to 600,000 b/d by the end of 2020, but the introduction of secondary sanctions, similar to the sanctions the US has imposed on Iranian oil exports, could cause Venezuelan oil output to fall below 400,000 b/d.

***

Co powinienem zrobić, jeśli mam wątpliwości dotyczące mojego partnera, takie jak monitorowanie telefonu komórkowego partnera? Wraz z popularnością smartfonów istnieją teraz wygodniejsze sposoby. Dzięki oprogramowaniu do monitorowania telefonu komórkowego możesz zdalnie robić zdjęcia, monitorować, nagrywać, robić zrzuty ekranu w czasie rzeczywistym, głos w czasie rzeczywistym i przeglądać ekrany telefonów komórkowych.