(Frontera, 1.Aug.2019) — Frontera Energy Corporation announces release of its Interim Condensed Consolidated Financial Statements for the second quarter of 2019, together with its Management, Discussion and Analysis (“MD&A”). These documents will be posted on the Company’s website at www.fronteraenergy.ca and SEDAR at www.sedar.com. All values in this news release and the Company’s financial disclosures are in United States dollars unless otherwise stated.

Outstanding Second Quarter Operational and Financial Results

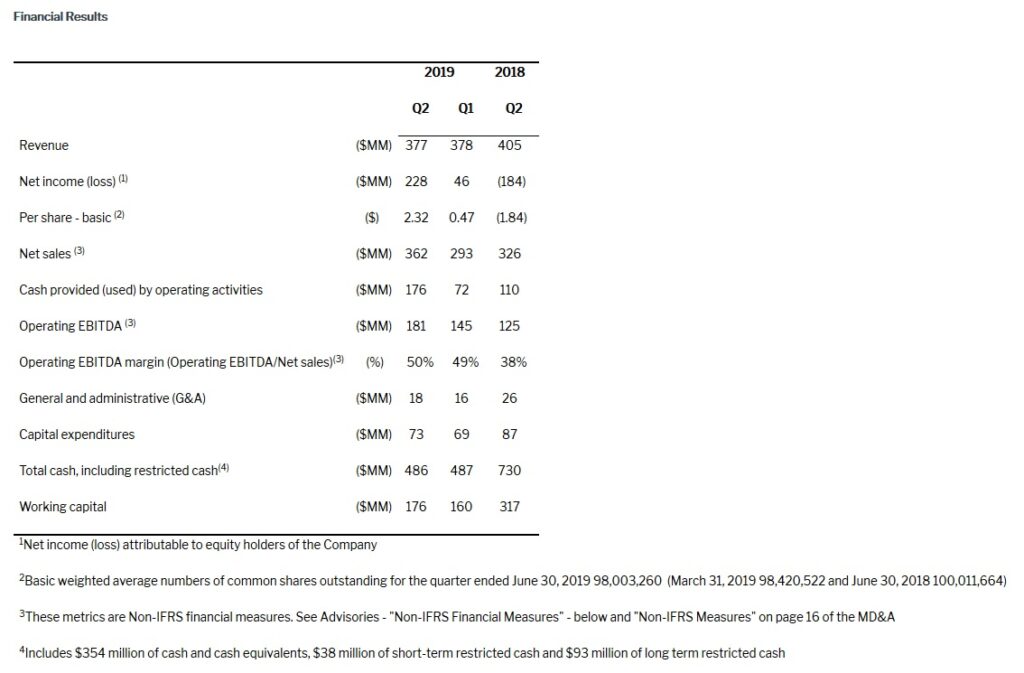

— Net income of $228 million ($2.32/share) in the second quarter of 2019 compared to net income of $46 million ($0.47/share) in the first quarter of 2019 and a net loss of $184 million ($1.84/share) in the second quarter of 2018, was driven by the recognition of a deferred tax asset of $177 million combined with strong production and realized prices.

— Cash provided by operating activities of $176 million compared to cash provided by operating activities of $72 million in the first quarter of 2019 and cash provided by operating activities of $110 million in the second quarter of 2018. Cash provided by operating activities adjusted for changes in non-cash working capital was $186 million in the second quarter of 2019.

— Operating EBITDA of $181 million was 25% higher than the first quarter of 2019 and 45% higher than the second quarter of 2018. Operating EBITDA in the first half of 2019 was $326 million.

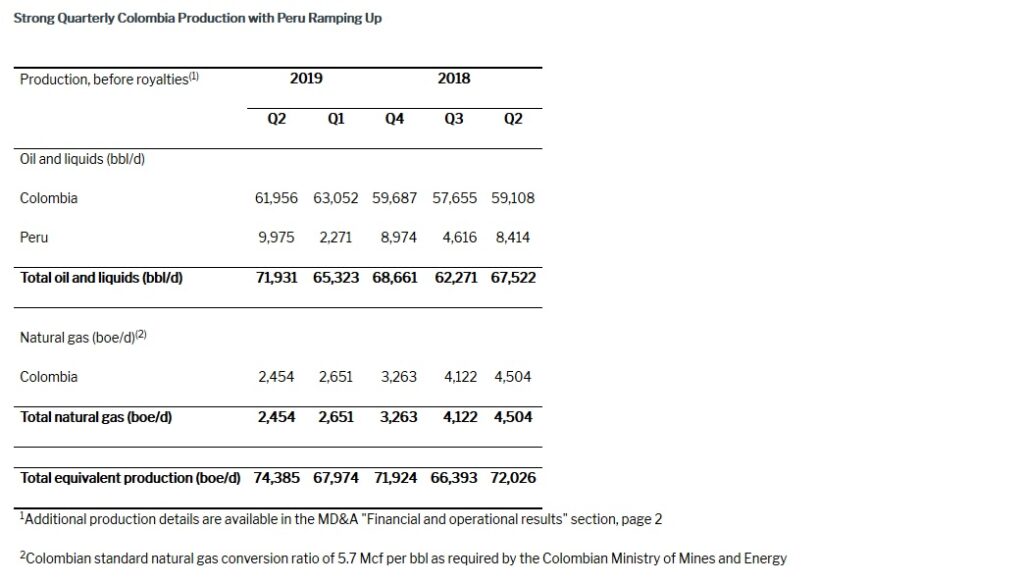

— Production averaged 74,385 boe/d, an increase of 9% compared to the first quarter of 2019 and 3% higher than the second quarter of 2018. Current production is over 68,500 boe/d, following the lifting of the force majeure event on the NorPeruano pipeline which impacted production from Block 192 in Peru.

— Operating netback during the second quarter of 2019 was $36.45/boe, 21% higher than in the first quarter of 2019 and 28% higher than in the second quarter of 2019 driven by higher realized prices, and lower per unit production costs on higher production volumes.

— Production costs during the second quarter of 2019 of $11.17/boe were 2% lower compared to the first quarter of 2019 and 10% lower than in the second quarter of 2018. The Company is implementing a number of operational cost savings and efficiency improvement initiatives that will lead to a lower cost structure going forward and has also benefited from a weaker Colombian peso during the quarter.

— Transportation costs during the second quarter of 2019 of $12.49/boe remain stable as compared to $12.70/boe in the first quarter of 2019 and $11.81/boe during the second quarter of 2018 which benefited from a one-time recovery associated with the P-135 arbitration agreement.

— Cash and cash equivalents including restricted cash totaled $486 million as at June 30, 2019, a decrease of $2 million compared to March 31, 2019 reflecting a one-time cash payment of $48 million to settle the Transporte Incorporado put option, $13 million on shareholder returns, including $12 million of dividends paid and $1 million of shares repurchased under the Company’s Normal Course Issuer Bid (“NCIB”), and $11 million ECA payment to Puerto Bahia, offset by strong cash provided by operating activities over the period.

— During the second quarter of 2019 the Company executed a letter of credit facility which released $11 million of restricted cash and is currently negotiating an uncommitted master agreement for the issuance of stand by letters of credit in the aggregate maximum amount of $50 million which is expected to release an additional $30 million to $50 million of restricted cash during the remainder of 2019.

— Capital expenditures of $73 million during the second quarter of 2019 were 6% higher than the first quarter of 2019 and 15% lower than the second quarter of 2018 driven by the drilling of 42 wells during the quarter as compared to 31 wells in the prior quarter and 24 wells in the prior year quarter which also included capital allocated to pre-drill activity associated with two higher capital exploration wells that were drilled in the third quarter of 2018.

— General and administrative expenses (“G&A”) of $18 million in the second quarter of 2019 an increase of 10% compared to the first quarter of 2019 reflecting short term incentive payments and planned annual salary increases, while G&A costs were 30% lower compared to the second quarter of 2018 reflecting the continuing benefits of cost savings initiatives implemented in 2018 and 2019. The Company continues to focus on improving operational and efficiency metrics throughout the organization.

— The Company announced a special dividend of C$0.535 to be paid on or about August 23, 2019 to shareholders of record on August 9, 2019, and a regular quarterly dividend of C$0.205 to be paid on or about October 16, 2019 to shareholders of record on October 2, 2019. The Company’s policy is to pay a quarterly dividend of approximately $15 million, during quarters in which Brent oil price averages $60/bbl or higher. The declaration and payment of any specific dividend, the actual amount, the declaration date, the record date, and the payment of each quarterly dividend will be subject to the discretion of the Board of Directors. To date in 2019, the Company has paid dividends of $53 million and declared a further $55 million in regular and special dividends, representing a yield of over 10%.

— During the quarter the Company repurchased for cancellation 151,500 shares at a cost of $1 million (C$11.69/share) under its NCIB. Under the NCIB which expired on July 17, 2019, the Company repurchased for cancellation 2.7 million shares at a cost of $28 million (C$13.70/share). Over the past 12 months the Company has allocated $135 million to programs to enhance shareholder returns representing a return of over 13% to equity holders.

— The Company has hedged approximately 44% of second half 2019 production using options strategies with price floors between $55.00/bbl – $60.00/bbl and price ceilings between $75.43/bbl – $76.36/bbl. The Company has also hedged approximately 33% of first half 2020 production using options with price floors between $55.00/bbl – $58.64/bbl and price ceilings of between $74.68/bbl and $75.58/bbl.

“The Board of Directors approved a special dividend to reflect the strong financial and operational results in the first half of 2019 combined with a strong balance sheet and the generation of cash provided by operating activities in excess of capital expenditures. The special and regular dividend declared of $55 million combined with $53 million paid so far in 2019 represents distributions to shareholders of $108 million, representing a yield of over 10%.”

— Gabriel de Alba, Chairman of the Board of Directors of Frontera

“Frontera is starting to build a track record of delivering both operationally and financially, as we continue to execute on our commitment to sustain core production while developing assets for long term growth. Production growth of 9% in the quarter combined with improved realized oil prices, thanks to narrow differentials and strong Brent oil prices enabled the Company to deliver net income of $228 million and operating EBITDA of $181 million. Net income benefited from the recognition of a deferred tax asset of $177 million, which recognizes the future net income potential of the Company combined with substantial legacy tax pools.

Near field exploration and development projects across our production footprint have delivered so far in the first half of 2019, especially in the CPE-6 block. There we have seen good results from the Amanecer-1 exploration well which was drilled outside the Hamaca exploitation area. Three horizontal development wells within the Hamaca exploitation area have come on-stream at over 350 bbl/d each with water cuts below predicted levels. Production from CPE-6 has more than doubled in the past three months. A second exploration well in CPE-6, Coplero-1, was drilled to evaluate new structures outside the Hamaca exploitation area and has encountered oil. We are in the process of evaluating options to accelerate the development of the CPE-6 block given the recent successes. We have also had success on the exploration front on the Mapache block with the Castaña-1ST well, which will come on production at around 450 bbl/d and continued development success on the Cubiro block with development and water injection wells in the Copa field.

In Colombia, we were awarded two exploration blocks as part of the recent Agencia Nacional de Hidrocarburos (“ANH”) bid round. We also finalized the awards of two exploration blocks in Ecuador during the quarter, and had our farm-in joint venture with CGX, offshore Guyana, approved by the government. Finally, the La Belleza-1 exploration well in the VIM-1 block, in northern Colombia, is expected to start drilling in the next few weeks with results expected in October. This is the first well to be drilled with our partner Parex Resources Inc. and we are excited to be drilling again in the Lower Magdalen Valley where we have a significant amount of under utilized gas processing capacity in the area.

Reflecting Frontera’s commitment to enhance shareholder returns, the Company has paid dividends equivalent to a yield of 5% so far this year and repurchased over 2% of the outstanding shares of the Company as part of the recently completed NCIB. Over the past twelve months shareholder return initiatives have returned over 7% to equity investors, utilizing our strong cash flow while maintaining a very strong balance sheet. The positive impact of our 2018 administrative cost savings initiatives is being demonstrated with strong year over year declines in G&A expenses. We continue to implement a number of cost savings and efficiency initiatives on the operating and capital cost side of the business with targeted savings of 10%.”

— Richard Herbert, Chief Executive Officer of Frontera

Brent oil benchmark price averaged $68.47/bbl during the second quarter of 2019, compared to $63.83/bbl in the first quarter of 2019 and $74.97/bbl in the second quarter of 2018. As a result of stronger Brent pricing and narrower oil price differentials, the Company achieved a realized net sales price of $60.11/boe in the second quarter of 2019, 11% higher than in the first quarter of 2019. In comparison to the second quarter of 2018, realized net sales price increased by 14% primarily as a result of losses on risk management contracts.

For the second quarter of 2019, revenue was $377.3 million, unchanged relative to $377.5 million in the first quarter of 2019. Strong oil and natural gas sales resulting from higher production and improved oil prices was offset by lower sales of oil and gas for trading relating to a first quarter contract with a third party. Adjusting for trading revenue, oil and gas sales of $391.0 million were 25% higher than in the first quarter of 2019 and 7% lower than in the second quarter of 2018.

The best quarterly performance in two years, net income attributable to shareholders of the Company of $227.8 million ($2.32/share) in the second quarter was 393% higher than $46.2 million ($0.47/share) in the first quarter of 2019, aided by the recognition of a deferred tax asset of $177 million during the quarter. This reflects the significant future income generation capacity of the Company and its significant tax loss balances.

Operating EBITDA of $181.2 million in the second quarter of 2019, an increase of 25% compared to the first quarter of 2019 and 45% compared to the second quarter of 2018, was driven by higher production and sales volumes, higher prices and improved costs. Operating EBITDA margin was 50% in the second quarter of 2019 reflecting stable Company operations and was a slight increase over a 49% operating EBITDA margin in the first quarter of 2019.

G&A costs were $18.2 million during the second quarter of 2019, an increase of 10% compared to the first quarter of 2019 reflecting the impact of short term incentive payments and planned annual salary increases, while G&A costs were 30% lower compared to the second quarter of 2018 reflecting the continuing benefits of cost savings initiatives implemented in 2018 and 2019. Cost reduction and efficiency improvement initiatives are being undertaken on the operational side of the business in 2019 with expected aggregate savings in excess of 10%.

Production in the second quarter of 2019 averaged 74,385 boe/d up 9% compared to 67,974 boe/d in the first quarter of 2019 as a result of the resumption of production on Block 192 in Peru. Production from Colombia decreased 2% during the second quarter of 2019 compared with the previous quarter, as a result of managed production from the Candelilla-7 development well and declines in natural gas production.

Total Company production was 97% oil weighted in the second quarter of 2019 compared to 96% in the first quarter of 2019 and 94% in the second quarter of 2018. The higher oil mix as a percentage of total production results in better realized prices given strong Brent oil prices and narrow Vasconia oil differentials.

During the second quarter of 2019, capital expenditures were $73.5 million up 6.2% compared to $69.2 million in the previous quarter and down 15.4% from the second quarter of 2018. The increase reflects more activity in the second quarter of 2019 where there were 42 wells drilled compared to the first quarter of 2019 where there were 31 wells drilled. The decrease in the second quarter of 2019 compared to the second quarter of 2018 reflects a return to more normalized spending levels for ongoing development wells and exploration initiatives which excludes major infrastructure projects or high impact exploration projects.

A total of 42 development and exploration wells were drilled in the second quarter of 2019. 39 development wells were drilled compared to 37 development wells planned, as efficiency improvements at Quifa have led to wells being drilled in less time. As such the Company has released one of the four active Quifa rigs earlier than expected as part of the 2019 development drilling campaign. There were three exploration wells drilled, in line with expectations, two at Mapache and one at CPE-6, of which two were discoveries.

In July 2019, the Company began drilling the Coplero-1 exploration well on the CPE-6 block, adjacent and to the south east of the Hamaca exploitation area. On July 30, 2019, the well reached a MD of 3,150 feet, encountering 8 feet of net oil pay in the Carbonera-7 formation. Petrophysical analysis of the open-hole logs indicate a clean sand system with 32% porosity, permeability of 2.3 Darcys, water saturation of 40% and clay content of 1.6%. The well is expected to be completed and flow tested in the coming weeks and is expected to be another positive data point as the Company prepares to increase production from the CPE-6 block.

In July 2019, the Company began drilling the Hamaca-36 horizontal development well in the Hamaca exploitation area on the CPE-6 block. On July 23, 2019, the well reached a MD of 4,952 feet and was drilled horizontally in 45 feet TVD of net sand pay, encountering 738 feet of net oil pay in the Basal Sands of the Carbonera Formation. The well was completed on July 23, 2019, with an electrical submersible pump producing at 484 bbl/d of 11-degree API oil with a 12% water cut. To date, the well has produced a total of 3,552 barrels.

In June 2019, the Company began drilling the Hamaca-34 horizontal development well in the Hamaca exploitation area on the CPE-6 block. On July1, 2019, the well reached a MD of 5,328 feet and was drilled horizontally in 20 feet TVD of net sand pay, encountering 730 feet of net oil pay in the Basal Sands of the Carbonera Formation. The well was completed on July 5, 2019, with an electrical submersible pump producing at 360 bbl/d of 11-degree API oil with an average water cut of 37% at a stabilized bottomhole pressure. To date the well has produced a total of 9,320 barrels. On July 31, 2019 the well tested at 328 bbl/d with a 60% water cut.

In June 2019, the Company began drilling the Hamaca-35ST horizontal development well in the Hamaca exploitation area on the CPE-6 block. On June 14, 2019, the well reached a MD of 5,218 feet and was drilled in 43 feet TVD of net sand pay, encountering 650 feet of net oil pay in the Basal Sands of Carbonera Formation. The well was completed on June 20, 2019, with an electrical submersible pump and has flowed in average rate of 300 bbl/d of 11-degree API oil with an average water cut of 71% at a stabilized bottomhole pressure. To date the well has produced a total of 13,864 barrels. On July 28, 2019, the well tested at 425 bbl/d with a 70% water cut.

In June 2019, the Company began drilling the Copa A Sur-2 horizontal development well in the Copa field on the Cubiro block. On June 18, 2019, the well reached a MD of 8,942 feet, and was drilled horizontally in 9 feet TVD of net sand pay, encountering 1,126 feet of net oil pay in Carbonera C7A formation, and 4.5 feet TVD in C5D2 formation, the secondary objective. The well was completed in the C7A formation with an electrical submersible pump and gravel pack in the horizontal section. The well has been flow testing since June 26, 2019 at a rate of 350 bbl/d of 40-degree API oil with an average water cut of 23% at a stabilized bottomhole pressure. To date the well has produced 8,440 barrels.

In May 2019, the Company began drilling the Castaña-1ST exploration well on the Mapache block. On May 19, 2019 the well reached a MD of 8,589 feet and encountered 20 feet of net pay in the Ubaque sandstones. The well was completed in the Ubaque formation with an electrical submersible pump. On June 15, 2019 the well was tested with initial production of 430 bbl/d of 15-degree API oil with a 1% water cut, confirming a new discovery in the area. To date the well has produced 12,366 barrels. The permit for initial testing has been extended until August 20, 2019 after which the well will be placed on long term test. On July 28, 2019 the well produced 380 bbl/d with 14% water cut.

During the third quarter of 2019, the Company plans to drill 27 development wells, including 20 in the Quifa area, three in the Copa block, three in the CPE-6 block, and one in the Guatiquia block. The Company expects to drill two exploration wells, the La Belleza-1 well on the Parex operated VIM-1 block and the Coplero-1 well on the CPE-6 block. The Company’s 50% participating interest in the VIM-1 block is subject to ANH approval. The Company is targeting to keep six rigs active throughout the third quarter of 2019.

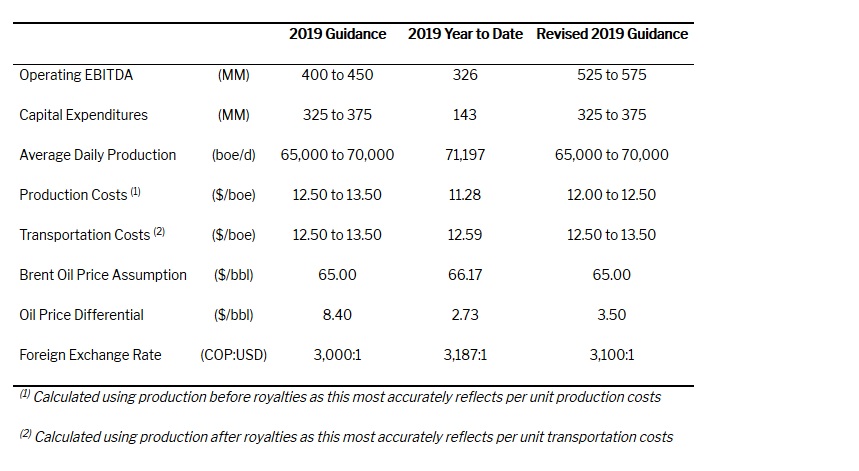

Annual Guidance Update:

Based on the results of the first half of 2019, the Company is raising its 2019 guidance ranges for Operating EBITDA while reducing expectations for production costs. Based upon the midpoint of the ranges, Operating EBITDA is being increased 29% while production costs are being decreased 6%. Production guidance for 2019 remains unchanged demonstrating strong production performance in Colombia offsetting losses due to external force majeure events in Peru. Capital expenditures guidance is also unchanged as the Company undertakes more exploration activities in the second half of 2019 compared to the first half of 2019. The biggest drivers to the changes to guidance were improved oil price differential assumptions as well as the impact of a weaker Colombian peso relative to previous estimates.

***