(Zacatecas Silver, 22.Mar.20222) — Zacatecas Silver Corp. (ZAC:TSX Venture; ZCTSF: OTC Markets; 7TV: Frankfurt) closed a $19.15mn offering of subscription receipts (the “financing”).

The financing was previously announced on 28 February 2022 as a $15mn private placement and then, due to strong demand, was upsized to $18mn on 4 March 2022. The financing has closed, on an oversubscribed basis, for total gross proceeds of $19,151,521 pursuant to the issuance of 17,410,474 subscription receipts at $1.10 per subscription receipt.

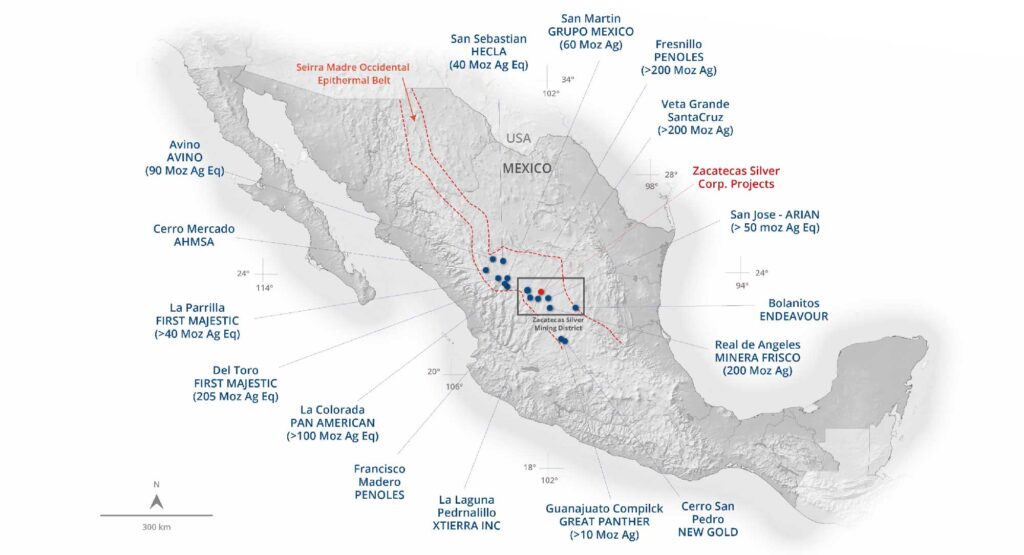

Zacatecas CEO Bryan Slusarchuk states, “We appreciate the strong support from the syndicate of agents on this transaction and the buy side participants, which include outstanding institutional and individual specialist investors in the metals space. We look forward to moving the advanced stage and high-grade Esperanza Gold Project towards production while also continuing our ongoing drill program at the Zacatecas Silver Project, where we are currently drilling to follow up on the recent high grade silver discovery at Panuco North.”

The proceeds raised from the financing will be used to satisfy the USD$5,000,000 cash consideration in connection with the acquisition of the Esperanza Gold Project from Alamos Gold Inc., begin advancing the Esperanza Gold Project towards production, fund the ongoing drill program at the company’s existing silver project and for general working capital purposes.

Each subscription receipt is convertible into one unit of the company upon the completion of certain escrow release conditions as described below. Each unit will consist of one common share of the company and one-half of one common share purchase warrant. Each warrant will entitle the holder thereof to purchase one Common Share at a price of $1.50 per common share for a period of 24 months from the date of issue.

The proceeds of the financing will be released from escrow, upon notice given to the Escrow Agent on or prior to 5:00pm (Toronto time) on 21 May 2022 upon (a) the completion, satisfaction or waiver, as the case may be, of all the conditions precedent to the acquisition of the Esperanza Gold Project by the company from a subsidiary of Alamos Gold Inc. (the “proposed transaction”) set forth in the share purchase agreement between such parties dated 28 February 2022; and (b) the receipt of all required corporate, shareholder and regulatory approvals in connection with the proposed transaction ((a) and (b) together, the “ escrow release conditions ”).

Clarus Securities Inc. acted as lead agent on behalf of a syndicate of agents that included Eventus Capital Corp., Haywood Securities Inc. and Canaccord Genuity Corp. Zacatecas will pay the syndicate of agents a cash commission of $998,716 (half of which was paid today and half of which will be paid upon the release of proceeds from the financing to the company from escrow) and issued a total of 907,924 compensation options, with each compensation option exercisable into a common share at a price of $1.10 for a period of 24 months from the date of issue.

The securities issued under the offering will be subject to restrictions on resale expiring on 23 July 2022.

____________________