(Energy Analytics Institute, 3.Aug.2021) — Energy briefs from the Latin America and Caribbean region including: New Pacific Metals Corp. commencing a diamond drilling program in Bolivia, Ecopetrol’s strong second quarter results [PDF download], Ecopetrol CEO Felipe Bayón Pardo says company eyeing green hydrogen projects, and Guyana’s most recent one million barrels oil lift.

Bolivia

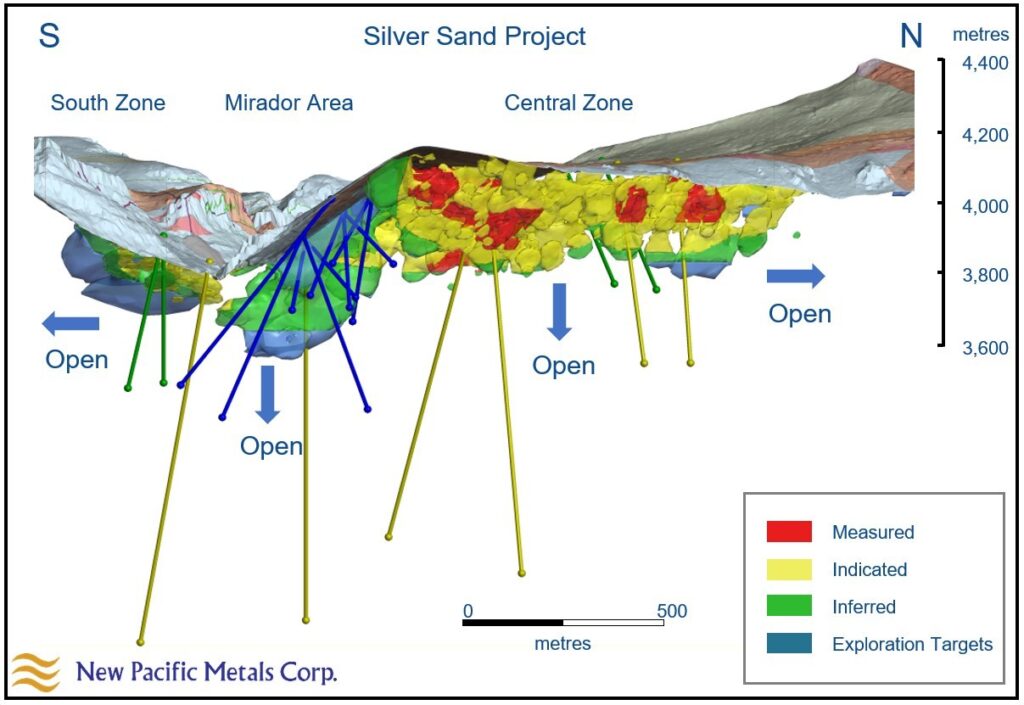

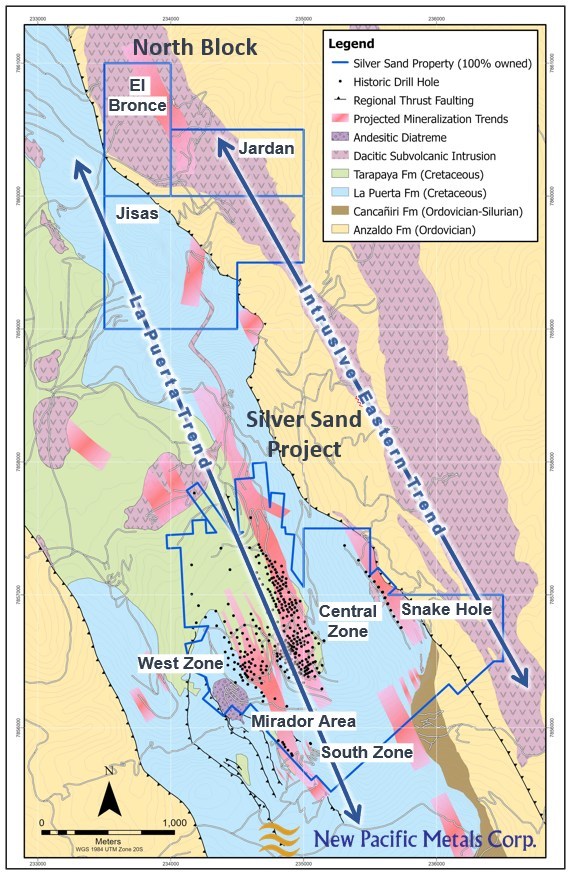

— New Pacific Metals Corp. (TSX: NUAG) (NYSE-A: NEWP) commenced a 38,000 meter diamond drill program at its flagship Silver Sand Project in Potosí Department, Bolivia, the company announced 27 July 2021 in an official statement. Details include: 8,000m drill program in progress; ~80% of the drill program is focused on expanding the existing Mineral Resources and on discovering additional resources; the deposit is open along strike and at depth; 5,000 m of the drill program dedicated to testing for feeder zones for the large Silver Sand deposit; district exploration drilling to target the North Block and Snake Hole Zone; mineral continuity and geotechnical drilling to support the Silver Sand Preliminary Economic Assessment (PEA); and environmental baseline, socioeconomic and social responsibility studies underway.

Colombia

— Colombia’s state owned oil giant Ecopetrol reported strong operating and financial results for the second quarter 2021.

RELATED STORY: Ecopetrol Group Announces Second Quarter 2021 Results

— Ecopetrol eyes the start of first green hydrogen pilot in 1Q:22 and in parallel is working on a transition map towards a greener hydrogen matrix where blue hydrogen play an important role as well was pilots for carbon capture use and sequestration, Ecopetrol CEO Felipe Bayón Pardo said in a company video on YouTube.

Guyana

— The Stabroek News reported on 1 August 2021 that while the sales terms have not been published, Guyana received nearly $80mn for its last one million barrels of oil, the highest sum to date, and pushing the total in its account at the New York Federal Reserve Bank to more than $430mn, the daily reported citing sources. “The account has seen a deposit of $79.6mn for the last oil sales and a $12mn in royalties,” according to the Sunday Stabroek. Using Brent crude oil estimates, it would have meant that this country received a little more than $79/bbl on the last million barrels lift, the daily said.

____________________

By Ian Silverman and Piero Stewart. © Energy Analytics Institute (EAI). All Rights Reserved.