(Talos 18.Feb.2020) — Talos Energy Inc. announced full year 2020 operating and financial guidance. The Company also announced that it expects to close the previously announced acquisition of affiliates of ILX Holdings, among other entities (the “Acquired Assets”, the “Acquisition”, or the “Transaction”), on February 28, 2020.

The Company expects to generate significant free cash flow in 2020, despite the recent commodity pullback. Talos expects its 2020 capital program, inclusive of the Acquired Assets, to be similar in size, or smaller, than the 2019 Talos stand-alone capital program, while benefiting from production contributions from the Acquired Assets and new wells commencing production throughout the year. The 2020 capital program will continue to focus on infrastructure-led, short-cycle projects, while allocating a portion of the program to high-impact exploration catalysts.

2020 GUIDANCE HIGHLIGHTS

Significant positive 2020 free cash flow at $50.00/bbl WTI and $2.00/MMBtu Henry Hub, as Talos expects to benefit from strong margins and premium pricing to WTI. Talos expects to be free cash flow neutral at an average 2020 WTI price well below $45.00/bbl, assuming $2.00/MMBtu gas prices. Furthermore, the Company expects free cash flow in excess of $100.0 million at $55.00/bbl WTI and $2.50/MMBtu Henry Hub commodity prices.

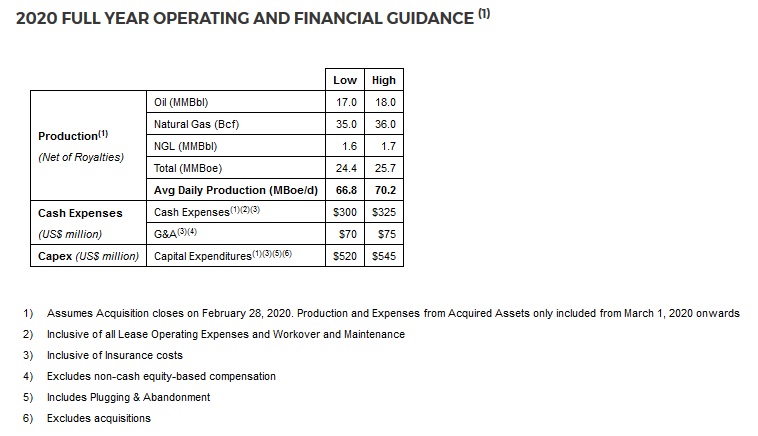

2020 production sales volumes expected to be 24.4 – 25.7 million barrels of oil equivalent (“MMBoe”), which represents an average daily production of 66.8 – 70.2 thousand barrels of oil equivalent per day (“MBoe/d”), including the impact of planned deferrals. This reflects production from the Acquired Assets beginning on March 1, 2020 – post Transaction close.

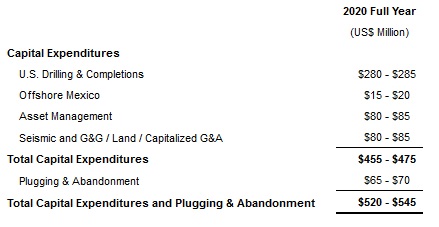

2020 capital expenditures expected to be between $520.0 million and $545.0 million, inclusive of plugging and abandonment, which is expected to be fully funded within cash flow from operations.

Continued focus on cost control on all aspects of the business, with cash general and administrative (“G&A”) expenses expected to be below $3.00 per Boe.

The Company expects to continue to maintain its low leverage metrics.

President and Chief Executive Officer Timothy S. Duncan commented, “We are pleased to present our 2020 guidance, which I believe strikes the right balance between free cash flow generation in a volatile commodity market environment, and the appropriate level of investment to allow for longer term value creation for our shareholders. We expect to achieve this balance by continuing to invest in our core business of infrastructure-led development and exploitation projects while exposing a portion of our capital program to high-impact catalysts. Our 2020 capital program will be self-funded well below the current $50.00/bbl WTI commodity price environment, and assures that we can maintain, and even improve, our peer leading leverage metrics. In offshore Mexico, we continue to stay focused on moving Zama forward towards final investment decision and also integrating the data we gathered during our successful Xaxamani discovery on Block 31.”

Duncan added, “As we approach the closing of our Transaction, expected at the end of February, we believe we are opportunity rich when combining the pro-forma inventory; however, we will continue to maintain the appropriate level of capital discipline, cost control and balance sheet conservatism throughout the year.”

EXPECTED ACQUISITION CLOSING DATE AND IMPACT TO 2020 GUIDANCE

The parties to the Transaction expect to amend the transaction documents in order to close the Transaction at an earlier date. The 2020 guidance therefore assumes the Transaction closes on February 28, 2020; therefore, production, cash expenses and capital expenditures from the Acquired Assets are only included in 2020 from March 1, 2020 onwards.

On a full year pro forma basis, if Talos were to assume the contribution from the Acquired Assets beginning January 1, 2020, the total daily average production guidance for the year would have been approximately 70.0 – 73.5 MBoe/d, inclusive of planned deferrals. Regardless of exact closing date, however, the economic benefits of the Acquired Assets will accrue to Talos’s benefit, because the effective date of the Transaction is July 1, 2019. This benefit will manifest itself as a purchase price reduction at closing.

2020 PLANNED PRODUCTION DEFERRALS

The production sales volumes, as guided, include certain Talos-owned facilities’ shut-ins, each related to operations necessary to connect and host new Talos and third-party subsea wells, operations necessary to mobilize and de-mobilize a platform rig on the Green Canyon 18 (“GC18”) platform, and general preventative maintenance on different facilities.

The hosting of third-party wells is an integral part of Talos’s strategy of utilizing available capacity on its existing production facilities to generate additional cash flows through production handling fees, paid by third-parties, and sharing the existing fixed operating costs. Shut-ins associated with these projects included in the 2020 production guidance include:

— Ram Powell Facility: connect the third-party Stonefly subsea development.

— Pompano Facility: connect the third-party Praline subsea development.

— GC18 Facility: connect the Talos operated Bulleit well, in which the Company owns a 50% working interest.

The total full year production impact of the planned downtime is approximately 1.5 – 2.0 MBoe/d and is already accounted for in the production guidance. Talos expects that the biggest impact will be in the second quarter of 2020, with an approximate production deferral of 3.0 – 3.5 MBoe/d in the quarter, but all four quarters of the year will be impacted by some level of downtime. The actual timing of these shut-ins may change from one quarter to the next, depending on several factors, which may include, among others things, weather and/or operations optimization.

2020 CAPITAL PROGRAM

The Company’s 2020 capital program was devised to balance infrastructure-led short-cycle projects, such as the Bulleit completion and tieback and several near-field development and exploitation wells, with up to three high-impact exploration wells, including Puma West.

The table below provides a high-level breakdown of the total 2020 capital program by activity.

U.S. Drilling & Completions

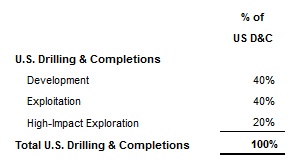

The U.S. Drilling & Completions (“US D&C”) category accounts for the majority of the planned capital expenditures in 2020. Below is a further breakdown of the types of projects Talos will invest in 2020, as a percentage of US D&C.

Development – 40% of US D&C

Bulleit (50% working interest – operated): completion and tieback to the GC18 platform, with first production expected in the third quarter of 2020.

Tornado water flood (65% working interest – operated): drilling the Tornado 4 subsea injector well that includes two completions: one completion in a known regional aquifer above the Tornado producing sands and a second completion in the Tornado pay sand. This technique will allow for intra-well flow between the aquifer and the producing horizon, providing a natural source of water and reservoir energy to the Tornado 1 and Tornado 2 subsea wells. By accessing the regional aquifer, the intra-well water injection does not require any subsea or topside modifications. The water flood is expected to help arrest natural declines, add production and materially enhance ultimate recovery of the Tornado field within the broader Phoenix complex. Tornado 4 is expected to be drilled in the second quarter before the Bulleit completion and tieback operations. Tornado 4 should be completed at the end of the third quarter.

Exploitation – 40% of US D&C

GC18 platform rig (100% working interest – operated): drilling two to three wells utilizing a platform rig at the Talos-owned Green Canyon 18 platform. The GC18 field, originally developed by ExxonMobil, has cumulatively produced over 100.0 MMBoe since being brought online. The planned infill wells were identified by Talos as a result of the Company’s initial round of seismic reprocessing within the field leases. The first well in the program is expected to spud at the end of the first quarter with first production planned for the third quarter of 2020.

Gunflint #5 (9.6% working interest – non-operated): this drilling location was recently identified, and will provide upside to the economics of Talos’s January 2019 acquisition of Gunflint. Gunflint #5 is expected to spud in the second quarter of 2020, with drilling operations planned for approximately 60 days. If successful, first oil is expected in 2021.

Claiborne #3 (25% working interest – non-operated): this well was spud in January of 2020 and first production is expected at the end of the second quarter of 2020. This project is part of the Transaction that Talos expects to close on February 28, 2020; therefore, the capex and production associated with the project will be reflected in Talos’s financials from March 1, 2020 onwards.

High-Impact Exploration – 20% of US D&C

Puma West (25% working interest – non-operated): plans are being developed to return to the prospect later this year with a slightly modified casing design to continue drilling the well through the main objectives in the Middle and Lower Miocene to a total true vertical depth of approximately 25,200 feet below the seabed. The well was temporarily suspended in January of 2020.

Up to two additional high-impact projects expected in 2020: projects currently going through permitting stages and specifics will be announced as these plans are finalized.

Additional Planned Activities in 2020

Offshore Mexico: includes the front-end engineering and design (“FEED”) work related to the Talos-operated Zama discovery on Block 7. Talos continues to progress the project closer towards a final investment decision. Additionally, the Company is working on permits for a potential drilling campaign of additional exploration opportunities on Block 7 in 2021. Lastly, Talos is participating in additional geological and geophysical studies related to the Company’s 2019 Xaxamani oil discovery on Block 31.

Asset Management: consists of 15 to 20 low-cost projects on our current producing assets to offset field declines and improve profitability across selected facilities.

HEDGES

As of February 18, 2020, the Company’s consolidated hedge position included:

— 2020 WTI swaps of approximately 6.5 MMBbl of oil at a weighted average price of $56.21 per barrel;

— 2020 WTI collars of approximately 2.7 MMBbl of oil at a weighted average floor and ceiling prices of $55.00 and $64.23 per barrel, respectively;

— 2021 WTI swaps of approximately 0.7 MMBbl of oil at a weighted average price of $54.63 per barrel; and — 2020 Henry Hub swaps of approximately 5.9 million MMBtu of gas at a weighted average price of $2.78 per MMBtu.

Obecnie oprogramowanie do zdalnego sterowania jest używane głównie w biurze i oferuje podstawowe funkcje, takie jak zdalne przesyłanie plików i modyfikacja dokumentów.