(S&P Global Platts, 30.Jan.2020) — ExxonMobil’s growing oil discoveries offshore Guyana are amplifying domestic calls for a review of production-sharing contract terms on the eve of the small South American country’s first elections as an oil exporter.

Opposition political parties vying to unseat the ruling coalition in 2 March parliamentary elections contend that existing PSC terms are “generous” to foreign oil companies, robbing Guyana of its fair share of the country’s newfound oil wealth.

ExxonMobil started production of light sweet Liza crude from the deepwater Stabroek block in December, and the first cargo was lifted early this month.

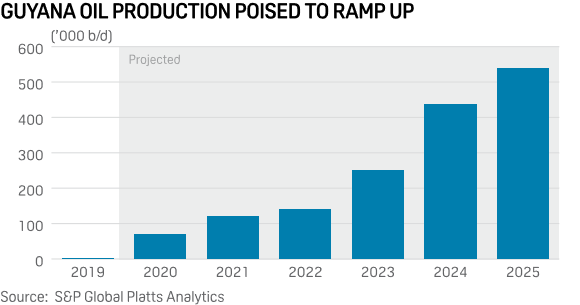

The US major projects output to reach 120,000 b/d by March, ramping up to 750,000 b/d by 2025.

ExxonMobil increased the estimate for recoverable resources from Stabroek block to more than 8bn barrels of oil equivalent (boe) following its 16th oil discovery announced on 27 January.

ExxonMobil operates Stabroek with a 45pc stake. US independent Hess holds 30pc, and the remaining 25pc belongs to Chinese state-owned CNOOC unit Nexen.

Other companies with Guyana exploration contracts include US major Chevron and European firms Total, Repsol, Eni and Tullow.

The ruling coalition led by the People’s National Congress (PNC) that has overseen the advent of oil development since 2015 is facing a challenge from the main opposition People’s Progressive Party (PPP) and other small parties that espouse an overhaul of contract terms.

The PPP is unhappy with the terms concluded by the government with the foreign oil companies, the party’s presidential candidate Irfaan Ali says, reinforcing the position of PPP leader and general secretary Bharrat Jagdeo.

Among PPP’s concerns is the contract royalty, which it says is too low.

Nonetheless, the PPP has said it would respect ExxonMobil’s contract, as the US company was a pioneer in the country’s unrisked acreage. But if elected, the party would renegotiate all other contracts.

At least one small member of the opposition coalition, Change Guyana (CG), wants all PSCs to be adjusted. “We could have negotiated a better deal for the people of Guyana,” CG presidential candidate Robert Badal said.

The government dismisses the opposition push to toughen contract terms. “Tearing up legal and legitimate contracts and business agreements on the basis of domestic party politics will severely damage the country, and harm its prospects not only for future investments in oil but in every sector,” a finance ministry official told Argus today.

“The contracts were agreed in good faith and they will bring significant economic benefits to the country.”

An April 2018 review of the country´s PSC model by the International Monetary Fund concluded it was “relatively favorable to investors by international standards.”

In an apparent acknowledgement of the concerns about the contract terms, the government has delayed any further contracts with oil companies, saying it needs to update legislation to increase the country’s benefits.

The PSCs are based on a model formulated in 1986, well before Guyana’s upstream potential became clear, the government has said.

New contracts will be considered after the review is concluded in 2021, “allowing the country to go to market with framework that is more robust as there are elements of the basin that have now been derisked,” the country’s energy department said.

The ExxonMobil-led consortium appears little concerned by the Guyanese opposition parties’ plans to renegotiate the production sharing agreement.

Both the government and opposition have signaled they will not renegotiate the consortium’s contract, Hess chief executive John Hess said 29 January.

“I think they both have been pretty clear that they are going to honor the production sharing contract,” Hess said. “We are committed to working collaboratively with the government, our partners and the people of Guyana to build a safe and sustainable industry that fulfills the promise of shared prosperity.”

ExxonMobil has not commented.

By Canute James

***

How should a couple handle this once they find out their spouse is cheating? Whether a husband should forgive his wife for her betrayal is a topic worth discussing.