(Tellurian, 2.Nov.2023) — Tellurian Inc. (NYSE American: TELL) continues to progress the production and sales of natural gas and the financing and construction of its Driftwood project.

President and CEO Octávio Simões said, “Tellurian’s upstream segment continues to provide growing natural gas production, improving significantly over the third quarter of last year, and we see natural gas prices on the rise through year end. We are having a number of discussions with counterparties for both equity partnership and liquefied natural gas (LNG) offtake for the Driftwood project and investment in the Driftwood Line 200/300 pipeline. We have invested over $1 billion to develop and advance construction of the fully permitted Driftwood project and remain on target to produce first LNG in 2027.”

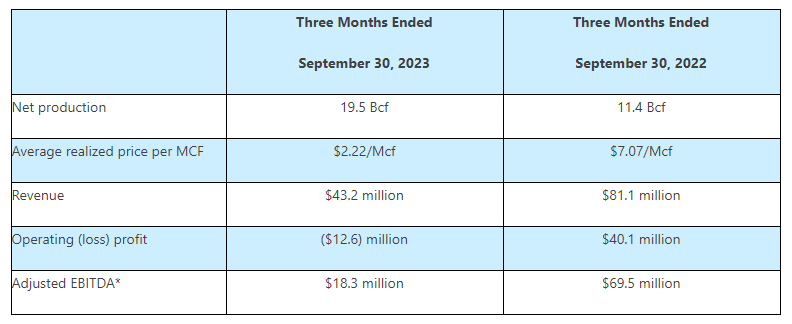

Upstream Segment Results

Operating Activities

Tellurian produced 19.5 billion cubic feet (Bcf) of natural gas for the quarter ended September 30, 2023, as compared to 11.4 Bcf for the same period of 2022. As of 30 September 2023, Tellurian’s natural gas assets included 31,149 net acres and interests in 159 producing wells.

Consolidated financial results

Tellurian generated approximately $43.2mn in revenues from natural gas sales in the third quarter of 2023 compared to $81.1mn in the third quarter of 2022, a change driven by decreased realized natural gas prices partially offset by increased production volumes. Tellurian reported a net loss of approximately $65.4mn, or $0.12 per share (basic and diluted), for the quarter ended 30 September 2023, compared to a net loss of approximately $14.2mn, or $0.03 per share (basic and diluted), for the same period of 2022.

As of September 30, 2023, Tellurian had approximately $1.3bn in total assets, including approximately $59.3mn of cash and cash equivalents.

____________________

| * Non-GAAP measure – see the end of this press release for a definition and a reconciliation to the most comparable GAAP measure. |