(Petrobras, 30.Nov.2022) — Petrobras informs that its Board of Directors approved, in a meeting held today, the Strategic Plan for the five-year period 2023-2027 (SP 2023-27).

Throughout 2022, Petrobras delivered an operational and financial performance in line with its commitment to generate value for society and shareholders and in full adherence with the 2022-2026 Strategic Plan, showing the company’s resilience and solidity, and thus increasing the degree of confidence in achieving its goals.

From an operational standpoint, in the first nine months of 2022, the company maintained a solid performance delivering significant advances in its operations.

From a financial standpoint, the company continued on its path of delivering consistent and sustainable results. The capital structure was maintained at a healthy level and cash reached a level more compatible with the company’s financial needs. The company delivered solid financial results, reaching the first and second highest quarterly EBITDA and operating cash flow marks in its history, in the second and third quarters of 2022, respectively. The generation of operating cash flow associated with stable and controlled indebtedness and solid liquidity prospects allowed Petrobras to declare R$13.80 per common and preferred share in shareholder remuneration in 2022. It is important to note that the Brazilian government receives about 37% of this total, the largest single portion, in addition to being benefited by the payment of taxes, which reached a record for the first nine months of the year of R$ 222bn.

In this context, the new SP 2023-27 was prepared preserving the company’s vision, values, and purpose. The strategies were maintained, with the exception of those related to Environmental, Social and Governance (ESG) and Innovation, which were improved.

With the vision of “Being the best energy company in value generation, focused on oil and gas, sustainability, safety, respect for people and the environment,” Petrobras preserves its values in the SP 2023-27:

(i) Respect for life, people and the environment;

(ii) Ethics and transparency;

(iii) Overcoming and trust;

(iv) Market and results orientation.

Furthermore, the company maintains its purpose of “Providing energy that ensures prosperity in an ethical, safe, and competitive manner”.

The SP 2023-27 proposes a set of strategies aimed at Petrobras’ effective contribution to a prosperous and sustainable future, such as: (i) deliver sustainable results for a society in transition, by acting in business with social and environmental responsibility, safety, integrity and transparency, strengthening its low-carbon positioning; (ii) maximize the value of the portfolio, with a focus on deepwater and ultra-deepwater assets; (iii) add value to the refining park, with more efficient processes and new products; (iv) strengthen the integration of marketing and logistics activities; and (v) innovate to generate value in business, today and in the future, and achieve the goals in decarbonization.

In order to ensure alignment of incentives for achieving corporate goals, SP 2023-27 reaffirms the four top metrics from the past plan, which are:

- Exploration and Production and Refining greenhouse gas emissions target achievement indicator (IAGEE);

- Volume of oil and oil products leaked (VAZO);

- Petrobras Delta EVA®; and

- Total Recordable Injury (TRI).

The first three metrics directly impact the variable remuneration of executives and all company employees.

Petrobras reaffirms in the SP 2023-27 the ambition of zero fatalities and zero leakage. Its commitment to life is a non-negotiable value, and its recognized culture for safety continues to be reinforced every day to strengthen people and operational safety.

The IAGEE and VAZO targets are aligned with the SP 2023-27 low carbon and environmental sustainability commitments, while the Delta EVA® indicator represents a measure of economic value creation.

The SP 2023-27 consolidates Petrobras as the country’s largest investor and includes all the projects that presented economic viability according to the company’s governance and approval criteria, with no damming of projects due to budget restrictions.

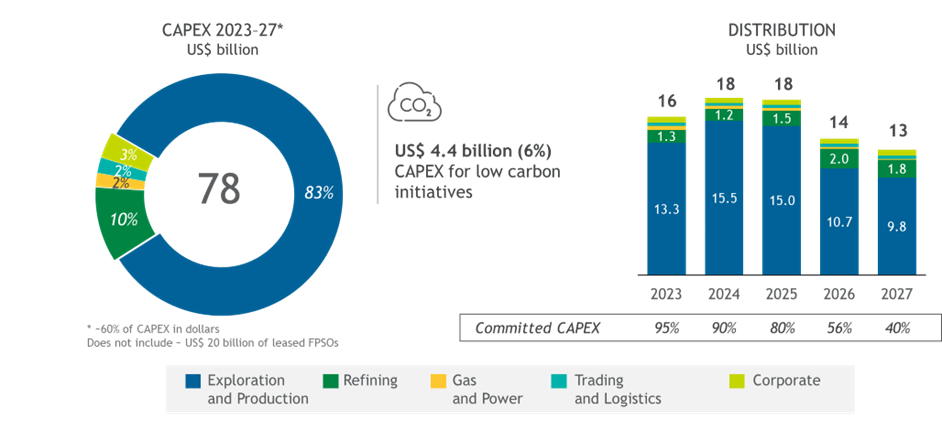

The investments (CAPEX) foreseen for the 2023-2027 period are US$ 78bn, 15% higher than the last plan and is on par with the average of industry peers. This amount is higher than the average of the last six strategic plans, which was US$ 72bn, and signals that investments have returned to the pre-covid level. CAPEX in the Exploration & Production (E&P) segment is 83% of the total, followed by Refining, Gas and Power with 12%, Trading and Logistics with 2%, and 3% in the Corporate segment. It is worth noting that in addition to these US$ 78bn, the company will also invest about US$ 20bn in chartering new platforms, thus totaling almost US$ 100bn of resources in projects. This allocation is adherent to the strategic focus of activities in Exploration and Production, in which Petrobras has competitive advantage and greater return.

The total E&P CAPEX is US$ 64bn, with about 67% going to the pre-salt. The plan also highlights that the E&P projects maintain the premise of double resilience – economic and environmental: viable to scenarios of low oil prices in the long term (Brent of US$35 per barrel) and low carbon (goal of carbon intensity in the E&P portfolio of up to 15 KgCO2e per barrel of oil equivalent by 2030).

With the objective of seeking new oil and gas frontiers, including opportunities in non-associated gas, the plan considers total exploration investment of US$6bn, with approximately 50% in the Equatorial Margin.

Total CAPEX in the Refining and Natural Gas area amounts to US$ 9.2bn, with about 50% of the resources invested in expanding and improving refining quality and efficiency. Petrobras thus continues to focus on the operational and energy efficiency of its refining units and on higher quality products with a lower carbon footprint, with the spotlight on investments in biorefining. The plan foresees investments in eight new processing units, in addition to six large-scale adaptation works in existing units. With these projects concluded, Petrobras’ refining processing and conversion capacity is expected to increase by 154,000 barrels per day (bpd), and the the low sulfur 10-ppm diesel production capacity will be boosted by more than 300,000 bpd. In the Gas & Power area, the SP 2023-27 highlights the continuity of the strategy of own gas commercialization, with commercial actions aligned to the increases in capacity, resulting from investments in infrastructure expansion and the own supply of natural gas.

In the 2023-2027 five-year period, the Trading and Logistics area will intensify its operations in strategic markets in Brazil while continuing to expand and strengthen its operations in foreign markets by attracting new customers and constantly seeking the best opportunities to enhance the value of its oils and products. Another focus of the area is the optimization of the logistics infrastructure with the removal of bottlenecks in the flow of products and oils, inventory optimization, and reduction in the fleet’s emission indexes. The area’s CAPEX foreseen in the plan is US$ 1.6bn.

An important highlight of the investments of SP 2023-27 also includes the amount of US$ 4.4bn (6% of total CAPEX) in projects directed to the company’s low carbon initiatives.

The SP 2023-27 maintains an active portfolio management, with expected divestments between US$ 10bn and US$ 20bn over the five-year period, which will contribute to improve operational efficiency, return on capital and additional cash generation to make new investments more adherent to the Company’s strategy. Active management allows the company to focus on assets that have the potential to raise the expected return on its portfolio in a sustainable way and/or reduce the risks perceived by Petrobras.

Oil, NGL and natural gas production

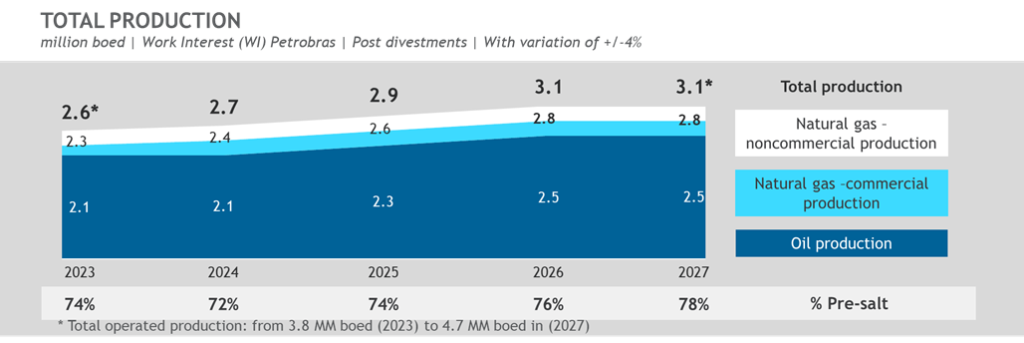

The oil and gas production curve projected for the 2023-2027 period indicates continued growth, even considering divestments, explained by the entry of new production systems and complementary projects.

In line with the company’s strategic focus, Exploration & Production activities are concentrated in deep and ultradeep waters in Brazil. Production from the pre-salt will account for 78% of the company’s total by the end of the five-year period.

The production curve considers the entry of 18 new platforms (FPSOs) in the period 2023-2027, 11 chartered, 6 owned and 1 non-operated.

The production target for 2023 was maintained at 2.1 million barrels of oil per day, with a variation of 4% up or down, considering the adjustments of the Sepia and Atapu Coparticipation Agreement, which reduced 0.1 million boed in relation to the last plan. The total production target for 2023, including oil and natural gas, was also maintained at 2.6 million boed, considering a variation of 4% up or down.

The oil production projection for 2024 and 2025 was reduced by approximately 0.1 million bpd, in comparison with the past plan, due to adjustments in the well interconnection schedule.

All total and commercial production projections were maintained for the SP 23-2027 horizon.

The RES20 program shows consistent delivery throughout the year, supported by its three pillars: (i) intense seismic acquisition campaign, (ii) master plans per asset and (iii) better reservoir models. This program will continue, but the disclosure of its projections to the market will be discontinued in alignment with the practice used by peers.

ESG – Environmental, Social and Governance

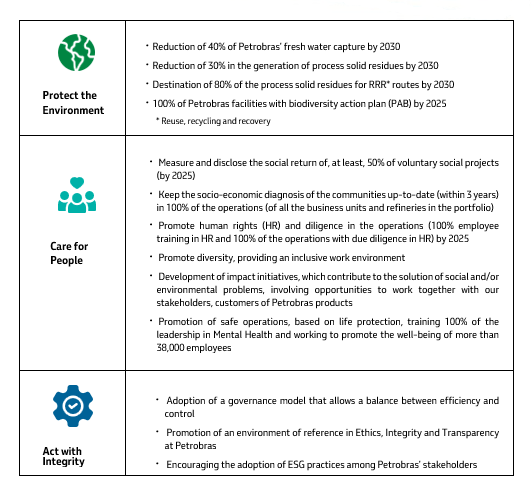

The SP 2023-27 integrated the ESG elements into a single vision, synthesizing the company’s position according to the diagram below. This ESG diagram guides planning and stakeholder engagement and is aligned with the company’s strategic elements and objectives. Four key ideas are highlighted: (i) reduce our carbon footprint; (ii) protect the environment; (iii) care for people; and (iv) act with integrity. For each one of these key ideas a set of relevant themes that support and guide our actions, projects, programs and related commitments was identified.

The goals related to each of the four key ideas of the diagram were consolidated into a single list, aligned with the concept of integrated ESG:

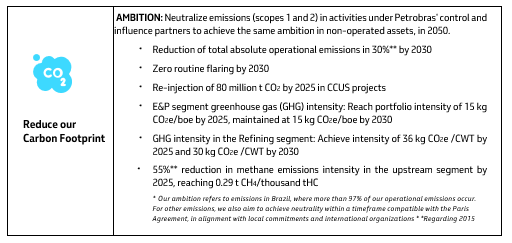

In the SP 2023-27, investments of US$ 4.4bn are planned for the company’s low carbon initiatives: (i) US$ 3.7bn applied in projects that contribute to the decarbonization initiatives of the operations (scopes 1 and 2); (ii) US$ 0.6bn in biorefining initiatives (renewable diesel and bio jet fuel); and (iii) US$ 0.1bn in Research and Development (R&D) for new competencies.

With the objective of supporting the emissions neutrality trajectory, the Petrobras Carbon Neutral Program and the Decarbonization Fund were reinforced in the SP 2023-27, with the objective of financing decarbonization solutions that reduce emissions with the lowest cost and greatest impact in carbon mitigation.

The Fund’s budget in SP 2023-27 is US$600mn, representing significant growth over the past plan, which was US$248mn.

Moving forward in the initiatives aimed at profitable diversification, the SP 2023-27 brings as novelty the businesses that were indicated by a multicriteria analysis, among several studied, as the most suitable for the company. The new businesses of offshore wind power, hydrogen and carbon capture were indicated, in addition to the continuity of the presence in biorefining.

It is also worth mentioning that the company is implementing a green recycling policy for platforms undergoing decommissioning, in line with the best ESG practices available in the market.

Financeability

The main assumptions for the financeability of the SP 2023-27 are:

- Competitive prices, aligned to the international market;

- The reference cash defined in the strategic plan is US$ 8bn. This amount is higher than the Company’s minimum cash, which is currently US$ 5bn;

- Dividends in accordance with the current Shareholder Remuneration Policy;

- Gross debt reference range of US$ 50bn to US$ 65bn; and

- Liability management: debt lengthening and maintenance around US$ 55bn.

The average Brent for the five-year period of the SP 2023-27 is US$ 75/bbl and the average exchange rate for the same period is R$ 5/US$.

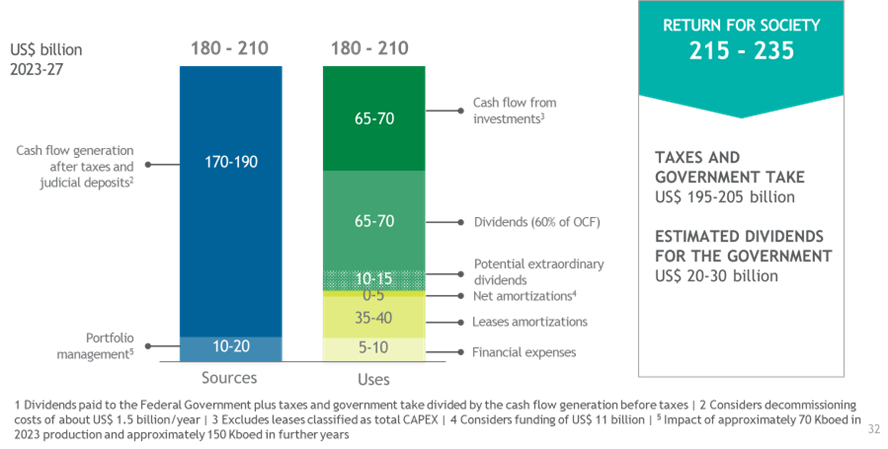

It is worth noting that the SP 2023-27 is self-financing for the next 5 years, with approximately 52% of its net cash generation going back to society.

The SP 2023-27 demonstrates Petrobras’ commitment to being a company focused on generating value, with the capacity to invest, generate jobs, pay taxes, and distribute its earnings to its shareholders and society. The company plans to build on its trajectory of being an increasingly healthy, solid, and resilient company, contributing to generate reliable and efficient energy and to an environmentally sustainable world.

____________________