(S&P Global, 23.Mar.2022) — Transportadora de Gas del Sur, or TGS, the biggest gas transporter in Argentina, said late March 22 it plans to invest $60 million to build a 17 million cu m/d pipeline out of Vaca Muerta, the latest transport project in the shale play that is boosting prospects for increasing exports.

The one-year project in the southwestern province of Neuquen calls for adding 32 km of 30-inch diameter pipeline from Los Toldos, a group of blocks operated by ExxonMobil and Tecpetrol, to Chevron‘s El Trapial, TGS said in a securities filing.

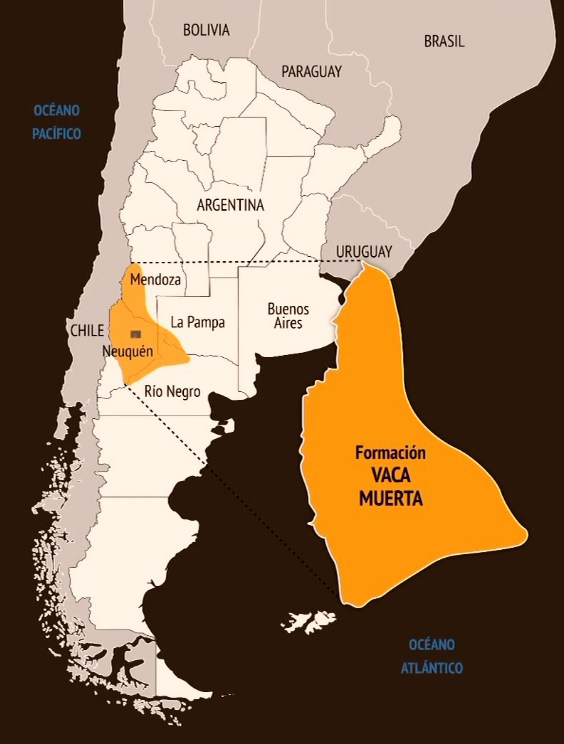

In a separate statement, Neuquen Governor Omar Gutierrez said the project will allow gas producers in Vaca Muerta, most of which is in that province, “to continue expanding the possibilities of drilling, production and transportation of gas to advance in the energy transition.”

This is the latest pipeline project in to get underway for Vaca Muerta, helping to accompany a surge in production that last year maxed out pipeline capacity during the winter months of June, July and August.

This has raised concerns that without more pipeline capacity, companies will have to slow production growth — and the country will have to increase imports — as national production at 130 million cu m/d was still shy of the 140 million cu m/d of average demand and peaks of 180 million cu m/d.

The other big project is the construction of a more than $2 billion pipeline from Vaca Muerta to near Buenos Aires, which will add 44 million cu m/d of capacity over the next three years. Construction of the line is poised to start in the next few months so that the first 11 million cu m/d comes on line next year, followed by another 13 million cu m/d in 2024 and the rest in 2025.

Export potential

The pipeline project is bolstering expectations that Argentina can start increasing exports from Vaca Muerta, one of the biggest shale plays in the world.

Marcos Bulgheroni, group CEO of BP-backed Pan American Energy Group, the second-biggest oil producer and fourth for gas in Argentina, said March 22 that the project “is the precondition to start finding foreign markets.”

He said the first markets to target for exporting are Brazil and Chile, which are already importing some supplies over existing pipelines, before going to overseas markets with LNG.

Brazil could import 30 million-40 million cu m/d, he said.

Chile was importing as much as 20 million cu m/d of gas from Argentina in the late 1990s and early 2000s, meaning that there is room for growth on the current shipments of less than 5 million cu m/d.

The next step would be to build a liquefaction terminal with 13 million mt of capacity, with an investment of $10-$15 billion on top of the $15-$20 billion in activities to boost output, Bulgheroni said.

To do this, he said a consortium of producers, LNG plant operators and buyers would have to be formed. Further, the government will have to provide clear signs that gas can be exported under long-term contracts, and give access to foreign currencies — now restricted — to finance the project and pay back what is borrowed abroad, he added.

Bulgheroni said that with Russia’s war on Ukraine, the world is looking for new suppliers as Russian energy imports have been banned in many countries.

____________________