(Pan American, 12.Apr.2021) — Pan American Energy, S.L., Argentine Branch, a branch of Pan American Energy, S.L., a Spanish limited liability company (“Pan American”), commenced a tender offer for cash (the “Offer”) for any and all of its outstanding 7.875% Notes due 2021 (CUSIP: 69783TAA2 and 69783UAA9/ISIN US69783TAA25 and US69783UAA97) (the “Notes”).

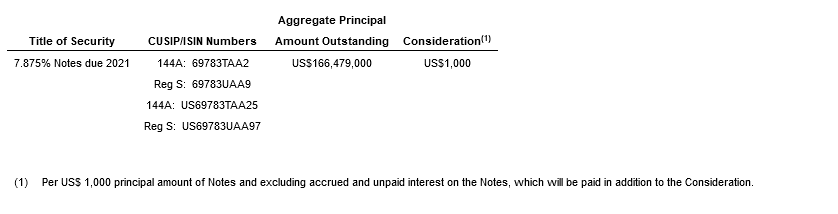

The Offer is being made on the terms and subject to the conditions set forth in the Offer to Purchase, dated 12 April 2021 (the “Offer to Purchase”) and the related Letter of Transmittal and Notice of Guaranteed Delivery (as these terms are defined in the Offer to Purchase and, collectively, the “Offer Documents”). The following table sets forth certain information relating to the Notes:

As set forth in the table above, subject to the terms and conditions of the Offer, Holders of the Notes (each, a “Holder”) must validly tender and not properly withdraw their Notes at or before 5:00 p.m., New York City time (6:00 p.m., Buenos Aires time), on 22 April 2021, unless the Offer is extended or earlier terminated by the Branch in its sole discretion, subject to applicable law (such time and date, as may be extended or earlier terminated, the “Expiration Time”) to receive $1,000 for each $1,000 in principal amount of Notes (the “Consideration”).

The Branch anticipates that it will accept for purchase Notes validly tendered and not validly withdrawn at or before the Expiration Time and pay for such accepted Notes promptly following the Expiration Time and the Guaranteed Delivery Date (the “Settlement Date”). In addition to the Consideration, holders of Notes accepted for payment will receive accrued and unpaid interest from the last interest payment date for the Notes to, but not including, the Settlement Date.

The Settlement Date for the Offer is expected to occur on 27 April 2021, which is the third business day after the Expiration Time, unless the Offer is extended or earlier terminated by the Branch in its sole discretion, subject to applicable law.

The Branch’s obligation to accept for purchase and to pay for Notes validly tendered and not withdrawn pursuant to the Offer is subject to the satisfaction or waiver, in the Branch’s discretion, of certain conditions, which are more fully described in the Offer Documents. The Offer is not subject to financing conditions or minimum tender conditions.

The Branch reserves the right to amend, terminate or withdraw the Offer for the Notes, subject to applicable law. In the event of a termination or withdrawal of the Offer, Notes tendered and not accepted for purchase pursuant to the Offer will be promptly returned to the tendering holders.

____________________