(Petrobras, 25.Nov.2020) — Petrobras announced its Board of Directors approved, in a meeting held today, the Strategic Plan for the five-year period 2021-2025 (SP2021-25).

The plan maintains the five pillars that support the implementation of the company’s set of strategies: (i) Maximization of the return on capital employed; (ii) Reduction of the cost of capital; (iii) Relentless search for low costs and efficiency; (iv) Meritocracy and (v) Safety, health, respect for people and the environment.

Petrobras reaffirms the vision of “Being the best energy company in generating shareholder value, focusing on oil and gas and with safety, respect for people and the environment,” aims to eliminate the performance gap that separates us from the best global oil and gas companies (Mind the Gap concept) and presents the model of double resilience: economic, resilient to low oil price scenarios, and environmental, focusing on low carbon.

SP 2021-25 presents four top metrics that will directly impact the compensation not only of executives, but of all company employees in 2021. Two metrics are related to sustainability (ESG):

▪Intensity of greenhouse gas emissions (GHG);

▪Leaked volume of oil and oil products;

▪Gross debt of $67bn in 2021;

▪Consolidated EVA® delta of $1.6bn.

We maintain the TRI indicator (total recordable injuries per million man-hours) as the top metric for 2021, but adjust the target to below 0.7, reinforcing the company’s commitment to life. We continue with our zero fatality ambition and insert in this plan the ambition of zero leakage.

Debt reduction and financial deleveraging will continue to be a priority, with the operating cash generation and divestments fundamental for these purposes. From January 2019 to September 2020, even with the impacts of Covid-19 pandemic and the oil shock in 2020, we have been able to reduce our gross debt by $31bn and maintain our target of $60bn by 2022.

Our divestment portfolio contains more than 50 assets at different stages of sale process. At the same time as debt relief, divestments contribute to improving the capital allocation and consequently to create value for the shareholder.

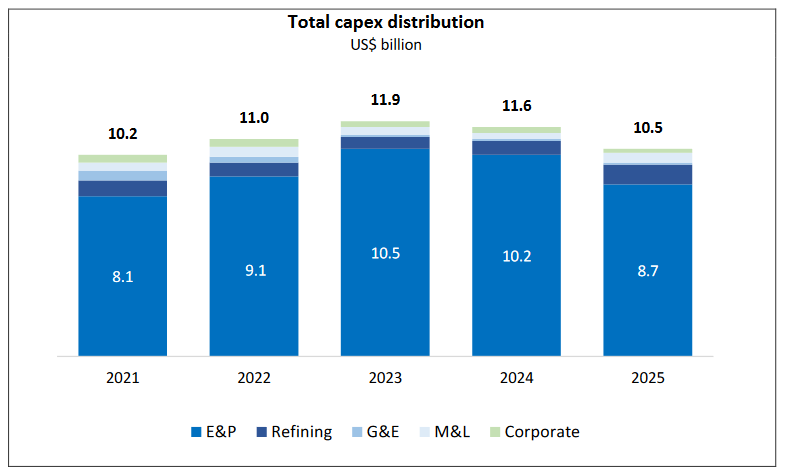

Capex foreseen for the 2021-2025 period is $55bn, of which 84% is allocated to the Exploration and Production of oil and gas (E&P). The investment of $46bn in E&P involve approximately $32bn, 70%, in pre-salt assets. This allocation is adherent to our strategic positioning, focusing on world-class assets in deep and ultra-deep waters, which we are natural owners, with a human capital quality, technological knowledge and ability to innovate.

The capital scarcity imposes competition between projects to obtain funding, approving only those that are resilient to Brent of $35/bbl.

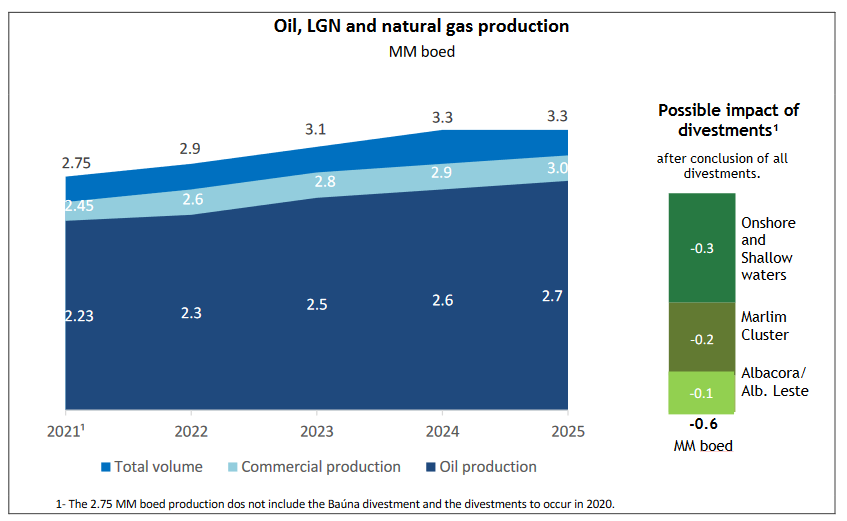

Oil, LNG and natural gas production

The oil and gas production curve estimated for the period 2021-2025, without considering the divestments, indicates a continuous growth focused on the development of projects that generate value, increasing the participation of the assets in the pre-salt with lower lifting cost. During this period, 13 new production systems are expected to come into operation, all of them allocated to deep and ultra-deep water projects.

The oil production for 2021 reflects the impacts related to the Covid-19 pandemic and the divestments that occurred in 2020. We consider a variation of 4% up or down for the 2021 production.

Low carbon and sustainability commitments

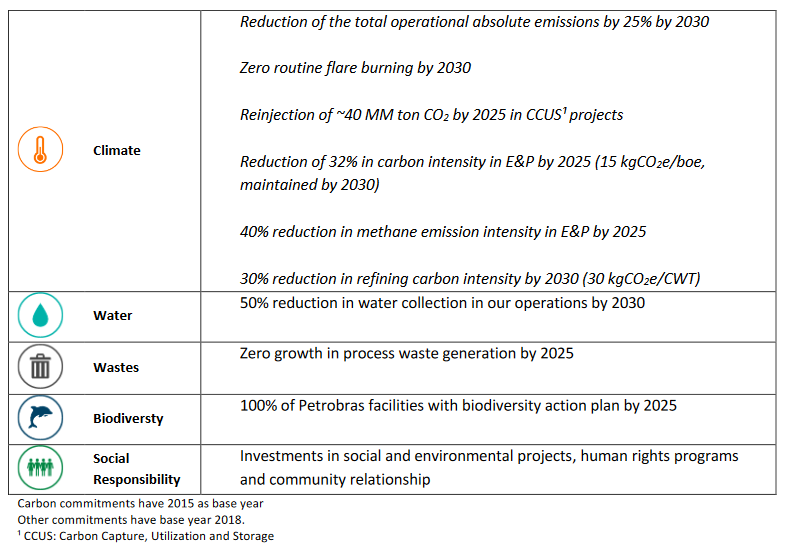

Petrobras reinforces commitment to the environment and the use of new technologies for decarbonization of our processes and products, which involve for example the reduction of natural gas flare burning, CO2 reinjection and energy efficiency gains in the refineries. We have created an executive management focused on climate change, linked to the Institutional Relations and Sustainability Office, and we aim to keep Petrobras in the first quartile of the industry in relation to low CO2 emissions.

To this end, we have reviewed our ten commitments to sustainability:

The 2021-25 Strategic Plan proposes a set of strategies that give visibility to issues that were relevant in 2020 for the future of Petrobras, such as (i) transparency and focus on sustainability (ESG), especially regarding the decarbonization of operations; (ii) strengthening of logistics activities, marketing and sales; (iii) search for a more efficient and sustainable Refining -BioRefining and (iv) strengthening of Petrobras’ management model.

With the execution of this Strategic Plan, Petrobras reaffirms its commitment to become a more financially robust company, with low indebtedness and cost of capital, focused on world-class oil and gas assets and value creation, always acting in an ethical and transparent manner, with safety in its operations and respect for people and the environment.

__________