(Angamos, 22.Sep.2020) — Empresa Eléctrica Angamos SpA announced early tender results of its offer to purchase for cash any and all of its outstanding 4.875% senior secured notes due 2029 and Extension of the early tender premium.

— early results of the previously announced offer to purchase for cash (the “Tender Offer”) of any and all of its 4.875% Senior Secured Notes due 2029, listed in the table below (collectively, the “Notes.”); and

— extension of the Early Tender Premium to the Expiration Date (each as defined below).

The Tender Offer will take place upon the terms and conditions described in the Company’s Offer to Purchase, dated September 8, 2020 (the “Offer to Purchase”).

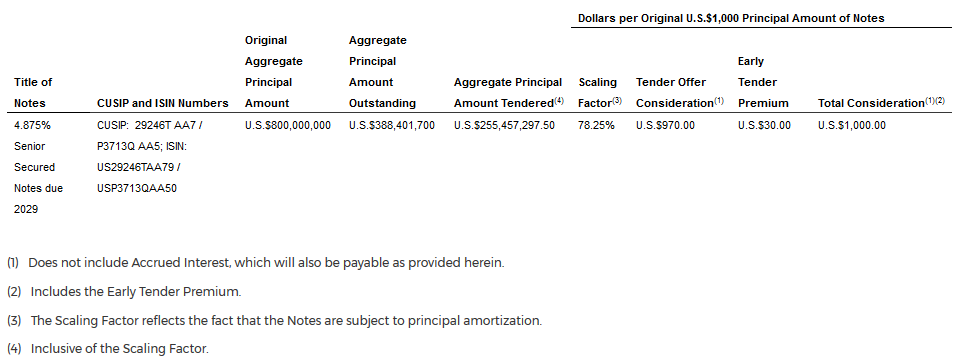

According to information received from Global Bondholder Services Corporation (“GBSC”), the Tender and Information Agent for the Tender Offer, as of 5:00 p.m., New York City time, on September 21, 2020 (that date and time, the “Early Tender Time”), Angamos had received valid tenders from holders of the Notes as outlined in the table below.

In addition, the Company hereby amends the Offer to Purchase so that Holders of Notes that are validly tendered prior to the Expiration Date and accepted for purchase pursuant to the Tender Offer will receive the Total Consideration (as set forth in the table above), which includes the early tender premium of U.S.$30.00 as set forth in the Offer to Purchase (the “

Early Tender Premium

The deadline for holders to validly withdraw tenders of Notes has passed. Accordingly, Notes that were tendered before the Early Tender Time and any additional Notes that are tendered at or prior to 11:59 p.m., New York City time, on October 5, 2020 (the “Expiration Date”) may not be withdrawn, except in the limited circumstances described in the Offer to Purchase.

The Tender Offer is subject to the conditions described in the Offer to Purchase. Subject to the satisfaction or waiver of all conditions to the Tender Offer described in the Company’s Offer to Purchase having been either satisfied or waived by the Company, the Company intends to accept for purchase all of the Notes validly tendered (and not validly withdrawn) before the Early Tender Time. These Notes will be purchased on September 23, 2020 (the “Early Settlement Date”). In addition, Angamos intends to accept for purchase any remaining Notes that are validly tendered and accepted in the Tender Offer prior to the Expiration Date. These remaining Notes are expected to be purchased on October 7, 2020 (the “Final Settlement Date”).

Payments for the Notes purchased will include accrued and unpaid interest from and including the last interest payment date applicable to the Notes up to, but not including, the applicable Settlement Date (as such term is defined in the Offer to Purchase). Holders of Notes that were validly tendered (and not validly withdrawn) prior to either the Early Tender Time, in respect of the Early Settlement Date, or the Expiration Date, in respect of the Final Settlement Date, and accepted for purchase pursuant to the Tender Offer will receive the Total Consideration (as set forth in the table above), which includes the Early Tender Premium, multiplied by the Scaling Factor (as set forth in the table above).

Full details of the terms and conditions of the Tender Offer are set forth in the Offer to Purchase, which is available from GBSC.

Citigroup Global Markets Inc. (“Citigroup”) is the Global Coordinator in the Tender Offer. Citigroup, Itau BBA USA Securities, Inc. (“Itaú BBA”), Santander Investment Securities Inc. (“Santander”) and SMBC Nikko Securities America, Inc. (“SMBC Nikko”) are the Dealer Managers in the Tender Offer. Persons with questions regarding the Tender Offer should contact Citigroup at (toll free) (800) 558-3745 or (collect) (212) 723-6106, Itaú BBA at (collect) (212) 710-6749, Santander at (toll free) (855) 404-3636 or (collect) (212) 940-1442, or SMBC Nikko at (toll free) (888) 868-6856. Requests for the Offer to Purchase should be directed to GBSC at (toll free) (866) 470-3700 or (collect) (212) 430-3774 or email at contact@gbsc-usa.com.

None of the Company, its board of directors, its officers, the dealer managers, the depositary, the tender and information agent or the trustees with respect to the Notes, or any of their respective affiliates, makes any recommendation that holders tender or refrain from tendering all or any portion of the principal amount of their Notes, and no one has been authorized by any of them to make such a recommendation. Holders must make their own decision as to whether to tender their Notes and, if so, the principal amount of Notes to tender.

__________