(Pampa, 11.Aug.2020) — Pampa Energía S.A., the largest independent energy integrated company in Argentina, with active participation in the country’s electricity and gas value chain, announces the results for the six-month period and quarter ended on June 30, 2020.

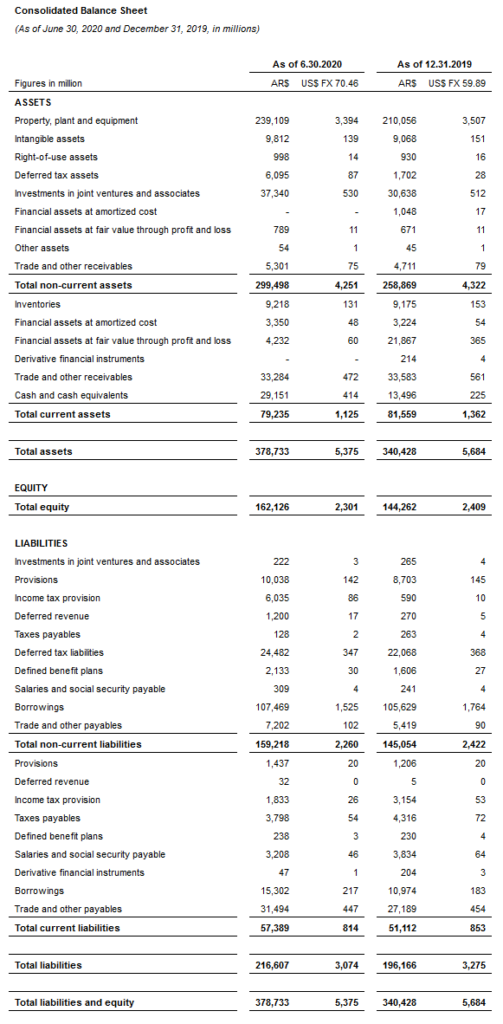

As from January 1, 2019, the Company adopted US$ as functional currency for the reporting of its financial information. The presentation of this information in AR$ is converted at transactional nominal exchange rate (‘FX’).

However, Edenor (electricity distribution), OldelVal (oil and gas), Transener, TGS and Refinor (holding and others) continue recording their operations in local currency. Thus, the 2020 figures are adjusted by inflation as of June 30, 2020 (1H 20: 6.4% and Q2 20: 2.6%), translated to US$ at closing FX of 70.46. Moreover, the 2019 figures are adjusted by inflation as of June 30, 2019 (1H 19: 10.1% and Q2 19: 4.5%), translated to US$ at closing FX of 42.461.

Main Highlights From The 1H 20 Results

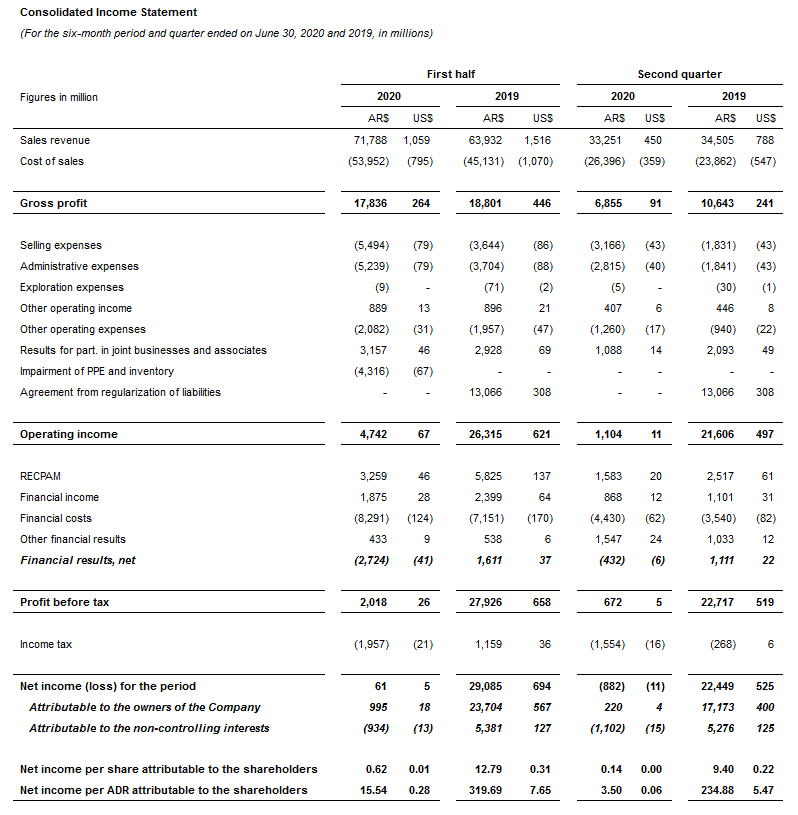

Consolidated net revenues of US$1,059 million2, 30% lower than the US$1,516 million recorded in 1H 19, mainly due to unadjusted tariffs at regulated businesses, the termination of fuel self-procurement for power sold to CAMMESA as from January 2020, and lower prices and volumes sold in oil and gas, partially offset by new power generation units priced under PPAs.

— Power Generation of 8,070 GWh from 15 power plants3

— Electricity sales of 9,994 GWh to 3.1 million end-users

— Production of 44.9 thousand boe per day of hydrocarbons

— Sales of 139 thousand tons of petrochemical products

Consolidated adjusted EBITDA4 of US$341 million, 30% lower than the US$484 million in 1H 19, due to decreases of 69% in electricity distribution, 65% in oil and gas, 60% in petrochemicals and 23% in holding and others, partially offset by 6% increase at power generation and lower intersegment eliminations for US$1 million.

Consolidated gain attributable to the owners of the Company of US$18 million, 97% lower than the US$567 million gain achieved in 1H 19, mainly due to the extraordinary non-cash profit from the settlement of Edenor’s regulatory liabilities in 1H 19, in addition to lower operating margins in oil and gas and regulated businesses, lesser RECPAM recorded due to the lower passive net monetary position allocated to the electricity distribution segment, an income tax charge and impairment of accrued assets in 1H 20.

Main Highlights From The Q2 20 Results5

Consolidated net revenues of US$450 million, 43% lower than the US$788 million recorded in Q2 19, mainly due to unadjusted tariffs at regulated businesses, the termination of fuel self-procurement for power sold to CAMMESA as from January 2020, and lower prices and volumes sold in oil and gas, partially offset by new power generation units priced under PPAs.

— Power Generation of 3,461 GWh from 15 power plants

— Electricity sales of 4,791 GWh to 3.1 million end-users

— Production of 43.7 thousand boe per day of hydrocarbons

— Sales of 52 thousand tons of petrochemical products

Consolidated adjusted EBITDA of US$120 million, 56% lower than the US$271 million in Q2 19, due to decreases of 5% in power generation, US$86 million in electricity distribution, 88% in oil and gas, and 35% in holding and others, partially offset by a 33% increase at petrochemicals and lower intersegment eliminations for US$1 million.

Consolidated gain attributable to the owners of the Company of US$4 million, 99% lower than the US$400 million gain in Q2 19, mainly due to Edenor’s extraordinary non-cash profit in Q2 19, in addition to lower operating margins in oil and gas and regulated businesses, and lesser RECPAM recorded due to the lower passive net monetary position allocated to the electricity distribution segment and income tax charge.

For a full version of Pampa’s Earnings Report, click here.

__________