(Ecopetrol, 29.Oct.2019) — Ecopetrol S.A. announced the Ecopetrol Group’s financial results for the third quarter and the first nine months of 2019, prepared in accordance with International Financial Reporting Standards applicable in Colombia.

The figures included in this report are not audited. The financial information is expressed in billions of Colombian pesos (COP) or US dollars (USD), or thousands of barrels of oil equivalent per day (mboed) or tons, and this is so indicated where applicable. For presentation purposes, certain figures of this report were rounded to the nearest decimal place.

In words of Felipe Bayón Pardo, CEO of Ecopetrol:

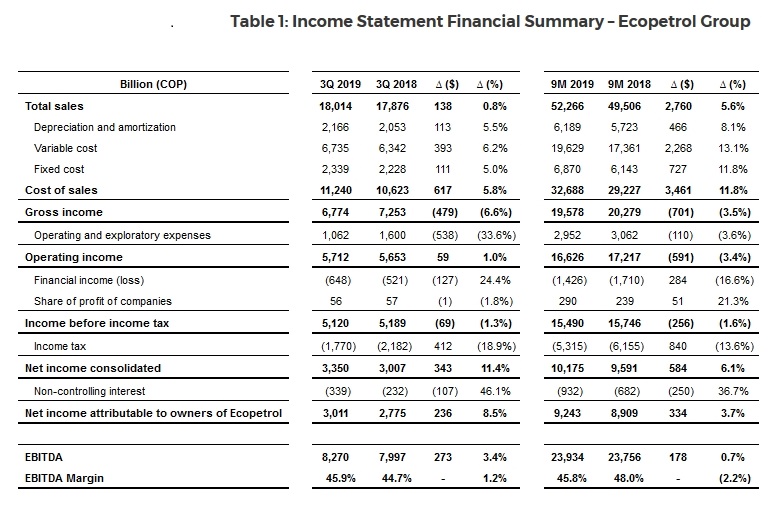

“The Ecopetrol Group achieved sound operational and financial results during the first nine months of the year, in particular net profit of 9.2 trillion pesos and EBITDA of 23.9 trillion pesos, equivalent to an EBITDA margin of 46%.

As of the close of the quarter, we reported a solid cash position of 16 trillion pesos, even after paying the third installment of dividends to the government on 2018 earnings, totaling 2.7 trillion pesos.

These results demonstrate the good operational performance in all segments and the positioning of our crudes in markets that generate greater value. The above, coupled with the devaluation of the average exchange rate, the financial savings associated with the prepayment of the debt and the lower nominal tax rate. All this allowed to compensate, the lower Brent price, which went from USD 76 per barrel in the third quarter of 2018 to USD 62 per barrel at the end of this quarter. We positively highlight the spread of crude oil basket of -5 USD/bl in the third quarter compared to -8.4 USD/bl for the same period of 2018.

On the international arena, I am pleased to highlight two very important milestones: the first, our entry to the Midland in the Permian basin, the most prolific in the world, through a Joint Venture (JV) with Occidental, to participate in the exploitation of unconventional resources. The JV would allow the company to incorporate proven reserves (P1) of around 160 million barrels of oil equivalent and increase production progressively until 2027, when it would contribute a net production for Ecopetrol estimated at about 95 thousand barrels of oil equivalent per day. The JV will also allow Ecopetrol to strengthen its knowledge in the evaluation, development and exploitation of unconventional resources.

Second, the execution of an agreement with Shell Brasil Petróleo Ltda. to acquire 30% stake in the “Gato do Mato” discovery, located in two offshore areas of Brazil’s Santos basin, in the so-called Pre-Salt.

Under this agreement, Shell will reduce its stake from 80% to 50% and continue as operator, while the French oil company Total will retain the remaining 20%. With this purchase, Ecopetrol deepen its strategic position in Brazil’s Santos basin.

It is important to note that these invesments are aligned with the strategic priorities of the 2019-2021 business plan, focused on the growth of reserves and production under strict capital discipline. The transactions will be paid with our cash.

On the other hand, we receive in a respectful, prudent and responsible manner, the provision of the State Council that allows us to advance to a research stage through the Pilot Projects (PPII, by its acronym in Spanish) recommended by the Experts Committee.

We believe that advancing to a research stage is a key opportunity to rigorously evaluate the possibility of developing unconventionals in Colombia. For Ecopetrol, this is a step forward that will be assuming responsibly, in strict compliance with the regulations and provisions of the authorities, while ensuring deep respect for the environment and communities.

In the production segment, during the quarter we faced a challenging environment and some operational limitations that forced us to temporarily shut down our Tibú, Caño Limón and Gibraltar fields, causing our average production for the quarter to be at 720 thousand barrels of oil-equivalent per day. However, accumulated average production to September was 723 thousand barrels of oil-equivalent per day, 8 thousand barrels higher than in the same period last year, in line with the 2019 target.

We note the positive results of the Group’s subsidiaries, which contributed more than 60 thousand barrels of oil-equivalent per day during the first nine months of the year, some 8.4% of total production. The recovery program, which is the strategic pillar for adding hydrocarbon reserves, contributed 30% of the Group’s daily production.

In the exploration campaign, the Group and its partners completed the drilling of 13 exploratory wells, exceeding the goal of 12 wells for the year, with a success rate of 38%. We note the success of the Flamencos-1 well, in the Valle Medio del Magdalena basin, 100% operated by Ecopetrol. This discovery forms part of the Near Field exploration strategy, which consists in identifying and testing opportunities in the vicinity of already existing fields and facilities.

In the transport segment, we highlight the higher volumes of crude transported. It is also worth to highlight the logistical improvements made at Buenaventura, facilitating the port’s use as an alternate route for supplying fuels to the country’s south western region, as well as the commissioning of the Chinchiná-Pereira bypass. This project demonstrate our commitment to emphasizing safety as a pillar of our operations.

During the third quarter, the oil pipeline network continued to suffer from attacks by third parties; nevertheless, contingent operations on the Bicentenario oil pipeline have succeeded in mitigating these impacts.

In the Downstream segment, during the third quarter of the year we achieved a new historic maximum average throughput of 389 thousand barrels per day for the two refineries, thus demonstrating their effective performance despite unscheduled operating events. Gross combined refining margin was 10.2 USD/bl, impacted mainly due to lower product prices and the strengthening of medium and heavy crudes, consistent with the behavior of the international market.

With regards the investment plan, between January and September 2019 the Group executed investments totaling USD 2,317 million, up 29% versus the same period in 2018. Eighty-one percent of investments were concentrated in the upstream segment, in line with the Group’s strategic priorities.

As part of our efforts to contribute to preserving the environment, we have committed to reducing greenhouse gas emissions by 20% by the year 2030, and reducing our operational vulnerability to climate change. It is important to highlight that Ecopetrol S.A. was the first company in Colombia’s Oil and Gas sector to verify its reduction in greenhouse gas emissions from operating processes. The firm Ruby Canyon Engineering verified the reduction of over one million tons of CO2-equivalent between 2013 and 2017.

Along these same lines, Ecopetrol has entered into an agreement with the Colombian Ministry of Environment and Sustainable Development to improve the country’s environmental quality and sustainable development, in areas such as water resources, biodiversity, climate change, circular economy and improved air quality.

In addition to the above, we have met an important milestone in our energy transition process. On October 18th, we inaugurated the largest solar farm for self-generation of energy in Colombia, located in the city of Castilla La Nueva, in the Department of Meta. It has installed capacity of 21 peak megawatts and will supply energy for the next 15 years to the Castilla field, Ecopetrol’s second largest. The tariff of the energy produced by the solar farm represents savings of more than 30% compared to that supplied by the national electricity grid.

The entry into solar energy demonstrates Ecopetrol’s commitment to renewable energies. This operation will prevent the emission of over 154,000 tons of CO2 into the atmosphere.

Over the year, we have focused our efforts on activities such as water recycling. During the third quarter, we reused some 66 million cubic meters of water, up 4% versus the same period the year.

We maintain our commitment to profitable growth in production and reserves with sustainable results, reducing the impacts of our operations, encouraging good environmental practices and promoting the socio-environmental development of the regions in which we are active.”

To review the full report please

visit the following link:

https://www.ecopetrol.com.co/english/documentos/Reporte%203Q19%20-%20ENG%20FINAL.pdf

***

Al tomar fotografías con un teléfono móvil o una tableta, debe activar la función de servicio de posicionamiento GPS del dispositivo; de lo contrario, no se podrá posicionar el teléfono móvil.