(Petrobras, 28.Mar.2019) — Petrobras signed a Revolving Credit Facility – RCF in the amount of US$3.25 billion, maturing in March 2024, which may be extended for up to two years. The contract, signed with 18 banks, allows the company to make withdrawals from such facility until the month prior to maturity.

The contract also provides for the possibility of drawing up to US$1 billion to provide counter-guarantee on bank guarantees in Brazil, focusing on judicial guarantees.

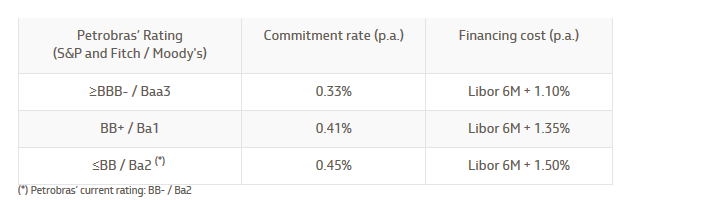

The Commitment fee for the unused credit facility and the financing cost, in case of withdrawal, will be impacted by the company’s corporate rating, as shown in the table below.

The transaction will allow greater efficiency in the company’s cash management, by enabling the early settlement of existing debts in an amount equivalent to the contracted volume, maintaining the level of liquidity. Moreover, it will increase the capacity to issue judicial guarantees in Brazil.

The banks’ performance in this operation is broken down as follows:

– Joint Bookrunner: Citibank, Credit Agricole, JPMorgan Chase, Mizuho and The Bank of Nova Scotia;

– Senior Mandated Lead Arranger: Bank of China and Intesa Sanpaolo;

– Mandated Lead Arranger: ABN AMRO, Credit Suisse, Goldman Sachs e HSBC;

– Participants: Commerzbank, Banco Bilbao Vizcaya Argentaria (BBVA), BNP Paribas, Natixis, Banco Santander, Standard Chartered Bank e Bank of America.

The transaction is in line with the company’s Resiliency Plan and liability management strategy, which seeks to improve the profile of amortization and cost of debt, considering the deleveraging goal set forth in its 2019-2023 Business and Management Plan.

***