(Pampa Energía S.A., 13.Aug.2018) – Pampa Energía S.A. reported results for the six-month period and quarter ended on June 30, 2018. All figures are stated in Argentine Pesos and have been prepared in accordance with International Financial Reporting Standards.

Main Results for the First Semester of 2018 (1)

In order to reflect the financial performance of each business segment, as from 2018 and for the comparative periods, the selling and administrative expenses, as well as the financial results, which used to be assigned to holding and others, will be redistributed among the operating segments.

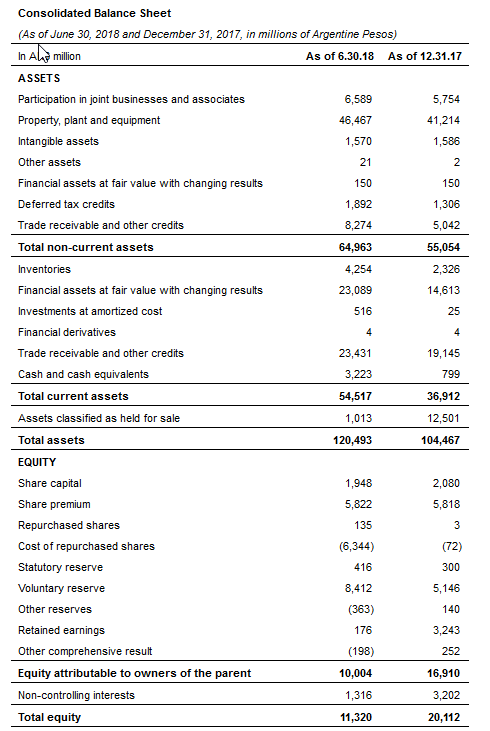

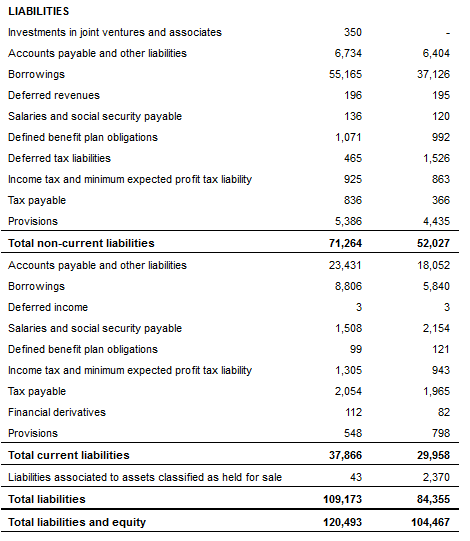

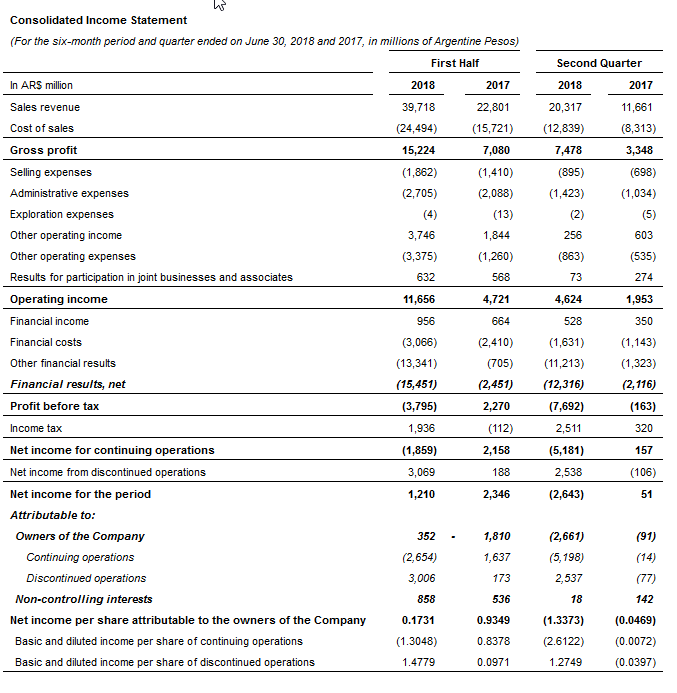

Consolidated net revenues of AR$39,718 million(2), 74% higher than the AR$22,801 million for the first half of 2017, explained by increases of 113% in power generation, 91% in electricity distribution, 34% in oil and gas, 30% in petrochemicals and 126% in holding and others segment, partially offset by 9% of higher eliminations as a result of intersegment sales.

— Power Generation of 7,948 GWh from 12 power plants

— Electricity sales of 10,894 GWh to 3 million end-users

— Production of 45.9 thousand barrels per day of hydrocarbons

— Sales of 182 thousand tons of petrochemical products

Consolidated adjusted EBITDA(3) for continuing operations of AR$14,881 million, compared to AR$6,435 million for 1H17, mainly due to increases of AR$2,945 million in power generation, AR$3,438 million in electricity distribution, AR$592 million in oil and gas, AR$6 million in refining and distribution, AR$79 million in petrochemicals and AR$1,425 million in holding and others segment, partially offset by higher intersegment eliminations of AR$39 million.

Consolidated profit attributable to the owners of the Company of AR$352 million, lower than the AR$1,810 million gain in 1H17, mainly explained by AR$13,772 million losses accrued due to 55%(4) of AR$ depreciation against US$, currency in which most of the company’s financial liabilities are denominated, whereas the FS reports in AR$, without inflation adjustment.

Main Results for the Second Quarter of 2018(5)

Consolidated net revenues of AR$20,317 million, 74% higher than the AR$11,661 million for the second quarter 2017, explained by increases of 116% in power generation, 78% in electricity distribution, 37% in oil and gas, 57% in petrochemicals and 151% in holding and others segment, as well as 5% of lower eliminations as a result of intersegment sales.

— Power Generation of 3,659 GWh from 12 power plants

— Electricity sales of 5,344 GWh to 3 million end-users

— Production of 45.9 thousand barrels per day of hydrocarbons

— Sales of 95 thousand tons of petrochemical products

Consolidated adjusted EBITDA for continuing operations of AR$7,505 million, compared to AR$3,208 million for Q2 17, mainly due to increases of AR$1,643 million in power generation, AR$1,247 million in electricity distribution, AR$486 million in oil and gas, AR$44 million in petrochemicals and AR$944 million in holding and others segment, partially offset by losses of AR$49 million in refining and distribution, and higher intersegment eliminations of AR$18 million.

Consolidated loss attributable to the owners of the company of AR$2,661 million, higher than the AR$91 million loss in Q2 17, explained by the accrual of AR$11,367 million losses due to 43%6 of AR$ depreciation against US$.

1 — The financial information presented in this document are based on financial statements (‘FS’) prepared according to the International Financial Reporting Standards (‘IFRS’) in force in Argentina, and consequently, the FS discriminates the continuing operations from the assets agreed for sale, which are reported as discontinued operations.

2 — Under the IFRS, Greenwind, OldelVal, Refinor, Transener and TGS are not consolidated in Pampa’s FS, being its equity income being shown as ‘Results for participation in associates/joint businesses’.

3 — Consolidated adjusted EBITDA represents the results before net financial results, income tax and minimum notional income tax, depreciations and amortizations, non-recurring and non-cash income and expense, equity income and other adjustments from the IFRS implementation, and includes affiliates’ EBITDA at ownership. For more information, see section 3 of this Earnings Release.

4 — 1H18 nominal exchange rate variation.

5 — The financial information presented in this document for the quarters ended on June 30, 2018 and of 2017 are based on unaudited FS prepared according to the IFRS accounting standards in force in Argentina corresponding to the six-month period of 2018 and 2017, and the quarters ended on March 31, 2018 and 2017, respectively.

6 — Q2 18 nominal exchange rate variation.

***