(Frontera, 1.Feb.2023) — Frontera Energy Corporation (TSX: FEC) announces its full year 2023 capital and production guidance and provides an update on its normal course issuer bid (“NCIB“), its 2023 hedging program and its estimated fourth quarter and 2022 full year average daily production. All values in this news release and the Company’s financial disclosures are in United States dollars, unless otherwise noted.

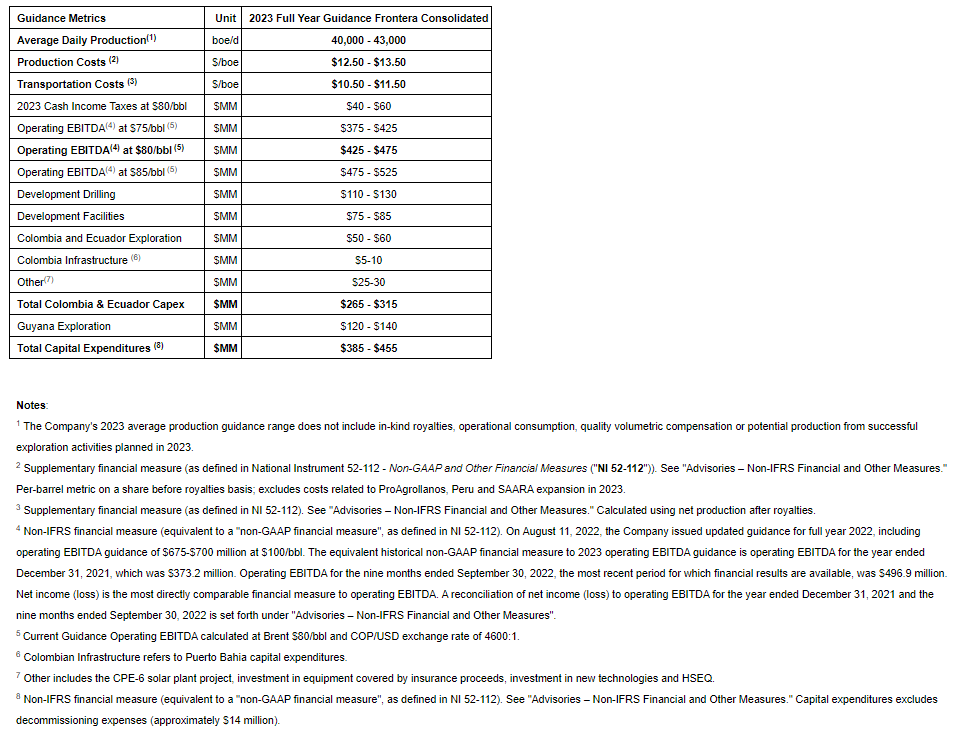

Summary of Frontera’s 2023 Capital and Production Guidance

Orlando Cabrales, Chief Executive Officer, Frontera, commented:

“Frontera’s 2023 capital program aims to deliver stable cash flow and $425-$475 million operating EBITDA at $80/bbl average Brent prices from the Company’s proven and diverse asset base while also investing for future growth through facilities expansion and both near-field and high-impact exploration. Frontera anticipates investing approximately $185-$205 million to deliver approximately 40-43,000 boe/d, a 13% decrease in development spending as compared to 2022. The 2023 program is fully funded from existing cash and 2023 cash flows, features balanced capital allocation across our most productive and prospective blocks, basins, and countries, supports our ongoing efforts to diversify our production mix and lays the foundation for the Company’s path to grow production to 50,000 boe/d.

In 2023, we will advance the Company’s exciting development and lower-risk exploration portfolio in Colombia and Ecuador, invest in infrastructure and facilities at Quifa and CPE-6 to increase production, leverage our advantaged transportation and logistics structure to maximize realized prices, mature our self-sustaining and growing midstream business including Puerto Bahia and ODL, execute our hedging program to protect our revenue generation and manage our exposure to price volatility, and seek to build on our Kawa-1 light oil and condensate discovery with the Wei-1 well, our second exploration well offshore Guyana.”

About Frontera’s 2023 Capital and Production Guidance

The company developed its 2023 capital and production guidance using an average 2023 Brent price of $80/bbl and an exchange rate of approximately 4,600 Colombian Pesos per US dollar. The Company’s 2023 Plan for Colombia and Ecuador is self-funded. The company expects to fund its Guyana exploration program from existing resources.

| $80/bbl Case | ($millions) |

| Operating EBITDA | $425 – $475 |

| Cash Income Taxes | ($40) – ($60) |

| Debt Service (1) | ($45) – ($50) |

| Total Colombia & Ecuador Capex | ($265) – ($315) |

| Colombia & Ecuador Free Cash Flow | $50 -$75 |

| 1. Excludes non-recourse debt to Frontera |

Capital Spending

The company anticipates total capital spending of approximately $385 to $455 million in 2023, which is approximately 10% lower at the midpoint compared to Frontera’s 2022 Guidance. Frontera’s anticipated total Colombia and Ecuador capital expenditures of $265-$315 million represents approximately 70% at the midpoint of the company’s 2023 capital budget. Capital expenditures will be divided between development and exploration activities as shown below.

Development Activities

The company anticipates directing approximately $215-$255 million towards the company’s base Colombia and Ecuador upstream activities. Frontera anticipates spending approximately $110-$130 million to drill 55 gross production wells, mainly in Quifa SW, CPE-6, Cajua and Copa fields, complete 24 gross well interventions and drill two injector wells, and approximately $75-$85 million on development facilities primarily to increase oil and water handling capacity at CPE-6 and Quifa.

- Quifa: Frontera plans to drill 27 production wells, complete 18 well workovers and install additional flow lines in 2023. Frontera will also continue developing its SAARA water treatment project, which if successful is expected to increase water disposal capacity. Frontera’s SAARA water treatment facility will diversify produced water disposal options from the Quifa field for irrigation use at the ProAgrollanos palm oil plantation.

- CPE-6: The company plans to drill 18 production wells and two injector wells and install additional flow lines in 2023. As part of its multi-year development plan, Frontera also plans to increase water-handling capacity by 100% from approximately 120,000 bbls/day to 240,000 bbls/day by year-end, supporting additional future growth for this field.

- Other fields: Frontera plans to drill five production wells at Cajua, two producer wells in the Copa field at Cubiro, two production wells and one production well at the Perico block in Ecuador.

- Colombian Infrastructure: Puerto Bahia plans to invest approximately $5-10 million in expanding its container business capabilities as well as in maintenance activities related to its hydrocarbon terminal.

- Other Capex: Frontera plans to invest $25-30 million primarily on a 9MW solar plant at CPE-6, investment in equipment covered under existing insurance policies and new well technologies. These Other capital expenditures will be offset by $10-15 million in insurance proceeds.

Exploration Activities

Frontera intends to invest $170-$200 million on its Colombia, Ecuador, and Guyana exploration programs.

- Colombia and Ecuador: In 2023, the company anticipates spending $50-$60 million on various exploration activities in Colombia and Ecuador including drilling the Chimi-1, Winner-1 and Tubara South-1 exploration wells in VIM-22 block in Colombia and the Yin Sur-1 well in Ecuador; complete civil works on the VIM-1 block at the Hydra well location; carry out initial seismic activities at VIM-46 block; complete an 80-kilometre seismic acquisition program and begin civil works at the Sol Nor-1 and Sol Nor-2 locations at the LLA-119 block; and complete an 164-kilometre seismic acquisition program and Environmental Impact Assessment at LLA-99.

- Guyana: On the Corentyne block, offshore Guyana, Frontera anticipates spending approximately $120-$140 million on the Wei-1 well, which will be funded from existing resources. The total cost of the Wei-1 well (including 2022 pre-drill costs and costs related to drilling delays) are forecast to be approximately $160-$170 million. The Wei-1 well is located approximately 14 kilometres northwest of the Joint Venture’s previous Kawa-1 light oil and condensate discovery and will target Maastrichtian, Campanian and Santonian aged stacked sands within channel and fan complexes in the northern section of the Corentyne block. The Wei-1 well will appraise both the Kawa-1 discovery as well as explore additional opportunities within the Corentyne block.

Operating EBITDA Sensitivities

Every one-dollar average annual change to the company’s $80/bbl Brent price assumption for 2023 impacts operating EBITDA by approximately $10 million including hedging. See the table below for illustrative Brent pricing sensitivities.

| Operating EBITDA(1) | Unit | 2023 Full Year Guidance Frontera Consolidated |

| At $75/bbl (2) | $MM | $375 – $425 |

| At $80/bbl (2) | $MM | $425 – $475 |

| At $85/bbl (2) | $MM | $475 – $525 |

| 1 Non-IFRS financial measure (equivalent to a “non-GAAP financial measure”, as defined in NI 52-112). See Advisories – “Non-IFRS Financial and Other Measures.” |

| 2 Current Guidance Operating EBITDA calculated at Brent $80/bbl and COP/USD exchange rate of 4600:1. |

Relative to 2022 Guidance, forecast Operating EBITDA for 2023 is expected to be impacted largely by a decrease in average commodity prices, higher inflation and partially offset by a weaker Colombian Peso exchange rate. Frontera’s 2022 updated financial and operating guidance was developed using an average Brent price of $100/bbl while Frontera’s 2023 financial and operating guidance was developed using an $80/bbl average Brent price. The company’s 2023 forecast sales volumes are expected to be similar to 2022 Guidance, however lower revenues are anticipated in 2023 due to lower expected average Brent prices for the year. In addition, the company is working to partially offset the Operating EBITDA impact of higher inflation in Colombia (13.1% in 2022) to its operating costs through a number of cost savings initiatives and an expected weaker Colombian Peso exchange rate relative to the US dollar.

Enhancing Shareholder Returns

Since 2018, Frontera has returned approximately $300 million to shareholders while maintaining a strong credit profile. Under its current NCIB that expires on March 16, 2023, Frontera is authorized to repurchase for cancellation up to 4,787,976 common shares. To date under its current NCIB, the company has repurchased approximately 4.1 million common shares, or over 85% of its approved NCIB amount, with approximately 700,000 additional common shares available for repurchase under its current NCIB.

Frontera remains committed to returning capital to shareholders. As part of its 2023 plan, the Company shall continue to consider future shareholder value enhancement initiatives.

2023 Hedging Program

As part of its risk management strategy, Frontera uses derivative commodity instruments to manage exposure to price volatility by hedging a portion of its oil production. Consistent with this strategy, the company entered into new put hedges totaling 2,160,000 bbls to protect a portion of the company’s production through May 2023. The following table summarizes Frontera’s 2023 hedging position as of February 1, 2023.

| Term | Type ofInstrument | Open Positions(bbl/d) | Strike PricesPut/ Call |

| January | Put | 14,839 | 80 |

| February | Put | 14,286 | 70 |

| March | Put | 14,194 | 70 |

| 1Q-2023 | Total Average | 14,444 | |

| April | Put | 14,333 | 70 |

| May | Put | 13,871 | 70 |

| 2Q-2023 | Total Average | 9,451 |

Colombian Tax Reform

In November 2022, the Colombian government approved tax reforms that will increase costs from 2023 onwards for Colombian oil and gas producers. The tax reform has two main impacts on the oil and gas industry. First, a 5 to 15% tax surcharge when current average oil prices exceed by 30% or more the average oil price over the last 10 years. Second, the tax reform makes royalties non-deductible. Treatment of high price participation (PAP) payments is not affected. Under the tax reform, oil and gas companies will not be permitted to deduct operating costs and capital expenditures associated with royalties paid whether in-kind or in-cash.

| 2023 Cash Income Taxes(1) | Unit | 2023 Full Year Guidance Frontera Consolidated |

| At $75/bbl(2) | $MM | $35 – $50 |

| At $80/bbl(2) | $MM | $40 – $60 |

| At $85/bbl(2) | $MM | $45 – $75 |

| 12023 cash income taxes under the new tax reform including withholding taxes. |

| 2Average Brent prices for the year. |

Estimated 2022 Production

Frontera’s estimated 2022 average daily production of approximately 41,400 boe/d was in-line with the company’s 2022 increased and tightened production guidance of 41,000 to 43,000 boe/d and represents an approximately 9.5% increase compared to the company’s 2021 average production. Frontera’s estimated average daily production for the fourth quarter was approximately 41,800 boe/d and Frontera’s estimated average daily production in December was approximately 42,200 boe/d. See the table below for production by product type.

| Unit | 2021 | 2022 | Q4’22 | Dec 2022 | |

| Production | |||||

| Heavy crude oil production (1) | (bbl/d) | 19,326 | 21,400 | 22,100 | 22,900 |

| Light and medium crude oil production (1) | (bbl/d) | 17,218 | 17,300 | 17,100 | 17,000 |

| Total crude oil production | (bbl/d) | 36,544 | 38,700 | 39,200 | 39,700 |

| Conventional natural gas production (1) | (mcf/d) | 5,022 | 9,800 | 9,100 | 9,000 |

| Natural gas liquids (1) | (boe/d) | 254 | 900 | 1,000 | 900 |

| Total production (2) | (boe/d) (3) | 37,818 | 41,400 | 41,800 | 42,200 |

| 1. References to heavy crude oil, light and medium crude oil combined, natural gas liquids and conventional natural gas production in the above table and elsewhere in this press release refer to the heavy crude oil, light and medium crude oil combined, natural gas liquid, and conventional natural gas, respectively, product types as defined in National Instrument (“NI“) 51-101 – Standards of Disclosure for Oil and Gas Activities. |

| 2. Represents W.I. production before royalties. Refer to the “Further Disclosures” section on page 30 of the Company’s management’s discussion and analysis for the three and nine months ended September 30, 2022 (the “MD&A”). |

| 3. Boe has been expressed using the 5.7 to 1 Mcf/bbl conversion standard required by the Colombian Ministry of Mines & Energy. Refer to the “Further Disclosures – Boe Conversion” section on page 30 of the MD&A. |

____________________