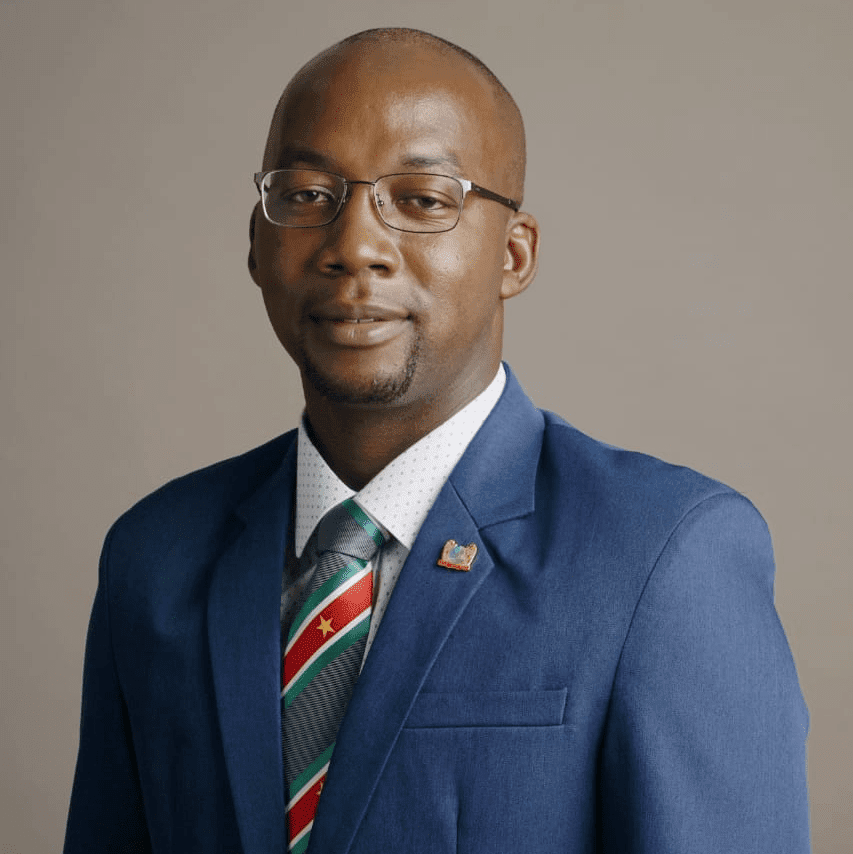

(SEOGS, 22.Jun.2022) — Suriname’s Minister of Natural Resources H.E. David Abiamofo spoke about the South American country’s energy sector and potential during an interview prior to the start of the Suriname Energy, Oil & Gas Summit & Exhibition (SEOGS) which takes place 28-30 June 2022 in the country’s capital Paramaribo.

1. Some investors and energy companies are still somewhat skeptical about the size and feasibility of Suriname’s offshore finds. What are the latest estimates for the amount of oil and gas in Suriname’s offshore blocks? And what would you tell cautious foreign companies?

Offshore there have already been 6 significant discoveries made – 5 in Block 58 and 1 in Block 52. Of course, we are still in the appraisal stage which means we are drilling more wells and acquiring further data to confirm the range of volumes. We have Production Sharing Contracts with our partners and those numbers can best be disclosed by them. I would tell cautious investors that we have a proven hydrocarbon province, and that the Suriname Government is supportive of the further development of the Petroleum Industry, and open/collaborative to implement the improvements needed to promote the sustainable/optimal development hereof.

To this extent, the Staatsolie Hydrocarbon Institute is expecting to release further deep-water blocks for open tender later in the year. Substantial technical work has been carried out on this unlicensed area which, in our opinion, supports the attractiveness of this acreage.

The SEGOS 2022 will offer a great opportunity for regional policymakers, entrepreneurs and local businesses to collaborate with international oil companies, services providers, business experts and investors interested in uncovering potential opportunities in Suriname’s rapidly expanding upstream, midstream and downstream oil and gas markets.

In my view this summit comes at an exciting time for Suriname as we enter into a new chapter of our country’s future, with the promising new developments in the Oil & Gas exploration landscape and the potential to rapidly grow as a new Oil & Gas hotspot in the Caribbean region.

2. Guyana has been able to scale oil production from 0 to 350k bpd in 8 years since its first commercial find. What is the most up to date timeline for first oil in Suriname and what can it replicate from Guyana’s successful ramp up? On the other hand, what has Guyana done that Suriname will seek to avoid?

We want to be cautious in providing a timeline in this regard, as Total Energies as operator in block 58 is the party that can answer this question with more certainty. We are confident that there are ample reserves for a first development. In the coming months two key wells will be drilled to determine if there is upside on top of what is already proven for a development. This upsizing would also mean that the FID targeted, now expected for the 4th quarter of 2022, could be pushed out a little bit. We assume a fast track approach which typically takes about 36-40 months for the execution / construction phase. And while we hope to replicate from Guyana’s successful ramp up, we are realistic that the geology and market circumstances are different. Activities in oil sector have picked up steam the last couple of months. As we have had an oil industry for 41 years in Suriname we will have firm oversight and knowledge transfer initiatives to further develop the capability of NOC.

We’re not competing with Guyana. Suriname and Guyana share a rich history and we have developed a fruitful relationship in different areas, including sharing our different experiences in the Petroleum Industry. This reciprocity is in sharing information on geology, national value (Local Content) and development and production phase. So, we have benefited from some of the early exploration work to help Suriname understand the geology and the petroleum system of the basin.

3. As Latin America doubled its U.S. LNG imports in 2021, what role will Suriname play as a new source of gas for the region? Do you foresee Suriname exporting its own LNG in the future?

- As Gas and subsequently LNG are regarded transition fuels, many studies predict that the demand for Gas and LNG will remain high and will even grow. This makes LNG development interesting for Suriname if volumes justify this. The investment capital and the long pay-back period will be a challenge.

- To-date, along with all the oil that has been discovered, a large volume of natural gas has also been found – both associated with the oil and non-associated.

- Our current estimates are that Suriname has potentially enough volume for an LNG plant.

- Staatsolie is currently undertaking studies to assess the commercialization options for this gas which includes the potential to export it to regional and international markets as LNG.

4. The involvement of the local population in the development of the country is a major focus for resource-rich economies. What will Suriname’s local content policy look like? Will there be any specific limitations that foreign investors should be aware of?

The Local Content strategy and policy is being drafted now by a multi-disciplinary work group. Taking in the lessons from other countries in, we are developing this through broad collaboration with representatives from the Government and the business society.

When doing so, the most important guideline will be that the policy should benefit Suriname and the people of Suriname in the long run. We are convinced that in this policy there will be plenty opportunities for foreign companies as well.

5. As countries increase their resource estimates, their tends to be more pressure to renegotiate existing and/or future production sharing agreements. Do you expect that to happen in Suriname?

Suriname is extremely proud of our track record in honoring our contracts, including the production sharing contracts. Based on our track record and being part of this Government, I do not expect that this will happen in Suriname

6. In Suriname and other frontier markets, local businesses struggle to access affordable capital, often having to pay high interest rates. How is the government planning on facilitating this process to encourage the creation of new local businesses?

A development banking institute exists in Suriname and needs to be strengthened. This will be part of the local content development strategy that the NOC is supporting the government with advice on.

7. What are the benefits and drawbacks of having a state oil company like Staatsolie in the development of the country’s energy sector?

As a country we are proud to have a national oil company like Staatsolie involved in the development of Suriname’s energy sector. Staatsolie has the experience, resources and focus to develop it. We see no drawbacks.

8. What does the Surinamese government plan to do to ensure that the local population benefits from this development?

- Review and adapt the current Sovereign Wealth and Stability Fund (Spaarfonds) legislation to existing reality and roll out executive orders.

- Strengthen all institutions to professionally oversee activities and collect revenues from this sector

- Develop local content

- Reinvest extra income in sustainable sectors

____________________

This interview was conducted on behalf of the SEOGS 2022 organising committee by Arthur Deakin, Co-Director of Energy, Americas Market Intelligence. To hear more from Arthur Deakin on how access to capital can transform frontier energy markets read his article here.