(CSI Compressco, 30.Jul.2021) — CSI Compressco LP (NASDAQ: CCLP) announced second quarter 2021 results.

Second Quarter 2021 Summary:

- Total revenues for the second quarter 2021 were $69.8mn, compared to $65.7mn in the first quarter 2021.

- Compression and related services revenue increased sequentially to $55.3mn in the second quarter 2021 compared to $54.2mn in the first quarter 2021.

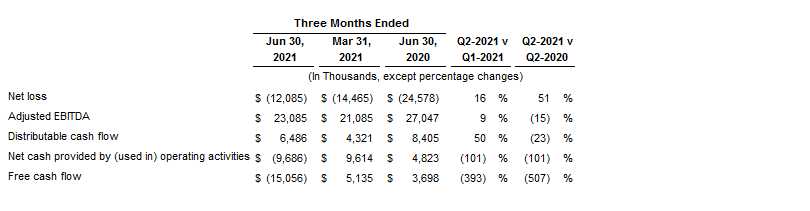

- Net loss was $12.1mn, including $0.7mn in non-recurring charges compared to a net loss of $14.5mn in the first quarter 2021 which included $0.4mn in non-recurring charges.

- Adjusted EBITDA was $23.1mn compared to $21.1mn in the first quarter 2021. The second quarter of 2021 Adjusted EBITDA included a $0.1mn benefit from the sale of used equipment compared to a $0.5mn benefit in the first quarter 2021.

- Distributable cash flow was $6.5mn compared to $4.3mn in the first quarter 2021.

- Distribution coverage ratio was 13.3x in the second quarter 2021 compared to 8.9x in the first quarter 2021.

- Second quarter of 2021 distribution of $0.01 per common unit will be paid on August 13, 2021.

Second Quarter 2021

“In the second quarter of 2021, we saw business activity starting to increase which is reflected in our results. Revenues, Adjusted EBITDA and fleet utilization all improved sequentially compared to the first quarter of 2021. We continue to see this trend improve in actual signed contracts for additional compression as well as additional forward looking quotes and activity. While we cannot predict with certainty the rest of the year’s performance, the trends continue to give us optimism that 2021 will improve as the year progresses. Our customers appear more confident in their projected activity for the rest of the year and are starting to execute around those plans. We have received a number of signed orders in the second quarter both in idle equipment going back to work and some orders for new large horsepower units. These contracted units will begin deploying in the third quarter and continue through the first quarter of 2022. The overall impact of this customer activity, if it continues, is that in the second half of 2021 both the contract compression business and the aftermarket services business should continue to see improving utilization and margins” commented John Jackson, Chief Executive Officer of CSI Compressco.

“We remain excited about the future of the Partnership and the industry overall. While the improving market trends exist, we recognize that risk around results may persist during 2021, but we are optimistic about both the near-term activity levels and long-term future of the compression industry. Capital efficiency, cost management and customer service are areas we continue to aggressively pursue as these are areas we can control. We expect to deliver the highest levels of service and performance to our customers as we have the people and assets in place that allow us to execute efficiently in any environment. We believe the natural gas business has a bright future and is a critical component of the energy infrastructure both today and in the transition in the energy markets in the years ahead.”

Cash used in operating activities was $(9.7)mn in the second quarter, compared to cash provided by operating activities of $9.6mn in the first quarter. Distributable cash flow in the second quarter was $6.5 million, resulting in a distribution coverage ratio of 13.3x.

This press release includes the following financial measures that are not presented in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”): Adjusted EBITDA, distributable cash flow, distribution coverage ratio, free cash flow, and net leverage ratio. Please see Schedules B-E for reconciliations of these non-GAAP financial measures to the most directly comparable U.S. GAAP measures.

Unaudited results of operations for the quarter ended 30 June 2021 compared to the prior quarter and the corresponding prior year quarter are presented in the table below.

TABL ….

As of 30 June, total compressor fleet horsepower was 1,181,485 and fleet horsepower in service was 908,614 for an overall fleet utilization rate of 76.9% (we define the overall service fleet utilization rate as the service compressor fleet horsepower in service divided by the total compressor fleet horsepower). Idle horsepower equipment under repair is not considered utilized, but we do count units on standby as utilized when the client is being billed a standby service rate.

Balance Sheet

Cash on hand at the end of the second quarter was $8.3mn. No amounts were drawn nor outstanding on the Partnership’s asset-based loan at the end of the second quarter. Our debt consists of $80.7mn of unsecured bonds due in August 2022, $400mn of first lien secured bonds due in 2025 and $159.9mn of second lien secured bonds due in 2026. Net leverage ratio at the end of the quarter was 6.5X.

Capital Expenditures – 2021 Expectations

We expect capital expenditures for 2021 to be between $45mn and $50mn. The forecast includes between $21mn and $23mn for capital growth. Maintenance capital expenditures are expected to be between $20mn and $22mn. Investments in the Helix digitally enhanced compression system and other technologies are expected to be between $4mn and $5mn.

Second Quarter 2021 Cash Distribution on Common Units

On 19 July the board of directors of our General Partner declared a cash distribution attributable to the quarter ended 30 June of $0.01 per outstanding common unit. This distribution equates to a distribution of $0.04 per outstanding common unit on an annualized basis. This distribution will be paid on 13 August to each of the holders of common units of record as of the close of business on 30 Jul. The distribution coverage ratio for the second quarter of 2021 was 13.3x.

Conference Call

CSI Compressco will host a conference call to discuss second quarter results today, 30 July, at 11:00 a.m. Eastern Time. The phone number for the call is 1-866-374-8397. The conference call will also be available by live audio webcast and may be accessed through CSI Compressco’s website at www.csicompressco.com. An audio replay of the conference call will be available at 1-877-344-7529, conference number 10158212, for one week following the conference call and the archived webcast will be available through CSI Compressco’s website for thirty days following the conference call.

____________________