(Ecuadorian Government, 28.Aug.2020) — The International Monetary Fund (IMF) announced today that it had reached a staff-level agreement on a new funded program for the Republic of Ecuador. Accordingly, the IMF Condition to settle the Republic’s Consent Solicitation and Invitation to Exchange has been satisfied.

The Republic announced that it is accepting all of the Eligible Bonds validly tendered pursuant to the Invitation, as reflected in the Republic’s communication of August 10, 2020. The settlement of the Invitation will occur on August 31, 2020. The Republic expects the GLC Opinion Condition to be satisfied on the Settlement Date. All other conditions for the consummation of the Invitation have been satisfied.

The terms and conditions of the Invitation are described in the invitation memorandum dated July 20, 2020. Capitalized terms used herein but not defined herein shall have the meanings ascribed thereto in the Invitation Memorandum.

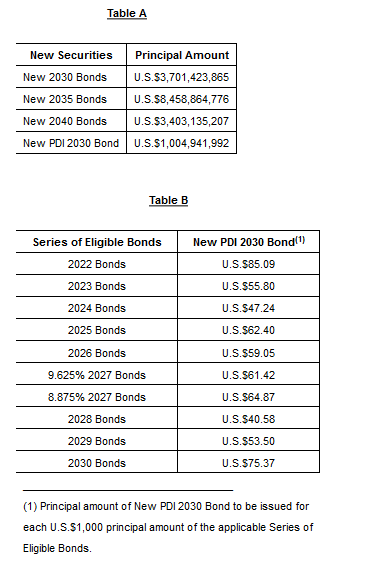

On the Settlement Date and upon the execution of the New Indenture pursuant to the Invitation to Exchange, the New Securities (including the New PDI 2030 Bond) will be issued in the principal amounts set forth in Table A below. All Eligible Holders who are entitled to receive New Securities will receive such New Securities by credit to the same account at the principal clearing system from which their Eligible Bonds were tendered. All Eligible Bonds exchanged pursuant to the Invitation to Exchange will be delivered to the Trustee for cancellation.

The principal amount of the New PDI 2030 Bond to be issued for each U.S.$1,000 principal amount of Eligible Bonds of the relevant series is set forth in Table B below. Only those Eligible Holders who validly delivered Consent and Tender Orders at or prior to the Consent Deadline, and whose Consent and Tender Orders were accepted by the Republic, will receive the New PDI 2030 Bond.

Separately, the final PDI Closing Payment (as defined in the Invitation Memorandum), which will be used to pay certain closing costs and expenses in connection with the Invitation, will be U.S.$1,060,000. For the avoidance of doubt, the PDI Closing Payment will not affect the principal amount of New PDI 2030 Bonds issued to Eligible Holders pursuant to the terms of the Invitation.

On the Settlement Date and upon the execution of the Supplemental Indentures for each series of Eligible Bonds pursuant to the Consent Solicitation, Eligible Bonds that were not validly tendered in the Invitation will be modified pursuant to the Proposed Modifications. Among other things, the Proposed Modifications will provide that each series of Eligible Bonds will be modified to replicate the maturity and economic terms of the New 2040 Bond, without changing the ISIN numbers of such Eligible Bonds and without re-issuing new Global Notes. In addition, the Proposed Modifications will include reducing the outstanding principal amount of the applicable Eligible Bond such that for every U.S.$1,000 principal amount originally due, only U.S.$911.30 principal amount will remain outstanding.

Eligible Holders, or custodians for such holders, of Eligible Bonds may obtain a copy of the Invitation Memorandum by contacting the Information, Tabulation and Exchange Agent at the contact information set forth below, or by download, following registration, via: https://gbsc-usa.com/ecuador.

This announcement is for informational purposes only and is not an invitation or a solicitation of consents of any holders of Eligible Bonds. The Consent Solicitation and Invitation to Exchange to Eligible Holders of Eligible Bonds was only made pursuant to the Invitation.

Ecuador did not register the Invitation, the Eligible Bonds or the New Securities under the Securities Act of 1933, or any state securities law. The Invitation was not made in the United States or to any U.S. persons except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act. The Invitation was only made to (A) “qualified institutional buyers” as defined in Rule 144A under the Securities Act, (B) “accredited investors” within the meaning of Rule 501(a)(1), (2), (3) or (7) of Regulation D under the Securities Act (“institutional accredited investors”) and (C) (x) persons outside the United States, (y) if located within a member state of the European Economic Area or in the United Kingdom, a “qualified investor” as defined in Regulation (EU) 1129/2017, and (z) if located outside the EEA or the UK, is eligible to receive this invitation under the laws of its jurisdiction. Only holders of Eligible Bonds who returned a duly completed eligibility letter certifying that they were within one of the categories described in the immediately preceding sentence were authorized to receive and review the Invitation Memorandum and to participate in the Invitation (“Eligible Holders”).

None of the DEALER MANAGER, the Trustee, the Information, Tabulation and Exchange Agent, the financial advisor nor any of their respective directors, employees, affiliates, agents or representatives made any recommendation as to whether Holders should deliver their consents or TENDER THEIR ELIGIBLE BONDS pursuant to thE INVITATION, and no one was authorized by any of them to make such a recommendation.

The Invitation Memorandum is available from the Information, Tabulation and Exchange Agent.

The Information, Tabulation and Exchange Agent for the Invitation is:

Global Bondholder Services Corporation

65 Broadway – Suite 404

New York, New York 10006

Attn: Corporate Actions

Banks and Brokers call: (212) 430-3774

Toll free (866)-470-3800

By facsimile:

(For Eligible Institutions only):

(212) 430-3775/3779

Confirmation:

(212) 430-3774

Email: contact@gbsc-usa.com

Any questions regarding the terms of the Invitation should be directed to the Dealer Manager or the Information, Tabulation and Exchange Agent at their respective addresses and telephone numbers set forth on this communication. Requests for additional copies of the Invitation Memorandum, the eligibility letter or any other related documents may be directed to the Information, Tabulation and Exchange Agent.

The Dealer Manager for the Invitation is:

Citigroup Global Markets Inc.

390 Greenwich St, 1st Floor

New York, NY 10013

Attention: Liability Management Group

U.S. Toll-free: +1-800-558-3745

Collect: +1-212-723-6106

Email: ny.liabilitymanagement@citi.com

The Republic of Ecuador

Ministry of Economy and Finance Av. Amazonas entre Pereira y Unión Nacional de Periodistas

Plataforma Gubernamental de Gestión Financiera, Pisos 10 y 11 Quito, Ecuador

(Financial Advisor to the Republic of Ecuador)

Lazard Frères

121 Boulevard Haussmann

75008, Paris

__________