(Bristow, 1.Nov.2023) — Bristow Group Inc. (NYSE: VTOL) reported net income attributable to the company of $4.3mn, or $0.15 per diluted share, for its quarter ended 30 Sep. 2023 on operating revenues of $330.3mn compared to net loss attributable to the company of $1.6mn, or $0.06 per diluted share, for the quarter ended 30 Jun. 2023 on operating revenues of $311.5mn.

Highlights

- Total revenues of $338.1mn in Q3 2023 compared to $319.4mn in Q2 2023

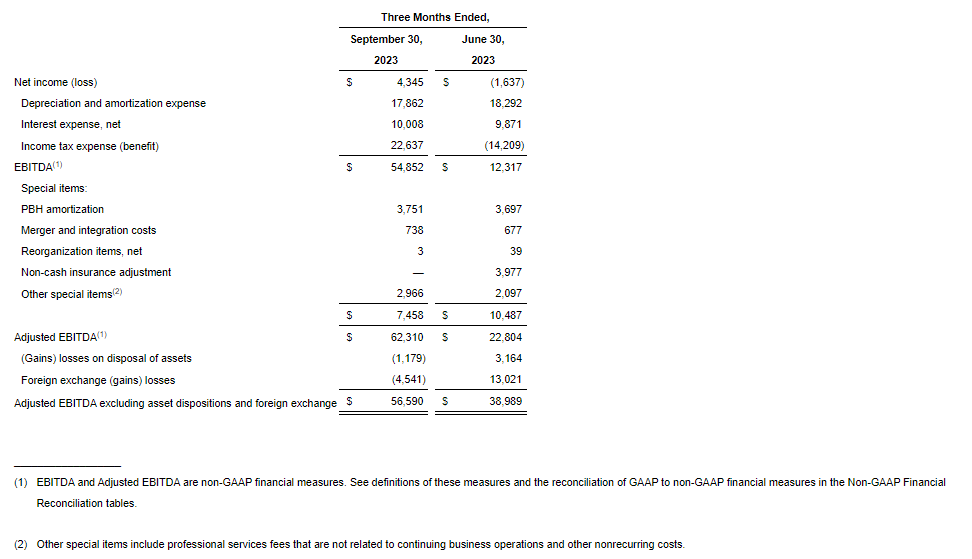

- Net income of $4.3mn, or $0.15 per diluted share, in Q3 2023 compared to net loss of $1.6mn, or $0.06 per diluted share, in Q2 2023

- EBITDA adjusted to exclude special items, asset dispositions and foreign exchange gains (losses) was $56.6mn in Q3 2023 compared to $39mn in Q2 2023(1)

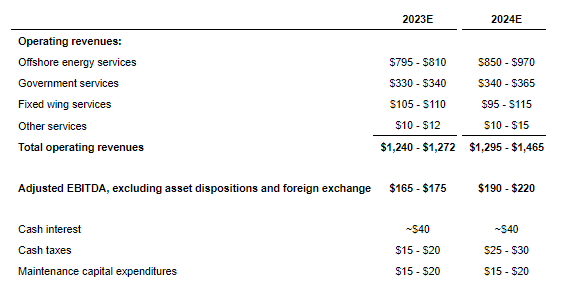

- Raised 2023 Adjusted EBITDA(1) outlook mid-point and reaffirmed 2024 financial outlook

Earnings before interest, taxes, depreciation and amortization (“EBITDA”) was $54.9mn in the current quarter compared to $12.3mn in the preceding quarter. EBITDA adjusted to exclude special items, gains or losses on asset dispositions and foreign exchange gains (losses) was $56.6mn in the current quarter compared to $39.0mn in the preceding quarter. The following table provides a reconciliation of net income (loss) to EBITDA, Adjusted EBITDA and Adjusted EBITDA excluding gains or losses on asset dispositions and foreign exchange gains (losses) (in thousands, unaudited). See “Non-GAAP Financial Measures” for further information on the use of non-GAAP financial measures used herein.

“Consistent with our outlook that the second half of 2023 would mark the positive inflection point for Bristow’s financial results, Q3 Adjusted EBITDA of $56.6mn represents a 45% sequential quarter improvement and supports our outlook for stronger financial results in 2024 and beyond,” said Chris Bradshaw, President and CEO of Bristow Group. “We are raising the company’s full-year 2023 Adjusted EBITDA guidance range to $165mn-$175mn. The fundamentals for Bristow’s business continue to strengthen, supporting our belief that we are in the early stages of a multi-year growth cycle. With the largest and most diverse aircraft fleet in the industry and the largest operational footprint, Bristow is well-positioned to benefit from opportunities in this upcycle.”

Sequential Quarter Results

Operating revenues in the current quarter were $18.7mn higher compared to the preceding quarter. Operating revenues from offshore energy services were $17.8mn higher primarily due to higher utilization in each geographic region and higher lease payments received from Cougar Helicopters Inc. Operating revenues from government services were $1.8mn lower in the current quarter primarily due to the transition from an interim contract to the tendered contract for the Dutch Caribbean Coast Guard, partially offset by higher utilization and the strengthening of the British pound sterling (“GBP”) relative to the U.S. dollar. Operating revenues from fixed wing services were $2.7mn higher in the current quarter primarily due to higher utilization.

Operating expenses were consistent with the preceding quarter. Personnel and fuel costs were higher in the current quarter, offset by lower insurance costs, repairs and maintenance and other operating costs.

General and administrative expenses were $1.6mn higher primarily due to higher professional services fees.

During the current quarter, the company sold or otherwise disposed of two helicopters and other assets, resulting in a net gain of $1.2mn. During the preceding quarter, the company sold or otherwise disposed of three helicopters and other assets, resulting in a net loss of $3.2mn.

Earnings from unconsolidated affiliates were $2.4mn higher in the current quarter primarily due to higher earnings at Cougar.

Other income, net of $4.8mn in the current quarter primarily resulted from foreign exchange gains of $4.5mn. Other expense, net of $13mn in the preceding quarter primarily resulted from foreign exchange losses of $13mn, of which $7.6mn was due to the significant devaluation in the Nigerian Naira.

Income tax expense was $22.6mn in the current quarter compared to an income tax benefit of $14.2mn in the preceding quarter primarily due to increased earnings during the current quarter, the earnings mix of the company’s global operations and changes to deferred tax valuation allowances.

Liquidity and Capital Allocation

As of 30 Sep. 2023, the company had $207.5mn of unrestricted cash and $66.8mn of remaining availability under its amended asset-based revolving credit facility (the “ABL Facility”) for total liquidity of $274.4mn. Borrowings under the amended ABL Facility are subject to certain conditions and requirements.

In the current quarter, purchases of property and equipment were $18.4mn, of which $4.7mn were maintenance capital expenditures, and cash proceeds from dispositions of property and equipment were $7.3mn. In the preceding quarter, purchases of property and equipment were $12.2mn, of which $2.5mn were maintenance capital expenditures, and cash proceeds from dispositions of property and equipment were $3.3mn. See Adjusted Free Cash Flow Reconciliation for a reconciliation of Adjusted Free Cash Flow.

Increased 2023 Outlook and Affirmed 2024 Outlook

Please refer to the paragraph entitled “Forward Looking Statements Disclosure” below for further discussion regarding the risks and uncertainties as well as other important information regarding Bristow’s guidance. The following guidance also contains the non-GAAP financial measure of Adjusted EBITDA. Please read the section entitled “Non-GAAP Financial Measures” for further information.

Select financial targets for the calendar years 2023 and 2024 are as follows (in USD, mns):

Conference Call

Management will conduct a conference call starting at 10:00 a.m. ET (9:00 a.m. CT) on Thursday, 2 Nov. 2023, to review the results for the third quarter ended 30 Sep. 2023. The conference call can be accessed using the following link:

Link to Access Earnings Call: https://www.veracast.com/webcasts/bristow/webcasts/VTOL3Q23.cfm

Replay

A replay will be available through 23 Nov. 2023 by using the link above. A replay will also be available on the company’s website at www.bristowgroup.com shortly after the call and will be accessible through 23 Nov. 2023. The accompanying investor presentation will be available on 2 Nov. 2023, on Bristow’s website at www.bristowgroup.com.

For additional information concerning Bristow, contact Jennifer Whalen at InvestorRelations@bristowgroup.com, (713) 369-4636 or visit Bristow Group’s website at https://ir.bristowgroup.com/.

____________________