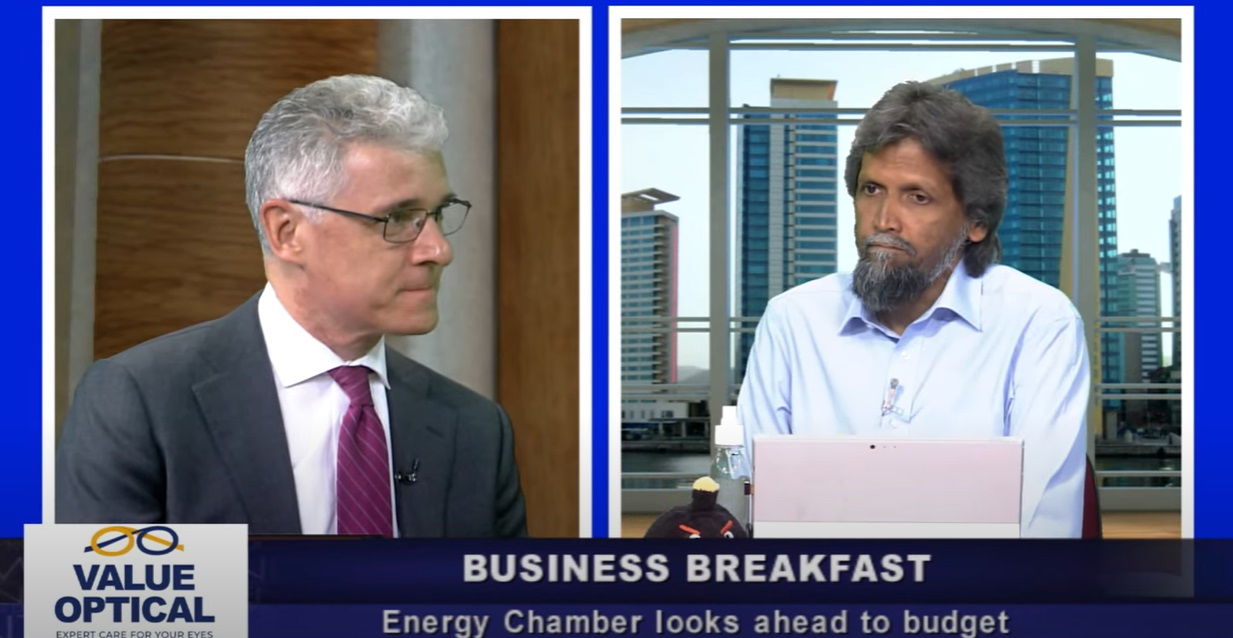

(Energy Analytics Institute, 20.Sep.2022) — The Energy Chamber of Trinidad and Tobago head Dr. Thackery “Dax” Driver spoke 20 September 2022 on Trinidad’s TV6 Morning Edition about the upcoming national budget, and the urgent need for action on Trinidad’s fiscal terms to attract much needed investment to our energy industry.

What follows is a rough transcript of his discussion with TV6’s Fazeer Mohammed:

FAZEER MOHAMMED: Seven days away from the budget presentation… what’s your perspective?

DRIVER: So, you know, we at the Energy Chamber tend to concentrate quite narrowly on what’s happening in the energy sector. That doesn’t mean that we don’t see all the other parts of the economy as being important, and diversification as being important but we concentrate quite heavily on the energy sector. For the budget what you really look at are things around how the government is going to spend the money and then how the government’s going to collect its taxes. So, our interest is particularly around the tax system and making sure that we have a tax system, so it’s what we call the fiscal regime, so it’s the taxes and the royalties, how that’s going to encourage investment into our energy sector because that’s the key thing that we need. And as the Prime Minister [Keith Rowley] was talking as he came back from these visits to BP, Shell and Proman… he’s talking about we need this investment if we are going to have a future for our oil and gas industry and also then to the wider greening of those industries, the decarbonization of the industry. So, what we’re really looking for is: what are the measures that are going to be put in place, the taxation measures that will encourage the investment into the energy sector? Because, that’s what we need.

MOHAMMED: There should have been proposals to the government based on what might be anticipated in the budget presentation. Are you satisfied that we’re heading in the right direction in that regard?

DRIVER: I think we’re satisfied that there’s an understanding of what the issues are and what’s needed to be changed but what we need to see now is action to make those changes. So, we’ve had a lot of announcements in the past about your intentions for action. Those things have to be carried through. We have to see those come to fruition and to actually see those changes being made. So, in the budget last year, the Minister of Finance announced that there was going to be an in-depth review of energy sector taxation with changes to be made. We were told that was going to happen by the end of the first quarter of 2022. It hasn’t happened yet. We know that they know the issues, but we need to see the action being taken there.

MOHAMMED: Just give us your sense of the environment that we’re in right now, because as you mentioned, the Prime Minister made those visits to some key energy partners for us here in Trinidad and Tobago. We know what is happening globally because of the Russian invasion of Ukraine. Gas prices are up. A lot of a lot of things are up. Are you willing to even forecast where this thing is heading?

DRIVER: Well, I don’t get involved in forecasting oil and gas prices. I think all you can do is forecast as know one really knows what to expect. Expect the unexpected. We’re in a situation now where you have these extremely high gas prices in some of the key markets in Europe in particular, also in Asia, high in North America, but not nearly as high as they are in Asia and in Europe in particular. And that wasn’t really predicted. People did see prices going up because there’s sort of a period of under-investment during the pandemic. But obviously, the big change there was the change with Russian gas. So, that has really sort of changed the geopolitics of that. But those things can change back again and they can change in different ways. And an investment will be going in so the expectation is that prices will vary and we need to plan for the potential the prices will go down in the future.

MOHAMMED: Given that you were here expecting to hear something by the end of the first quarter and that didn’t happen, would you like to get some detail from the budget presentation come next Monday afternoon as to whether or not they will revisit the issues, whether it’s taxation, pricing or whatever it might be?

DRIVER: Certainly, that’s exactly what I think the industry is sort of really hoping to see is actual concrete proposals being made. There’s a bid round in execution at the moment, so there is a process of asking for companies to bid on onshore acreage and some very shallow water acreage in the Gulf of Paria. There is an intention to go for companies to bid for shallow water off the East Coast and some off the north coast. Next year there’s an intention to go for a deep water bid round if we want those things to be successful and you want to see a large number of international companies putting forward bids for that acreage, because the more companies that put forward bids, the better off you get as a as a country. We need to have the fiscal regime in place, which is going to attract that investment. So this is an urgent for the country that we get this done.

MOHAMMED: Does that suggest that right now a lot of the big players are waiting and watching?

DRIVER: Yes, that’s what’s happening. I think that a lot of times people are weighing their investment decisions. Remember these international companies have their entire world to look at. So, they’re looking… where do they get the best investment yet to be made? And it’s important to recognize that they’re not saying that based on today’s oil price and today’s gas price, they are saying will that investment make sense over a 20 year lifespan with the likelihood the prices will go down at some stage in the future. So, they will run the economics, not on $90 oil, they’ll run it on $40 or $50 oil. The system we have in place needs to make sense. There are various price points. What we have in the moment in Trinidad’s fiscal system, particularly for oil, gas… there are some different issues around royalties but for oil, we have this particular problem with something called the supplemental petroleum tax (SBT), and the way it kicks in when oil prices hit $50 for most producers. That means that anybody running the economics of $50, they are losing money and people are not going to sign capital to invest in Trinidad if they’re going to be losing money at $50, because that’s a price which you might well see again in the future.

MOHAMMED: We see a lot of instability in Central Asia as well and I’m sure you’re following what is happening. It seems as if what Russia has done has awakened concerns in Azerbaijan and Kazakhstan and quite a few of those areas. I mean, it’s not something I suppose you want to put your house on, but is there the feeling there might be greater instability in Central Asia that could keep energy prices up?

DRIVER: Predicting those geopolitical changes and prices is very, very difficult. You know, no one predicted a pandemic. We had negative oil prices just over two years ago. So you’re making bets on that, companies are not gambling here. They will base their projections on what is seen in the past and what likely sort of oil prices might exist and they will make their investment decisions based on that. And they have opportunities around the entire globe to look at where the best opportunities are and they will place their capital where the best opportunity is for them to get a secure return on their capital. That’s just the reality of the industry that we’re in and I think this was clearly recognized with the Prime Minister when he came back recently from his trips from Europe. And, you know, he was very clear that if we don’t change things, we are going to see Trinidad’s production continue to fall and then the country has a really serious problem.

MOHAMMED: I suppose the question always from the ordinary citizen is are we really getting value for whatever we produce? Because I think the public fully understands that we are not a big player in this. We are price takers in many ways. But is it that we are being called upon to give up too much for those big investors to stay here?

DRIVER: The oil and gas in the ground has zero value until it’s produced. So, you have to attract the capital, which is, you know, billions of US dollars worth of capital to produce that oil and gas. If you’re going to monetize it and have any revenue coming to the country, leaving oil and gas in the ground and in a world which is moving towards net zero carbon emissions makes no sense from an economic planning point of view. We are in a situation where the window for oil production in particular is narrowing. There is plenty of oil in the ground in the world. The problem isn’t producing the oil which is in the ground, the problem is that people are trying to produce that quickly because the world will go on producing oil, but the last producers are going to be the most cost effective producers where people can continue to make money even at a low oil price because demand for oil is going to start decreasing over the next few years. Electric car sales are doubling and that’s the major consumer of oil… is for transport. When you have anything where it’s doubling sales in a year, that trend seems slow at first because it’s going from 1% to 2%, then it goes from 2% to 4%, then 4% to 8% and then 16% and then 32%. And suddenly people are buying only electric cars and no gasoline cars being bought anymore and that means that global demand will fall so that the window for producing oil is narrowing. Every year it’s narrowing and we need to we need to say, if we’ve got this resource which we want to sell to the world we’ve got to start to produce it as quickly as we possibly can. Every year we waste is potential that we’re going to have oil left, which will have no market in the future.

MOHAMMED: Have we lost too much ground, though?

DRIVER: Yeah, we have lost too much time. We need to accelerate… we’re behind where we should be and we need to accelerate fast.

MOHAMMED: So, again framing our discussion in relation to the budget, apart from those taxation and royalty issues that are clearly tricky to keep those big players here. Is there anything that you would like to hear in the budget presentation that would suggest that there’s a real interest now in really getting on with the game that we are already falling behind?

DRIVER: The first thing is the realization we need to change the structure of taxation. If we hear that then I think people will then say, okay, look, this has really been thought about seriously. Second part of that then is that what are the measures which are going to be put in place to help us decarbonize our industry? We have a great opportunity in that petrochemical industry to bring in other ways of producing hydrogen, which is the basic feedstock which we get from the natural gas. And the natural gas is used to produce hydrogen, which then goes into our ammonia and our methanol production. You can also produce hydrogen from other sources, particularly from water, and you can do that using green electricity from solar or from other low carbon forms of electricity that can give a future to our petrochemical sector as well. So it would be also good to hear those elements around how we’re going to green and decarbonize our existing industry. We have a great opportunity with the industry that we have. That puts us a little bit ahead of other people, the fact we have this big industry, but if you don’t decarbonize it, you will lose your market. There is going to be what they call a carbon tax, border taxes. So this means the amount of tax that you have to pay to take products, petrochemicals into some of the key markets, particularly into Europe, this is what’s going to happen first, will depend on the carbon footprint of what you produce. If you cannot reduce the carbon footprint of what you’re producing, then you wouldn’t be able to sell that. So, I would also like to hear some announcements around the intentions in that area. We have a big solar project which was announced two years ago, which has not begun construction yet. It’d be great to get some details like the ground will be turned to begin construction on this date. It’d be lovely to hear that is working and that’ll give people some confidence because this thing was announced two years ago and there have been ongoing discussions to finalize the final agreements. We say the construction is supposed to be beginning this year, but until the final agreements is signed to be good to see that because that would give people a bit of confidence. You’ve got the first big solar project happening and then you know what’s going to happen with future solar projects and how are we going to bring wind power into the mix as well. So, those are the sort of things I’ll be listening out for as well.

MOHAMMED: There seems to be a significant implementation deficit in Trinidad and Tobago, and that is no secret. In fact, I thought the solar energy thing you were talking about was the one that the EU supported and was announced just a couple of months ago?

DRIVER: No, that’s the one for Piarco. Good that’s happening. But it’s tiny compared to the one which is supposed to happen. The one which has been was announced two years ago is a major project would be by far the biggest solar PV project in the entire Caribbean, delivering electricity at the lowest cost for any renewable energy project in the Caribbean we’ve had so far. So, it’s a major project. That was announced over two years ago. There’s been negotiations’ going on for more than two years now. They’re very, very close to the final agreement, but it’s not actually signed up yet. And the construction has not yet begun.

MOHAMMED: Is the window can be closing because we have to think of those renewables. But do we have the window as far as the increase in revenues since the Russian invasion that would accommodate we’re thinking about wind farms on the Atlantic coast and those sorts of things, are they pie in the sky?

DRIVER: Those things are not pie the sky they’re very achievable. Yeah, a big study has been done recently by National Energy on the use of wind. It’s a sort of a scoping study on the use of wind to generate electricity to put that into producing green hydrogen, which can go into the ammonia sector, which then gives us longevity in petrochemicals. So, those things are all very feasible, but you’ve got to make them happen. You know, things can be feasible when you sort of look. A piece of paper and you say, okay, look, you work it out, work out the numbers, the numbers make sense, the economics of that. But until you actually then go and do the detailed study of wind and then you approve wind farms coming forward, then, you know, it is just scoping and we need to get that action. So, I think that’s what the focus which we were looking for is, the talk is great, but you got to follow the talk up with action. And that’s what really I think everyone is looking for in this budget.

MOHAMMED: In summation in a few seconds, if you can, talking about all with the budget presentation, that’s going to be next Monday afternoon, just to repeat, what bit of information would you like to hear that would give you confidence that we are moving in the right direction?

DRIVER: The bit of information which will give me confidence is a clear announcement from the Minister of Finance that oil and gas tax will be changed with the reforms which have been talked about will be implemented by the end of this year so that as we go into next year those will actually be in place in law, not talked about as an idea, but actually implemented.

____________________

By Aaron Simonsky. © Energy Analytics Institute (EAI). All Rights Reserved.