(Petrobras, 19.Mar.2019) — Petrobras announced the expiration and expiration date results of the previously announced offer to purchase (the “Offer”) by its wholly-owned subsidiary Petrobras Global Finance B.V. (“PGF”), of any and all of its outstanding notes set forth in the table below (the “Notes”).

The Offer was made pursuant to the terms and conditions set forth in the offer to purchase dated March 12, 2019 (the “Offer to Purchase” and, together with the accompanying notice of guaranteed delivery and related letter of transmittal, the “Offer Documents”).

The Offer expired at 5:00 p.m., New York City time, on March 18, 2019 (the “Expiration Date”). The settlement date with respect to the Offer will occur promptly following the Expiration Date and is expected to occur on March 21, 2019 (the “Settlement Date”).

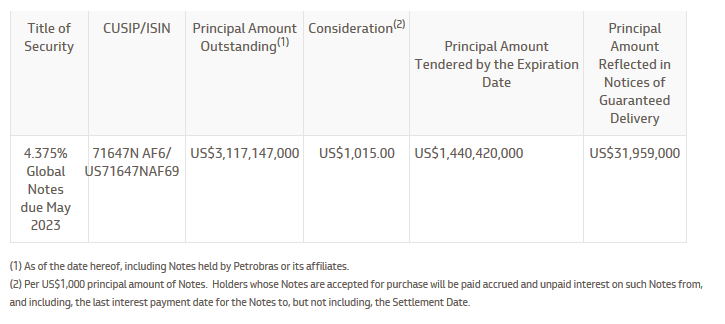

The table below sets forth the aggregate principal amount of Notes validly tendered in the Offer and not validly withdrawn, and the aggregate principal amount of Notes reflected in notices of guaranteed delivery delivered, at or prior to the Expiration Date and the consideration payable for Notes accepted for purchase in the Offer.

In order to be eligible to participate in the Offer, holders of Notes reflected in notices of guaranteed delivery received by PGF prior to the Expiration Date must deliver such Notes to PGF by 5:00 p.m., New York City time, on March 20, 2019 (the “Guaranteed Delivery Date”).

On the terms and subject to the conditions set forth in the Offer to Purchase, PGF expects that it will accept for purchase all of the Notes tendered on or prior to the Expiration Date, and all of the Notes delivered on or prior to the Guaranteed Delivery Date. The principal amount of Notes that will be purchased by PGF on the Settlement Date is subject to change based on deliveries of Notes pursuant to the guaranteed delivery procedures described in the Offer to Purchase. A press release announcing the final results of the Offer is expected to be issued on or promptly after the Settlement Date.

PGF engaged BNP Paribas Securities Corp., Banco Bradesco BBI S.A., Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, HSBC Securities (USA) Inc., and Santander Investment Securities Inc. to act as lead dealer managers with respect to the Offer, and ABN AMRO Securities (USA) LLC, BBVA Securities Inc. and Commerz Markets LLC to act as co-dealer managers with respect to the Offer. Global Bondholder Services Corporation acted as the depositary and information agent for the Offer.

Any questions or requests for assistance regarding the Offer may be directed to BNP Paribas Securities Corp. at + 1 212 841-3059, Banco Bradesco BBI S.A. at +1-646-432-6643, Citigroup Global Markets Inc. (toll free ) at +1 (800) 558-3745 and (collect) at +1(212) 723-6106, Goldman Sachs & Co. LLC at +1 (212) 902-6351 or +1 (800) 828-3182, HSBC Securities (USA) Inc. at +1 (212) 525-5552 and Santander Investment Securities Inc. (toll-free) at +1 (855) 404-3636 or +1 (212) 940-1442. Requests for additional copies of the Offer to Purchase may be directed to Global Bondholder Services Corporation at +1 (866) 470-3800 (toll-free) or +1 (212) 430-3774. The Offer Documents can be accessed at the following link: http://www.gbsc-usa.com/Petrobras

***