(Ecopetrol, 16.Jan.2024) — Ecopetrol S.A. (NYSE: EC) announced the tender offer consideration (the “Total Consideration”) payable in connection with the previously announced cash tender offer (the “Offer”) by Ecopetrol, which commenced on 9 Jan. 2024, to purchase any and all of its outstanding 4.125% Notes due 2025 (the “Securities”), upon the terms and subject to the conditions set forth in Ecopetrol’s Offer to Purchase, dated 9 Jan. 2024 (as the same may be amended or supplemented from time to time, the “Offer to Purchase”) and in the related Notice of Guaranteed Delivery (as it may be amended or supplemented from time to time, the “Notice of Guaranteed Delivery”), the terms and conditions of which remain unchanged. Capitalized terms used but not defined herein shall have the meanings given to such terms in the Offer to Purchase.

The Offer will expire today, 16 Jan. 2024, at 5:00 p.m., New York City time, unless extended (such date and time, as it may be extended, the “Expiration Time”). The Offer to Purchase contains detailed information regarding the manner in which the Total Consideration was calculated.

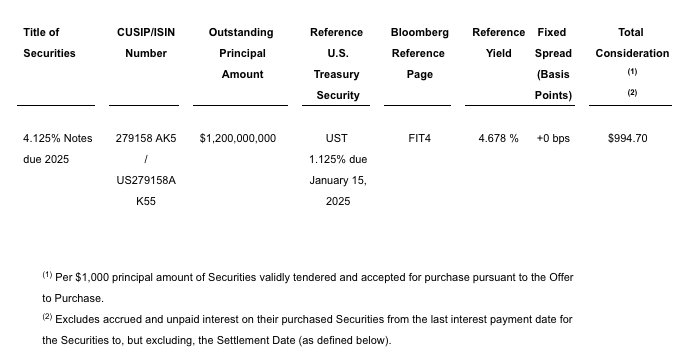

The following table sets forth the Total Consideration for the Securities. The Fixed Spread over the Reference Yield listed in the table below is based on the bid-side price of the Reference U.S. Treasury, as calculated by the Dealer Managers (as defined below) at 10:00 a.m., New York City time, today, as described in the Offer to Purchase.

In addition to the Total Consideration, holders whose Securities are accepted for purchase pursuant to the Offer, including Securities tendered by guaranteed delivery, will also receive accrued and unpaid interest on their purchased Securities from the last interest payment date for the Securities to, but excluding, the Settlement Date.

Upon the terms and subject to the conditions of the Offer, the settlement date is expected to be January 19, 2024 (the “Settlement Date”). On the Settlement Date, Ecopetrol expects to accept for payment and pay the Total Consideration for Securities validly tendered and not validly withdrawn at or prior to the Expiration Time or delivered by guaranteed delivery prior to 5:00 p.m., New York City time, on 18 Jan. 2024.

Tenders of Securities pursuant to the Offer may be validly withdrawn at or prior to the Expiration Time. If the Offer is extended, tendered Securities may be withdrawn at any time before the 10th business day after commencement of the Offer. Securities subject to the Offer may also be validly withdrawn at any time after the 60th business day after commencement of the Offer if for any reason the Offer has not been consummated within 60 business days after commencement.

The Offer is conditioned upon the satisfaction or waiver by Ecopetrol of certain conditions described in the Offer to Purchase, including the Financing Condition (as defined below), but is not conditioned upon any minimum principal amount of Securities being tendered. Subject to applicable law, Ecopetrol may, at its sole discretion, waive any condition applicable to the Offer and may extend the Offer. Under certain conditions and as more fully described in the Offer to Purchase, Ecopetrol may terminate the Offer before the Expiration Time.

The Offer is being made in connection with a concurrent offering of notes (the “New Notes”) by the Company (the “Notes Offering”). The “Financing Condition” means that the Company shall have priced and closed the Notes Offering on terms satisfactory to the Company and resulting in net cash proceeds sufficient to fund the Total Consideration with respect to the Securities validly tendered at or prior to the Expiration Time (regardless of actual amount of Securities tendered), plus accrued and unpaid interest on the purchased Securities from the last interest payment date to, but excluding, the Settlement Date. The Offer is not an offer to sell or a solicitation of an offer to buy the New Notes.

The complete terms and conditions of the Offer are set forth in the Offer to Purchase and in the related Notice of Guaranteed Delivery, which holders are urged to read carefully before making any decision with respect to the Offer.

The Offer is open to all registered holders of Securities. A beneficial owner of Securities that are held of record by a broker, dealer, commercial bank, trust company, or other nominee (each, a “Custodian”) must instruct such Custodian to tender such Securities on the beneficial owner’s behalf in a timely manner. Beneficial owners should be aware that a Custodian may establish its own earlier deadline for participation in an Offer.

Global Bondholder Services Corporation is serving as the tender agent and information agent. Requests for documents may be directed to Global Bondholder Services Corporation by telephone at +1 212-430 3774 (banks and brokers) or Toll-Free at +1 855-654-2014.

Copies of the Offer to Purchase and related Notice of Guaranteed Delivery are available at the following web address: at https://gbsc-usa.com/ecopetrol/.

BBVA Securities Inc., BofA Securities, Inc. and Citigroup Global Markets, Inc. are serving as Dealer Managers (the “Dealer Managers”) for the Offer. Questions regarding the Offer may also be directed to the Dealer Managers as set forth below:

This press release is for informational purposes only and does not constitute an offer to purchase nor the solicitation of an offer to sell any Securities. The Offer is being made only pursuant to the Offer to Purchase and related Notice of Guaranteed Delivery.

No Recommendation

None of Ecopetrol, BBVA Securities Inc., BofA Securities, Inc., Citigroup Global Markets, Inc., Global Bondholder Services Corporation, or the trustee or security registrar with respect to the Securities, nor any affiliate of any of the foregoing, has made any recommendation as to whether holders should tender or refrain from tendering all or any portion of their Securities in response to the Offer or expressing any opinion as to whether the terms of the Offer are fair to any holder. Holders must make their own decision as to whether to tender any of their Securities and, if so, the purchase price of Securities to tender. Please refer to the Offer to Purchase for a description of the offer terms, conditions, disclaimers and other information applicable to the Offer.

____________________