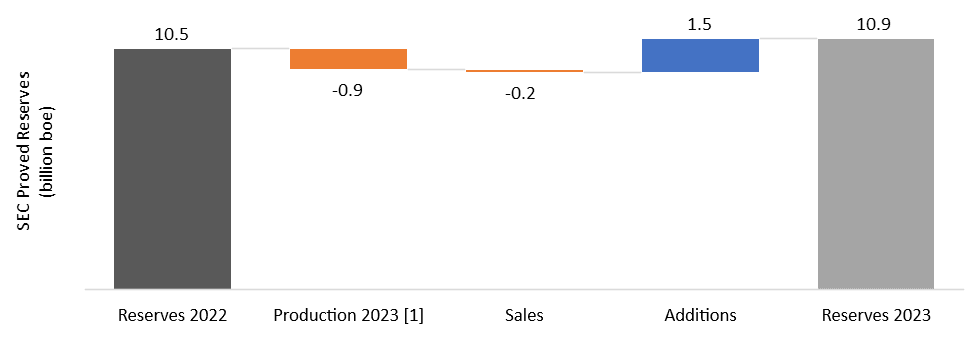

(Petrobras, 26.Jan.2024) — Petrobras discloses its proved reserves of oil, condensate, and natural gas, according to SEC (US Securities and Exchange Commission) regulation, estimated at 10.9 billion barrels of oil equivalent (boe), as of 31 Dec. 2023. Oil and condensate, and natural gas correspond to 84% and 16% of this total, respectively.

In 2023, Petrobras maintained its trajectory of reserves addition (1.5 billion boe), with focus on profitable assets and aligned to our search for a just energy transition. The organic reserve replacement index (IRRorg), that is, disregarding sales effects, reached 168% of this year’s production, turning the last three-year period IRRorg the highest in the company’s history, amounting to 207%.

This reserves addition occurred mainly due to the good performance of our assets, with emphasis on the Búzios, Tupi and Atapu fields, in Santos Basin, and the declaration of commerciality of Raia Manta and Raia Pintada fields (non-operated), in Campos Basin. We did not have relevant changes related to the variation in the oil price. The evolution of proved reserves is shown in the graph below.

[1] Does not consider: (a) natural gas liquids, since the reserve is estimated at a reference point prior to gas processing, except in the United States and Argentina; (b) volumes of injected gas; (c) production from extended well tests in exploration blocks; and (d) production in Bolivia, since the Bolivian Constitution does not allow the registration of reserves by the company.

The ratio between proved reserves and production (R/P ratio) remained in 12.2 years.

Considering the expected production for the coming years, it is essential to continue investing in maximizing the recovery factor and mainly in exploration of new frontiers, to replace oil and gas reserves.

Petrobras historically submits at least 90% of its proved reserves according to SEC definition to independent evaluation. Currently, this evaluation is conducted by DeGolyer and MacNaughton (D&M).

Petrobras also estimates reserves according to the ANP/SPE (National Agency of Petroleum, Natural Gas and Biofuels / Society of Petroleum Engineers) definitions. As of 31 Dec., the proved reserves according to these definitions reached 11.1 billion barrels of oil equivalent (boe). The differences between the reserves estimated by ANP/SPE definitions and those estimated using SEC regulation are mainly due to different economic assumptions and the possibility of considering as reserves the volumes expected to be produced beyond the concession contract expiration date in fields in Brazil according to ANP reserves regulation.

____________________