(RPC, 25.Jan.2024) — RPC, Inc. (NYSE: RES) announced its unaudited results for the fourth quarter and full year ended 31 Dec. 2023.

* Non-GAAP and adjusted measures, including adjusted operating income, adjusted net income, adjusted earnings per share (diluted), EBITDA and adjusted EBITDA, adjusted EBITDA margin, and free cash flow are reconciled to the most comparable GAAP measures in the appendices of this earnings release.

* Sequential comparisons are versus 3Q:23. The company believes quarterly sequential comparisons are most useful in assessing industry trends and RPC’s recent financial results. Both sequential and year-over-year comparisons are available in the tables at the end of this earnings release.

Fourth Quarter 2023 Highlights

- Revenues increased 19% sequentially to $394.5mn

- Net income was $40.3mn, up 120% sequentially, and diluted earnings per share (EPS) was $0.19; net income margin increased 470 basis points sequentially to 10.2%

- Adjusted EBITDA was $79.5mn, up 53% sequentially; Adjusted EBITDA margin increased 440 basis points sequentially to 20.1%

- The strong sequential improvement in revenues and profitability resulted from significantly higher pressure pumping fleet utilization compared to the third quarter of 2023

Full Year 2023 Highlights

- Revenues increased 1% year-over-year to $1.6bn

- Net income was $195.1mn and diluted EPS was $0.90; net income margin was 12.1%

- Adjusted EBITDA was $374.4mn, with Adjusted EBITDA margin of 23.1%

- Net cash flow from operating activities was $394.8mn and free cash flow was $213.8mn

- The company remained debt-free, paid $34.6mn in dividends and repurchased $21.1mn of common stock in 2023 (including $8.6mn of buyback program repurchases during 4Q:23)

- The company acquired the Spinnaker cementing business effective 1 Jul., expanding RPC’s existing cementing operations and customer relationships

Management Commentary

“We closed out 2023 with a strong sequential improvement in fourth quarter financial results,” stated Ben M. Palmer, RPC’s President and Chief Executive Officer. “As anticipated, the fourth quarter began with a solid increase in pressure pumping activity. However, as oil prices fell toward the end of the year, customer demand followed suit and we experienced a more significant holiday season slowdown than originally expected. Looking forward, we have a new Tier 4 dual-fuel fleet on order and anticipate placing it in service by the end of the second quarter of 2024, replacing a Tier 2 diesel fleet as we upgrade our asset base without adding to pressure pumping industry capacity.

“We have over $220mn in cash on the balance sheet, are highly liquid, debt-free, and capable of navigating an uncertain environment. This solid financial position also supports targeted organic investments, as well as continued capital returns to our shareholders through both dividends and opportunistic share buybacks. With the Spinnaker integration essentially complete, we are actively assessing additional acquisition opportunities to bolster selected service lines, increase our scale, and enhance our growth outlook,” concluded Palmer.

| Selected Industry Data | ||||||||||||||||||||

| 4Q:23 | 3Q:23 | Change | % Change | 4Q:22 | Change | % Change | ||||||||||||||

| U.S. rig count (avg) | 622 | 649 | (27) | (4.2) | % | 776 | (154) | (19.8) | % | |||||||||||

| Oil price ($/barrel) | $ | 78.52 | $ | 82.17 | $ | (3.65) | (4.4) | % | $ | 82.67 | $ | (4.15) | (5.0) | % | ||||||

| Natural gas ($/Mcf) | $ | 2.74 | $ | 2.59 | $ | 0.15 | 5.8 | % | $ | 5.55 | $ | (2.81) | (50.6) | % |

4Q:23 Consolidated Financial Results (Sequential Comparisons versus 3Q:23)

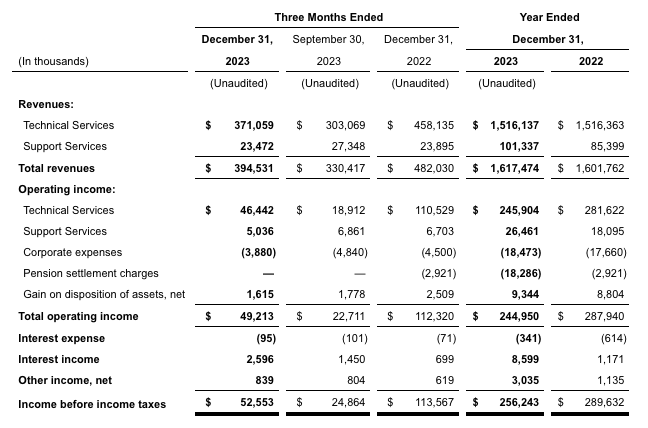

Revenues were $394.5mn, up 19%. Revenues increased primarily due to a significant rebound in pressure pumping activity compared to 3Q:23. However, growth was constrained by lower-than-expected activity during the December holiday season, which may have been influenced by declining oil prices throughout the quarter.

Cost of revenues, which excludes depreciation and amortization, was $279.4mn, up from $239.1mn. These costs increased as a function of revenue growth during the quarter.

Selling, general and administrative expenses were $38.1mn, down from $42mn. The decrease in expenses is due in part to a reduction in incentive compensation and other cost control measures.

Gain on disposition of assets was $1.6mn, reflecting asset sales through the company’s normal course of operations.

Interest income totaled $2.6mn, reflecting higher cash balances.

Income tax provision was $12.3mn, or 23.4% of income before income taxes.

Net income and diluted EPS were $40.3mn and $0.19, respectively, up from $18.3mn and $0.08, respectively, in 3Q:23. Net income margin increased 470 basis points sequentially to 10.2%.

Adjusted EBITDA (adjusted earnings before interest, taxes, depreciation, and amortization) was $79.5mn, up from $51.9mn; adjusted EBITDA margin increased 440 basis points sequentially to 20.1%.

Non-GAAP adjustments: there were no adjustments to GAAP performance measures in 4Q:23, other than those necessary to calculate EBITDA. However, in the first and second quarters of 2023, the company reported pension settlement charges totaling $18.3mn, or $0.07 of diluted EPS, which were excluded when calculating adjusted financial measures (see Appendices A, B and C).

Balance Sheet, Cash Flow and Capital Allocation

Cash and cash equivalents were $223.3mn at the end of 2023, with no outstanding borrowings under the Company’s $100mn revolving credit facility.

Net cash provided by operating activities and free cash flow were $394.8mn and $213.8mn, respectively, for the full year 2023.

Payment of dividends totaled $34.6mn in 2023. The Board of Directors declared a regular quarterly cash dividend of $0.04 per share, payable 11 Mar. 2024, to common stockholders of record at the close of business on 9 Feb. 2024.

Share repurchases totaled $21.1mn in 2023. Buybacks under the company’s share repurchase program totaled $8.6mn during 4Q:23 (1,200,000 shares) and $18.7mn (2,469,056 shares) for the full year.

Segment Operations: Sequential Comparisons (versus 3Q:23)

Technical Services performs value-added completion, production and maintenance services directly to a customer’s well. These services include pressure pumping, downhole tools and services, coiled tubing, cementing, and other offerings.

- Revenues were $371.1mn, up 22%

- Operating income was $46.4mn, up 146%

- Results were driven primarily by higher pressure pumping revenues, the largest service line within Technical Services, and the related leverage of fixed personnel costs

Support Services provides equipment for customer use or services to assist customer operations, including rental of tubulars and related tools, pipe inspection and storage services, and oilfield training services.

- Revenues were $23.5mn, down 14%

- Operating income was $5mn, down 27%

- Results were driven by lower activity in rental tools and the high fixed-cost nature of these service lines

Conference Call Information

RPC, Inc. will hold a conference call today, 25 Jan. 2024, at 9:00 a.m. ET to discuss the results for the quarter. Interested parties may listen in by accessing a live webcast in the investor relations section of RPC, Inc.’s website at www.rpc.net. The live conference call can also be accessed by calling (888) 440-5966, or (646) 960-0125 for international callers, and use conference ID number 9842359. For those not able to attend the live conference call, a replay will be available in the investor relations section of RPC, Inc.’s website beginning approximately two hours after the call and for a period of 90 days.

____________________