(Nucor, 23.Oct.2023) — Nucor Corporation (NYSE: NUE) announced consolidated net earnings attributable to Nucor stockholders of $1.14bn, or $4.57 per diluted share, for the third quarter of 2023. By comparison, Nucor reported consolidated net earnings attributable to Nucor stockholders of $1.46bn, or $5.81 per diluted share, for the second quarter of 2023 and $1.69bn, or $6.50 per diluted share, for the third quarter of 2022.

Third Quarter of 2023 Highlights

- $4.57 earnings per diluted share for the third quarter, bringing year-to-date diluted EPS to $14.83

- Net earnings attributable to Nucor stockholders of $1.14bn

- Net earnings before noncontrolling interests of $1.22bn; EBITDA of $1.82bn

- Returned $627mn to stockholders during the quarter through share repurchases and dividends

In the first nine months of 2023, Nucor reported consolidated net earnings attributable to Nucor stockholders of $3.74bn, or $14.83 per diluted share, compared with consolidated net earnings attributable to Nucor stockholders of $6.35bn, or $23.85 per diluted share, in the first nine months of 2022.

“We are on pace to set another safety record for the fifth consecutive year. And with $14.83 of earnings per diluted share for the first nine months of 2023, this already represents the third-best full-year result in Nucor’s history. We believe that our world-class manufacturing team, product diversity, and our sustainable solutions set us up for continued success over the long term,” said Leon Topalian, Nucor’s Chair, President and Chief Executive Officer. “The investments we are making to grow our core businesses and expand into new products continue to generate attractive returns for stockholders.”

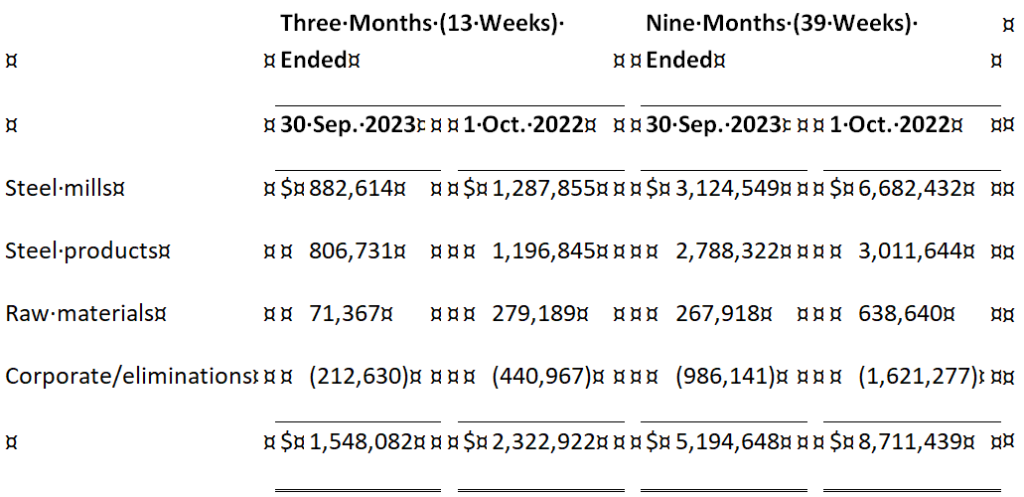

Selected Segment Data

Earnings (loss) before income taxes and noncontrolling interests by segment for the third quarter and first nine months of 2023 and 2022 were as follows (in thousands):

Financial Review

Nucor’s consolidated net sales decreased 8% to $8.78bn in the third quarter of 2023 compared with $9.52bn in the second quarter of 2023 and decreased 16% compared with $10.50bn in the third quarter of 2022. Average sales price per ton in the third quarter of 2023 decreased 3% compared with the second quarter of 2023 and decreased 14% compared with the third quarter of 2022. A total of 6,240,000 tons were shipped to outside customers in the third quarter of 2023, a 5% decrease from the second quarter of 2023 and a 3% decrease from the third quarter of 2022. Total steel mill shipments in the third quarter of 2023 decreased 4% as compared to the second quarter of 2023 and decreased 2% as compared to the third quarter of 2022. Steel mill shipments to internal customers represented 20% of total steel mill shipments in the third quarter of 2023 and the second quarter of 2023, compared with 22% in the third quarter of 2022. Downstream steel product shipments to outside customers in the third quarter of 2023 decreased 4% from the second quarter of 2023 and decreased 12% from the third quarter of 2022.

In the first nine months of 2023, Nucor’s consolidated net sales of $27.01 bn represented a decrease of 18% compared with consolidated net sales of $32.79bn reported in the first nine months of 2022. Total tons shipped to outside customers in the first nine months of 2023 were 19,271,000, a decrease of 3% from the first nine months of 2022, and the average sales price per ton in the first nine months of 2023 decreased 15% from the first nine months of 2022.

The average scrap and scrap substitute cost per gross ton used in the third quarter of 2023 was $415, a 9% decrease compared to $455 in the second quarter of 2023 and a 17% decrease compared to $502 in the third quarter of 2022. The average scrap and scrap substitute cost per gross ton used in the first nine months of 2023 was $429, a 16% decrease compared to $511 in the first nine months of 2022.

Pre-operating and start-up costs related to the company’s growth projects were approximately $101mn, or $0.31 per diluted share, in the third quarter of 2023, compared with approximately $90mn, or $0.27 per diluted share, in the second quarter of 2023 and approximately $52mn, or $0.15 per diluted share, in the third quarter of 2022.

In the first nine months of 2023, pre-operating and start-up costs related to the Company’s growth projects were approximately $273mn, or $0.83 per diluted share, compared with approximately $174mn, or $0.50 per diluted share, in the first nine months of 2022.

Overall operating rates at the company’s steel mills decreased to 77% in the third quarter of 2023 as compared to 84% in the second quarter of 2023 and 77% in the third quarter of 2022. Operating rates in the first nine months of 2023 were 80%, which was the same as the first nine months of 2022.

Financial Strength

At the end of the third quarter of 2023, we had $6.73bn in cash and cash equivalents, short-term investments and restricted cash and cash equivalents on hand. The company’s $1.75bn revolving credit facility remains undrawn and does not expire until November 2026. Nucor continues to have the strongest credit rating in the North American steel sector (A-/A-/Baa1) with stable outlooks at Standard & Poor’s, Fitch Ratings and Moody’s.

Commitment to Returning Capital to Stockholders

During the third quarter of 2023, Nucor repurchased approximately 3mn shares of its common stock at an average price of $168.99 per share (approximately 8.8mn shares during the first nine months of 2023 at an average price of $157.36 per share). On 11 May 2023, Nucor’s board of directors approved a new share repurchase program under which Nucor is authorized to repurchase up to $4bn of Nucor’s common stock and terminated any previously authorized share repurchase programs. As of 30 September 2023, Nucor had approximately 27mn shares outstanding and approximately $3.5bn remaining for repurchases under its authorized share repurchase program. This share repurchase authorization is discretionary and has no scheduled expiration date.

On 14 September 2023, Nucor’s board of directors declared a cash dividend of $0.51 per share. This cash dividend is payable on 9 November 2023 to stockholders of record as of 29 September 2023 and is Nucor’s 202nd consecutive quarterly cash dividend.

Third Quarter of 2023 Analysis

Earnings for the steel mills segment declined in the third quarter of 2023 as compared to the second quarter of 2023 primarily due to lower pricing, and to a lesser extent, decreased volumes. The largest impact on earnings occurred at our sheet mills. The earnings of the steel products segment decreased in the third quarter of 2023 as compared to the second quarter of 2023 also due to lower realized prices and volumes. Earnings for the raw materials segment decreased in the third quarter of 2023 as compared to the second quarter of 2023 due to margin compression at our direct reduced iron, or DRI, facilities and scrap processing operations.

Fourth Quarter of 2023 Outlook

We expect earnings in the fourth quarter of 2023 to decrease compared to the third quarter of 2023 due primarily to lower pricing across all three operating segments, and, to a lesser extent, decreased volumes. In the steel mills segment, we expect the decrease in realized pricing to be most pronounced at our sheet mills. In the steel products segment, we expect decreased earnings due to moderating average selling prices at most of the product groups within the steel products segment and lower volumes. Earnings for the raw materials segment are expected to decrease in the fourth quarter of 2023 as compared to the third quarter of 2023 due to lower pricing for raw materials and planned outages at our DRI facilities.

Earnings Conference Call

You are invited to listen to the live broadcast of Nucor’s conference call during which management will discuss Nucor’s third quarter results on 24 October 2023 at 10 a.m. Eastern Time. The conference call will be available over the Internet at www.nucor.com, under Investors.

____________________