(Bloomberg, Amy Stillman, 14.Aug.2018) – By most financial measures, Mexico’s state oil company is seriously unwell. The country’s new leader is promising to revive it. But the treatment could end up killing the patient.

After borrowing more than $100 billion, Petroleos Mexicanos is one of the world’s most indebted oil majors. It doesn’t have much oil to show for it: Production has declined every year since 2004, and reserves are down more than half over the past six years. Its refineries lose money, and the more they refine, the more they lose.

Amid all this gloom, Pemex has managed to hang on to investment-grade credit ratings –- by cutting back on capital spending, and enlisting help from private companies to develop oil assets, in exchange for stakes in them. Investors and analysts worry that Andres Manuel Lopez Obrador will do the exact opposite.

The leftist politician won a landslide election victory on July 1, riding a wave of discontent with Mexico’s establishment parties and their austerity policies. AMLO, as he’s known, won’t take office until December. But he’s already busy outlining the change that’s coming, and filling key positions -– including in the oil industry, where his recipe is much the same as for the wider economy: Ramp up investment.

‘Risk Number One’

For Pemex, that means an additional 75 billion pesos ($4 billion) of spending on exploration and production, with the aim of boosting output by one-third over two years. There’ll be another 49 billion pesos to overhaul Pemex’s six refineries, currently producing 41 percent of their potential output. AMLO wants them operating at full capacity. And he may build new ones too.

Money to rehabilitate the refineries will come from the company’s budget, according to Lopez Obrador’s pick for energy minister, Rocio Nahle. And that’s the problem for investors who fear a return to the bad old days when the state company was saddled with outsized tax bills, tapped for spending projects that failed to generate new revenue, and steered toward less profitable areas such as refining rather than drilling.

“Risk number one for Pemex would be higher capital expenditure, from a company that is not generating that same amount in cash,’’ said Nymia Almeida, senior credit officer at Moody’s Investors Service, by phone from Mexico City.

Moody’s classifies Pemex debt as one step above junk. That rating could come into question if there’s a change in the trajectory of spending, Almeida said. While debt reached $104 billion in June, Pemex has actually been “on the right path’’ by gradually reducing the amount of new borrowing, she said. It currently plans to tap markets for $3 billion to $3.5 billion in the remainder of this year.

Bond Rout

The man chosen by Lopez Obrador to steer Pemex through these tricky waters is a longtime political ally — with zero experience in the oil industry.

Octavio Romero , an aide from AMLO’s years as Mexico City mayor last decade, was announced as the oil company’s next chief executive on July 27. The same day, Pemex reported a quarterly loss of $8.8 billion, the biggest since 2016. In the subsequent week, Pemex’s 2028 bonds posted their worst performance since they were sold.

One thing Pemex-watchers will be looking out for under the new regime is the interaction between Pemex’s finances and those of the general government -– and how sharply they’re distinguished.

Even specialists struggle to explain the formula under which Pemex pays taxes to its sole owner, the Mexican state. But whatever it is, the take amounts to a big chunk of the federal budget -– about 20 percent last year.

The figure has come down from 40 percent a decade ago. But, with crude edging back up again in the past year, tax payments are set to rise again -– and that will cancel out much of the benefit that Pemex reaps from the oil rebound, according to Sergio Rodriguez, an analyst at Fitch Ratings.

Gasolinazo

Lopez Obrador’s plans to refine more oil locally and freeze pump prices could add to the financial strain.

The cost of gasoline soared as much as 20 percent last year after the government stopped imposing a cap. The so-called gasolinazo, or price spike, triggered widespread protests. Lopez Obrador has said there’ll be no repeat under his administration, and that may require subsidies. It’s not clear whether any costs would be met by the Finance Ministry, or Pemex.

The latter would be “detrimental’’ to cash-flow, said Lucas Aristizabal, a senior director at Fitch Ratings. At the same time, if Pemex is expected to foot the bill for new refineries, “it’s a very high level of investment with a very low level of return,’’ he said. Lopez Obrador’s proposed new refinery in Tabasco, his home state, is estimated to cost $8.7 billion.

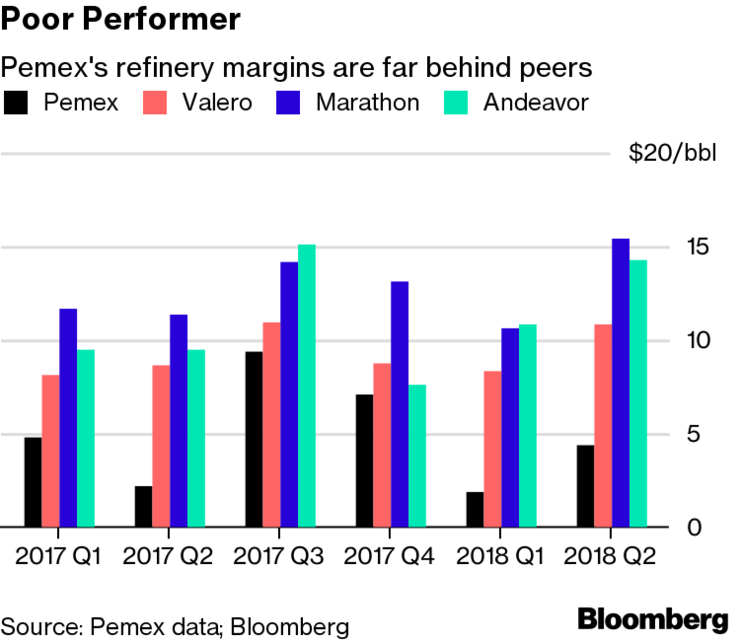

Pemex’s refining arm is making marginal financial improvements but analysts say its not enough. The company reduced its refining losses by about half last year, to a net loss of 31.6 billion pesos. Output hit the lowest level since 1990. The Salina Cruz refinery, Mexico’s largest, was out of operation for almost half the year due to flooding, fires and earthquakes, while others suffered maintenance delays.

The end of government-set fuel prices should allow Pemex to make some money from refining if ”they were competitive and if they were efficient,” said Almeida at Moody’s. ”The problem is that the company’s costs are too high.”

Pemex already spends less on the more profitable business of exploration and production than regional peers. Bringing in private cash to cover that gap was a key goal of the outgoing President Enrique Pena Nieto. His landmark measure in 2014 opened Mexican energy markets to competition after almost eight decades of state monopoly.

Lopez Obrador has a mandate to slow that process down, if not roll it back. His team is reviewing 105 already-signed contracts with private firms, looking for irregularities. Further auctions due in September and October, for exploration rights and contract-sharing with Pemex, have been postponed until February, by which time Lopez Obrador will be in office.

Stealing Fuel

One important Pemex file may land on the desk of AMLO’s police chief rather than his energy or finance ministers.

The practice of tapping pipelines has been around for decades, but it’s booming lately as drug gangs got in on the act. The result has been an increase in violence, and billions of dollars of losses for Pemex.

Lopez Obrador made the fight against corruption central to his campaign. He was often vague on the details.

“We haven’t heard much from AMLO in respect to the issue of fuel theft,’’ said Ixchel Castro, a senior analyst at energy consultant Wood Mackenzie in Mexico City. “But if you want to improve the operations of Pemex, if you want to reduce the losses of the company, this has to be one of the main priorities.’’

— With assistance by Justin Villamil

***