(EnergyNomics, Carlos A Rossi, 18.Aug.2018) – Are natural resource endowed countries victims of their own wealth? Is there a richness threshold beyond which the institutions designed to protect a country’s citizens turn against them and become their worst enemy by annihilating their productive apparatus riddling it with the miseries of declining GNP, hyperinflation, unpayable debt, zero investor confidence, poverty, crime, hunger and repression of loss liberty?

This is exactly what has happened to Venezuela, holder of the world’s largest petroleum reserves, and it happened precisely because the oil prices were high. Examination of this paradox renders Rentism its principal culprit.

Rentism is an endemic degenerative fiscal disease that metastasises throughout a nation’s economy because it is a degradation of Rent, a concept first defined by 19th century English Economist David Ricardo to distinguish between “normal profits” produced by the wise employment of capital and labor on land, from “abnormal profits”-or Rents-that are captured due to the bountiful legacy of better fertile land even though this luckier lad is employing the same mix of capital and labor; except at lower costs. Ricardo reckoned that the difference between rent and normal profits, which can be huge, is windfall luck that is captured but never produced.

Rentism occurs when this rent portion is captured by the State, meaning politicians, a common occurrence in institutionally weak-oil rich countries that places politicians too close to unimaginable amounts of money. Rentism produces expensive white elephants projects that are never finished because their sole intent is to pocket its budget in offshore accounts.

By acquiring a life of its own, Rentism at its highest creates crony “state-capitalism”, corruption, bloated invoices, inflated import receipts, vanishing loans, kickbacks, plutocracy, and capital flight. When the commodity price plunges the ill effects of Rentism crystallize in disappearing international reserves, budget deficits, hyperinflation, worthless currencies, unemployment, poverty, commodity dependency, foreign debt, political crisis, etc resulting in a skewed economy within an incapacitated repressive state.

You can think of Rentism as Lupus, a deadly serious autoimmune disease that turns the very defensive mechanisms that your body has designed to protect you (politicians and institutions) into your worst possible enemy.

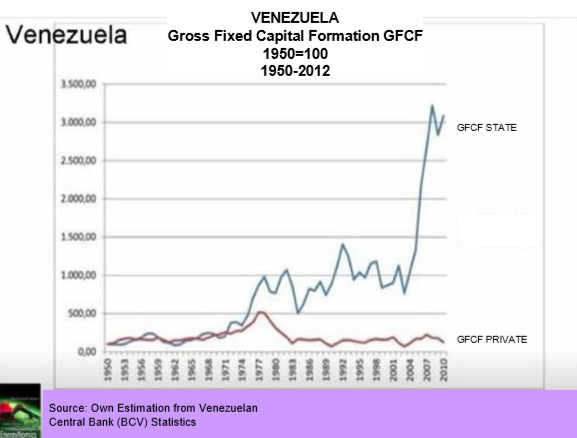

The following graphs illustrate this.

The first graph demonstrates Venezuela’s Gross Fixed Capital Formation, a measure of capital accumulation, for both the private and state sector between 1950-2012 (Venezuela stopped publishing data in 2015). In the early period 1950-1976, capital accumulation of both Private and State grew in tandem at a vigorous pace of 400% and 900% respectively. During this golden era GNP grew at 6.7% annual average and Inflation never topped 2.5% per annum. Venezuela prospered well.

In mid 1970’s two things happened that forever changed Venezuela’s history for the worst. The 1973 Yom Kippur war quadrupled oil prices showering the State with unprecedented revenues. Then, in 1976 Venezuela’s oil was nationalized passing ownership from Private to the State. To the delight of politicians, this opened the door for explicit rent seeking exigencies from all sectors especially local capitalists and bureaucrats. From then onwards a widening gap between the curves opened favouring State capital accumulation that saw a 210% increase at the expense of Private accumulation, which suffered an 80% decrease lessening to oblivion, close to 1950 levels.

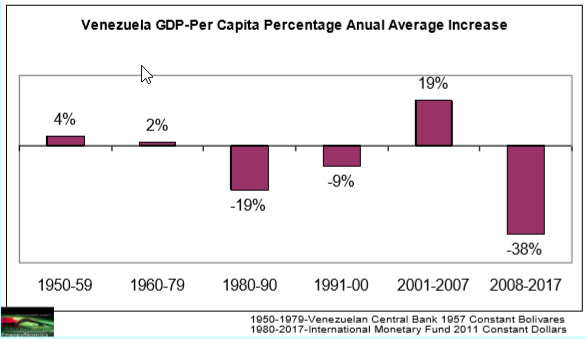

Venezuela’s prosperity turned sour illustrated in the per-capita income behaviour of the second graph, exacerbated ad absurdum by Hugo Chavez’s private property expropriation years of this century. When the Private Sector (national and international) stopped accumulating capital Venezuela’s economy imploded. The political control of Rent is the smoking gun.

We can also say that Rentism pushed Venezuela’s incipient industrial development backward in time to the age of 18th century Mercantilism, the step-stone transition system between Feudalism and Capitalism. Coined by Adam Smith, Mercatilism is State controlled capitalism were the State has the power decision making of which sectors (specifically which companies) get the generous dollar “loans” and to which ends. It was never a formal economic system per se, but rather a set of very adaptable ad-hoc rules which goals was to promote national wealth through strict regulation of private entrepreneurship. Or as Max Webber cleverly defined it: “The Passage of Capitalist Lust into Politics”.

The major difference being that whereas in Adam Smith’s England the State benefited solely from the efficiency of its tax collectors on its crony friends, in Venezuela there is no need for a tax-man because nature’s petrol bounty is already in the hands of the State; meaning that all it has to do is to pick and choose which of its crony clients get the money and what level are the tariff walls to shield them from competition (500% tariffs were common). Kickbacks and crafty graft were and are the price the crony benefactor gracefully paid. This happened in Venezuela during the oil boom of the 1970s and on this millennium’s oil price rack up with the difference that last century graft and distortions lead to some construction whereas in this period graft has meant only destruction of all the productive apparatus, including investor confidence, ethics and PDVSA’s oil machine.

Adam Smith (the finest of the enlightment thinkers), spent many pages debunking mercantilism with his liberalism laissez faire-laissez passer policy; he would have certainly predicted, in both of Venezuela’s experience with rentism the end results to be, in the best of cases: disastrous. Now those French words are to Venezuela as foreign as they sound, and they have been for at least 2 generations and counting.

Solving for Rentism and for Mercantilism is easy: A managing contract with an established multilateral institution with experience in development, like the World Bank and/or the UN´s Food and Agriculture Organization to administer investment of all Rent proceeds under proven criteria.

Problem: Venezuela’s politicians need to make this decision of be forced to make this decision by an international coalition of power that is bent on bringing the opportunity of economic prosperity to its 30+million citizens and of assuring themselves increasing quantities of the Worlds most efficient fossil base energy resource in the planet. Until this happens, Venezuelan citizens will always be victims of their own wealth.

Scrapping Rentism and Mercantilism will not solve all of Venezuela’s problems, which are deep seeded thanks to Chavism; but it will in all certainty go along way into resolving them for good.

Editor’s Note: Carlos Rossi is President of Caracas-based EnergyNomics and a regular contributor to Energy Analytics Institute.

***