(BBC, Jack Goodman, 25.Feb.2019) — The United States has imposed tough sanctions on Venezuela’s oil industry to put pressure on President Nicolás Maduro to step down.

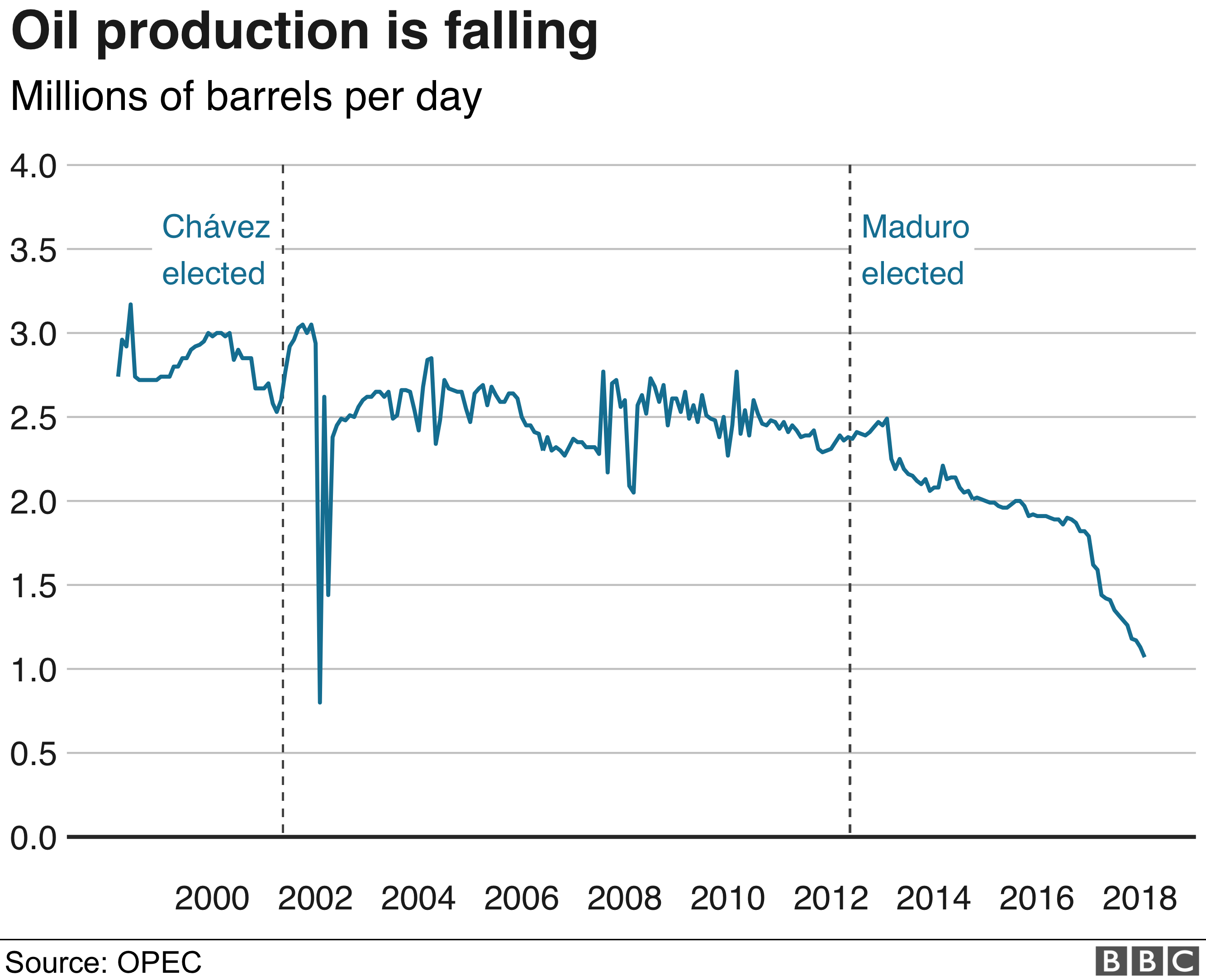

Oil dominates Venezuela’s economy, accounting for almost all of its export earnings.

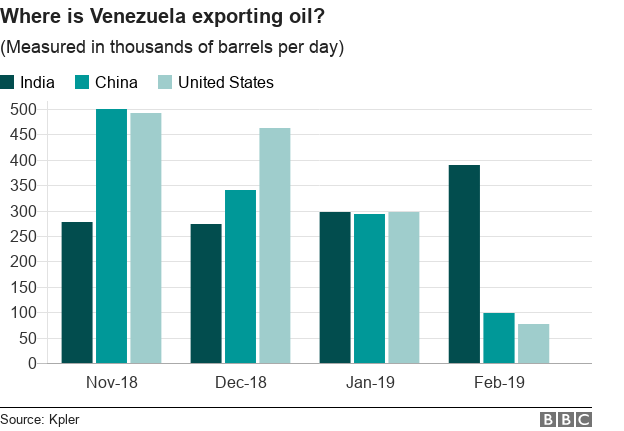

Its biggest customers have been the US, followed by India and China.

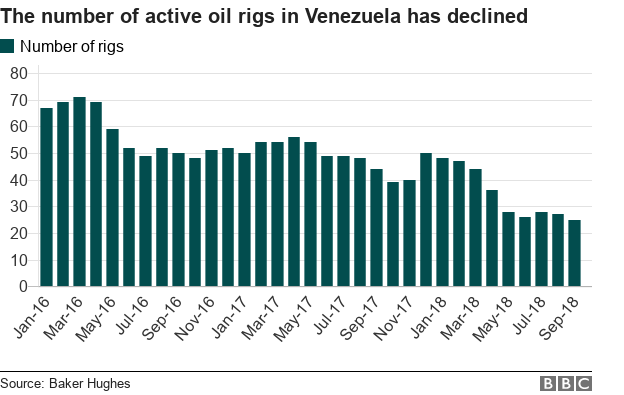

But over the past decade, oil production has collapsed and the country is in a deep economic crisis.

So what effect are the sanctions having and who is buying its oil now?

What are the sanctions?

The sanctions block US companies doing business with Venezuela’s state oil company, the PDVSA, and freeze the company’s assets in the United States.

These measures do not cut off imports entirely, but they do require payments to be made into accounts that Venezuela’s state oil company cannot access.

Sanctions have also had an impact on access to the chemicals required to process the oil.

Venezuela’s heavy crude is almost solid when it comes out of the ground, so it cannot flow through pipelines.

It needs chemicals, diluting agents such as naphtha, to turn into a lighter substance that can eventually be exported. Sanctions include a ban on US firms exporting these agents.

Venezuela must import these, and in recent years they have come from the US, said Shannon O’Neil, senior fellow for Latin America Studies at the Council on Foreign Relations.

The Russian firm Rosneft is reportedly helping to fill this particular gap.

Where is Venezuela’s oil now going?

Currently sitting off the Venezuelan coast are tankers holding in the region of 10 million barrels of oil, according to Kpler, which tracks commodities.

They were originally destined for the United States, but are stranded as a result of the sanctions.

Venezuela’s government has been looking for new buyers for its oil and says it wants to double shipments to India.

But although there has been a recent increase in exports to India, it is not a substantial one, says Samah Ahmed, a crude oil analyst at Kpler.

Exports to China are also not encouraging and have in fact been dropping in line with a general decline in Venezuela’s total production.

Selling more oil to markets in Asia would increase transport costs, because ports in Venezuela are not well-equipped to load tankers for travelling long distances.

Exports to India may be heavily discounted “because of quality issues and to compete with Middle Eastern grades,” says Paola Rodriguez-Masiu, an analyst at Rystad Energy.

But there is certainly a demand for heavy crude oil such as that found in Venezuela.

There is a global shortage because of sanctions on Iranian oil, while lower levels of production in Canada, Mexico and Opec member countries has also had an impact.

US importers will need to find new suppliers of heavy crude, which it uses to produce diesel and jet fuel.

“The Venezuelan crisis has made heavy crude more expensive for the US,” says Ms Rodriguez-Masiu.

But this will not help Venezuela, desperate to find new markets for its oil at a time of deepening economic and political crisis.

***